Earnings Are Down Again This Quarter — No Need for Short-Term Worry

Earnings Are Down Again This Quarter — No Need for Short-Term Worry

You wouldn’t know it from the stock market, but we’re actually in the middle of an “earnings recession.”

It’s hard to tell this earnings season because the good news keeps piling up:

-

-

-

-

- The Procter & Gamble Co. (PG) went up 4% after it raised its profit forecast.

- JP Morgan & Chase Co. (JPM) hit an all-time high after it beat expectations.

- Netflix Inc. (NFLX) jumped 8% after its earnings and international efforts beat estimates.

- And Amazon.com Inc. (AMZN) is expected to fare well when it reports on Thursday.

-

-

-

Even so, we’ve had two straight quarters of declining corporate earnings — the very definition of an earnings recession. Here’s how: An economic recession for a country is defined as two consecutive quarters of declines in year-over-year (YoY) Gross Domestic Product (GDP) — the amount of goods and services a country produces.

- For the S&P 500 stocks, two consecutive quarters of YoY earnings declines signal an “earnings recession.”

- And this quarter looks set to be the third.

- Some are calling this “bad news,” a “problem,” even a “blaring warning.”

- Even so, the market doesn’t care.

And here’s why you shouldn’t worry, either.

Why does this earnings recession seem less troublesome to me? Earnings are “net profits.” It’s what’s left of your revenues after you pay your expenses (and do some number wrangling like accountants do).

And it’s these revenues that give me some optimism – because while YoY earnings are down, YoY revenues are rising. For the third quarter of this year, earnings look set to go down -4.7% versus the third quarter last year, but revenues are set to go up +2.6% over the same time period.

In other words, companies are taking in more money but keeping less of it. Their net profit margins are falling, not their revenues.

That makes traders, and thus the market, more forgiving.

The reason why costs have been rising has also helped.…

As you’d imagine, some companies have brought up China and tariffs as a reason for rising costs. But in the companies’ official filings, the more commonly cited reasons for reduced margins are rising wages and the cost of currency exchange due to the strong dollar.

These are two issues companies can’t do much about. As you can see in this chart, unemployment hasn’t been this low in the U.S. since the late 1960s:

Less unemployment means more competition for workers, and so wages start rising. That’s long overdue after the long period of stagnant wages that followed the 2008 Financial Crisis, and at the current rate of increase is not yet cause for concern.

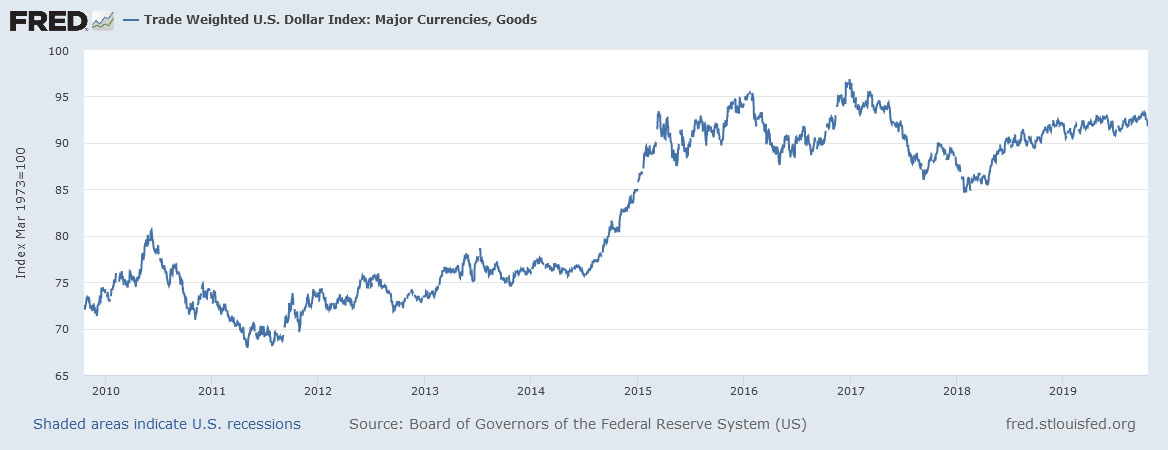

As for the U.S. dollar, it too has been inching back up in value:

That makes companies that sell their products or services abroad make fewer dollars per sale, in effect increasing their cost of doing business.

But with the Fed lowering interest rates, the dollar should decline a bit in value, which would help companies that are struggling with currency exchange issues.

Companies are also citing concerns about Europe as a source of higher costs. The Brexit mess itself makes planning difficult and adds costs and complexity to every company doing business in Europe.

But just like the strong dollar, the issue of Brexit will soon go away (or get kicked down the road, depending on how one reads the tea leaves).

So as you can see, many of the issues that are raising costs for businesses are temporary, and the underlying revenues keep rising. The markets have taken it in stride.

Now, some old-school analysts will tell you earnings are the only things that really matter for stocks. So no matter the reason, falling earnings should be taken as a bad sign, and stocks should fall accordingly.

I’d say that’s half true…

In the long term, the value of a company is of course determined by how much money it makes. But earnings and costs can be shifted here or there by a quarter, and legally “massaged” in other ways by skilled accountants.

Cash flow, a measure of how much money is coming in, is a much better measure.

But here, today, all of that matters less. We’re traders. We have to trade the market we have, not the one we wish we had or our theories say we should have.

And right now, the markets are an expectations game. As long as companies keep beating expectations, the market will reward them.

Markets will keep doing that until the mood changes. We’ve already seen how sensitive the market mood is to news and rumors about trade with China. News on that front has been good lately, with last week’s small deal between President Trump and China, and talk of a more comprehensive deal to come by mid-November.

Should China or the White House go back to harsher rhetoric around trade, or if earnings really took a dive, the market mood might change.

But unless that happens, expect traders to stay in a forgiving mood this earnings season. In the next six trading days, the five largest publicly traded companies in the world report earnings. That’s Microsoft (MSFT) and Amazon (AMZN) this week plus Apple (AAPL), Alphabet/Google (GOOGL) and Facebook (FB) next week. If a majority of these leviathans beat expectations on their important benchmarks, then the markets will get a nice lift. Based on early indications, that’s the higher probability outcome.

Earnings recession bears and other bearish analysts will have things their way someday — but market internals and key earnings so far are telling us that day is not yet here.

Great trading and God bless you,

D. R.