I first started this business of helping traders and investors in 1982. Those first years in business coincided with the start of the great bull market in stocks that lasted from 1982 through 1999. My first clients, however, were mostly futures and option traders; we had very few stock traders. Equity traders really didn’t make a significant portion of our customers until the mid-1990s.

Fast forward to the year 2000 when we were teaching a workshop on trading stocks. One of my Super Traders developed a version of CANSLIM with some modification that I helped him make and he taught that system in this workshop. In March 2000, we had 70 people attending that course — the largest attendance we’ve ever had at one of our workshops. And, of course, March 2000 was just about the top of the stock market. After that record-breaking event, we probably offered the CANSLIM workshop 2-3 more times before it died a natural death because people stopped attending. (Stateside, we only give workshops now at our facility in Cary that holds around 30 people seated at tables so we will probably never break that March 2000 record.)

Now fast forward once more to about 2007. We noticed that our psychological workshops had 15-20 people attending on average but technical workshops were always packed. Ken Long would give his trading system workshops at least 3 times a year and the attendance was always at least 30 people. This went on for a number of years but by 2016, more people were attending our psychological workshops than the technical workshops.

Here are some other disappearances I have noticed. If you went into any Barnes & Noble bookstore in the late 1990s, you would find about 40 cases of investment books. And all of my books would be there, often multiple copies. Today, if you go into a Barnes & Noble bookstore you will find perhaps 2 cases of investment books — mostly Robert Kiyosaki, Jim Cramer and the usual crowd. And you will probably not find any useful investment/trading books. While eBook sales are probably now bigger than the sales of hardbound books, those certainly have not come close to accounting for the lack of physical book sales.

In February of last year, The Van Tharp Institute hosted a booth at the Traders Expo in New York City. The event planners claimed the attendance was about 4,000 people. The attendance at that expo used to be about 15,000 people. There was only one weekend evening for the event and huge lines formed at our Trading Beyond the Matrix book giveaway. On the other days, the lines were not nearly as long so I suspect 4,000 was the attendance over the entire event.

What can we conclude? People are afraid of the markets. The GFC of 2008 was probably the last straw for many investors and traders. Most people in the markets at that time didn’t practice risk management through effective position sizing strategies. They didn’t know how to make money in volatile down markets (something which is fairly easy and that we teach), and got wiped out (actually, they wiped themselves out).

Fast forward to today — let’s look at the stock market right now. On March 1st, I prepared my monthly update on the market. My 25-day Market SQN® score, my 50-day Market SQN score, my 100-day Market SQN score, and my 200-day Market SQN score were all Strong Bull and the volatility was Quiet. I’ve been doing the market type report for over 10 years now and that’s the strongest showing I’ve ever seen. And the strongest ETF of the 500 plus that we watch in our world market model report was the one representing the DOW 30 (DIA) with a Market SQN 100 score of over 3.0. I’ve never seen that before.

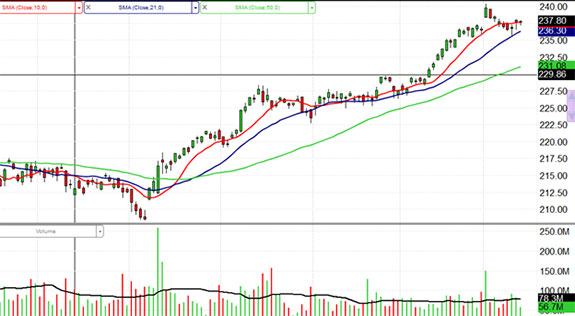

Look at the chart below of the S&P 500 (using the ETF SPY). It’s been easy money since Donald Trump took office. The red line is the 10-day moving average. And it’s been above that red line for about 75% of the time since November 2016. In the 75 days since November 21st, there have been 20 all-time new highs in the S&P 500. Twenty of them — that’s more than 25% of the time.

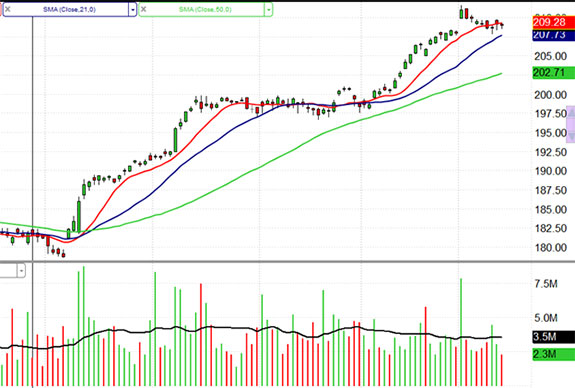

So, look at the chart of the DIA (Dow 30) below since last November. It’s pretty similar. And remember the Market SQN 100 for that ETF is currently over 3.0 which is very, very strong.

Okay, and just in case you are not convinced, here is a chart of the NDX over the same time period. It’s up over 10% in just two months.

While a strong trend doesn’t necessarily mean the trend will continue and a Strong Bull Quiet market also doesn’t necessarily mean it will continue, I think the lack of interest by investors could easily mean that this market could be strong for a long, long time. How long? Well, I think one indicator could be when everyone wants to come to our workshops and learn how to make money in this market. But of course, by that time, it will be too late.

So what are you doing right now? This is the kind of market that everyone wants — when making money is easy. Are you up 5% on the year like the S&P 500 or the DOW 30? Are you up 10% like the NDX? Or are you sitting on the sideline too afraid of disasters that might happen in the future so you don’t see what is going on right in front of you.

I’d value your input. What’s happening with you and the market right now? Let me know at van <at> vantharp.com

I’d perpetually want to be update on new content on this internet site, saved to favorites! .