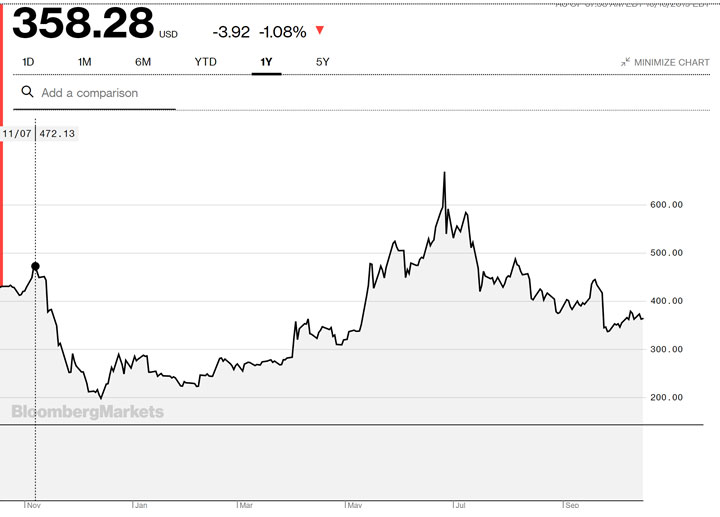

A lot of things are happening in the crypto world but none of them seem to be driving prices up. Last month BTC went into a bear market according to our SQN® 100 index. And it was a pretty clear bear. It’s still there despite BAKHT being active. Last month, for example the GBCI index was at 405.65. Today, as you can see from the chart below, it’s at 358.28.

A lot of things are happening in the crypto world but none of them seem to be driving prices up. Last month BTC went into a bear market according to our SQN® 100 index. And it was a pretty clear bear. It’s still there despite BAKHT being active. Last month, for example the GBCI index was at 405.65. Today, as you can see from the chart below, it’s at 358.28.

Cryptoassets started the year with three flat months followed by a strong uptrend until the end of June when the Bloomberg Galaxy Crypto Index (GBCI) peaked. The peak in the index this year was on June 26th at 668.61. You can see the clear decline since the Peak in June.

The index began in early May 2018 at 1000. And if you backtrack to January 4th, 2018, it would have hit a high of 1650.2. Thus, the index has been active for over a year and is now just over 40% of its starting level and would be at 25% of what would have been its all-time high (if it had existed in early 2018).

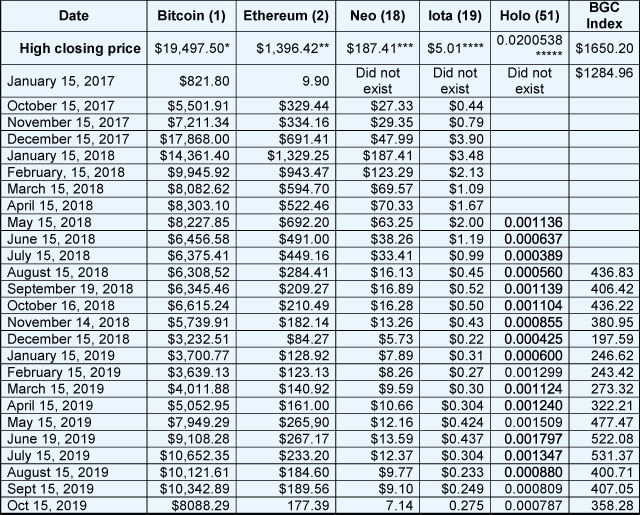

The following table below tracks the price of five major cryptoassets across three generations of the technology:

- Bitcoin, a 1st generation crypto asset,

- ETH and NEO, 2nd generation cryptos, and

- Iota, a 3rd generation crypto

- I’ve replaced Skycoin with Holo (HOT) because Skycoin is pretty dead and there probably won’t ever be a market in it for US Investors.

- I’ve also started including BGCI prices in the table.

Date of the All-Time High Closes *Dec 16, 2017 ** Jan 13, 2018 ***Jan 15, 2018 **** Dec 8, 2017 ***** May 29, 2019 # Jan 5, 2017

Just because BTC is a 1st generation crypto does not mean it is likely to die off and be survived by the later generation cryptos. It’s hard (impossible?) to predict which cryptoassets will thrive or even survive as we move forward as there are so many variables in play. Technology, use case, adoption, support, and multiple other factors come into play.

Altcoins (all the others than BTC) have taken a huge hit in the last 60 days – and no one seems to mention the real reason for the drop. Effective Sept 12th Binance closed its current operations to US Investors so 25% of the world’s volume for crypto trade lost access to the market for many crypto symbols. That is a huge blow to most cryptos, especially those that won’t be available to the US Market any longer. I replaced SKY with HOT for our table because SKY had dropped tremendously, didn’t have a great market behind it, and was delisted from US ownership.

Binance.us opened to US investors, but 12 states are excluded from participation in the new version (which doesn’t have that much) and North Carolina (where I live is one of them).

HOT, BTC, ETH, and NEO are up significantly since December, but Iota is just positive. I’m now running a regular Market SQN (100 days) program on BTC just to keep track. First, on October 15, BTC is now at strong bear (minus 0.7 or weaker). It’s been off and on-again strong bear since Oct 4th. And the last bull day was September 20, 2019 when BTC was still over 1000. It would probably have to be about 12,000 now to become bull again.

However, it’s been in a range from 7858 to 8565 for most of Oct. If it stays there for a while and then breaks out, rather than falling significantly we could see a bull market begin again in 2019. We are only about 7 months away from the BTC halving that will occur in May 2020.

One of the crypto newsletters I read said that BTC had just had its biggest initial bull run in its history. That newsletter also says that Altcoin rallies usually come about 6 months later — after the bull market in BTC stops. I think altcoins are being impacted, however, by the inability of US investors to trade many of them.

One of the crypto newsletters I read said that BTC had just had its biggest initial bull run in its history. That newsletter also says that Altcoin rallies usually come about 6 months later — after the bull market in BTC stops. I think altcoins are being impacted, however, by the inability of US investors to trade many of them.

By the way, US investors cannot participate in many altcoins because the SEC is exercising its power and calling all of them securities and thus they come under its regulation.

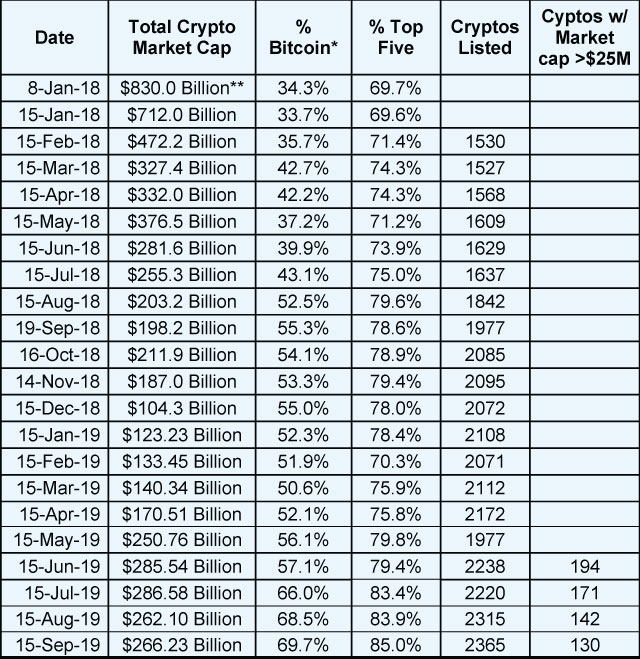

The market cap table below shows a similar pattern to the individual cryptos in the table above. The total market cap for cryptos is the highest it has been since June 2018.

* Bitcoin was as high as 90% of the market cap of all cryptos at the beginning of 2017 to as low as 32% at the top of the market. Part of the difference is that there are now nearly 2000 cryptocurrencies. So the number keeps going up even though the market cap goes down. BTC is now at 69.7 and the top 5 are 85% of the market cap. ** This was the peak of the crypto market in terms of market cap. Data via Tama Churchouse, Asia West Investor email on 4/11/18 Top-Bottom Charts

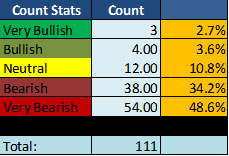

This month we are following 111 cryptos. Three of them are strong bull. And only 7 of them in total are bullish. Only four of them, including BTC, are bull. 12 more are neutral. And 82.9% of them are bear (38) or strong bear (54). My belief is that the altcoins are affected by the market closing to US investors. It’s the wild-wild west out there and it was clear to me that Binance was manipulating the market knowing that many US investors would be selling. Eventually that sort of thing must stop, but it will probably continue in markets outside the US.

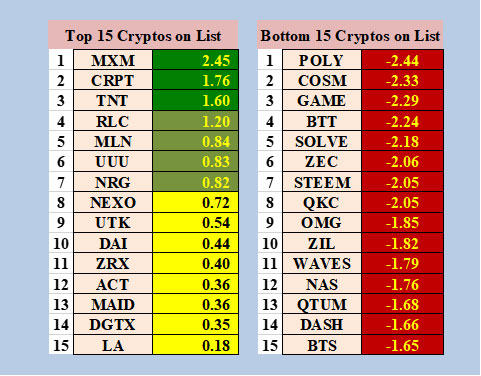

The following chart shows the 15 top and bottom cryptoassets.

Last month BTC was the last bull coin. And this month it moved to strong bear and isn’t close to the top 15.

CRPT is the only altcoin I ever bought as an ICO. I should be happy that it’s in a strong bull market, but it’s currently close to the price I paid for it as a new ICO.

The Big Picture with Crypto Assets.

This is the year that I expect significant institutional involvement in cryptoassets. I’ve said most of this information in prior newsletters, but I’ve updated some of it. Here is what’s going on right now and in the coming months:

- Fidelity is now selling cryptos to its best clients (although the typical retail client cannot buy through them yet.

- TD Ameritrade plans to offer the ability to buy crypto assets soon.

- The same goes for E-Trade.

- Bakkt – the ICE platform allowing institutions to trade cryptos safely tested its 1st product, physically delivered BTC futures on July 22nd and it launched on September 23rd. It’s now buying BTC for delivery on the futures market. But that didn’t stop BTC from going into a bull market.

As I already mentioned, in May of 2020, the BTC protocol will only allow half as many new coins produced in each cycle. The average block generation time is about 9 min and 20 seconds. Right now, 12.5 BTC are mined in each cycle, but on May 27, 2020, that will drop to 6.25 coins per cycle. This means the supply of new coins will drop at the time when institutions will be wanting them more. BTC usually rises about 200% in the year prior to a halving, however, I would expect the rise to be much greater in a roaring bull market which is possible for 2019-2020.

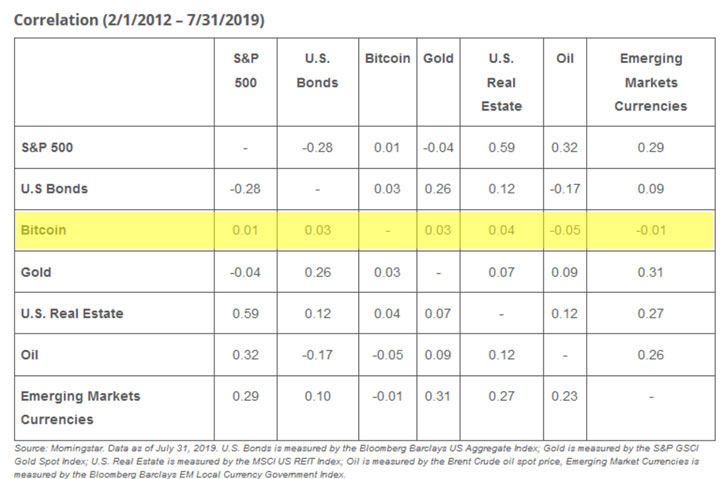

Institutions want to own BTC. They see it as a totally uncorrelated asset. So, when it’s possible I expect them to put 2-4% of their assets into cryptocurrencies. That could give cryptos a market cap of $3-5 trillion. And if BTC remains at least 50%, it translates into at least one more very big move in cryptos.

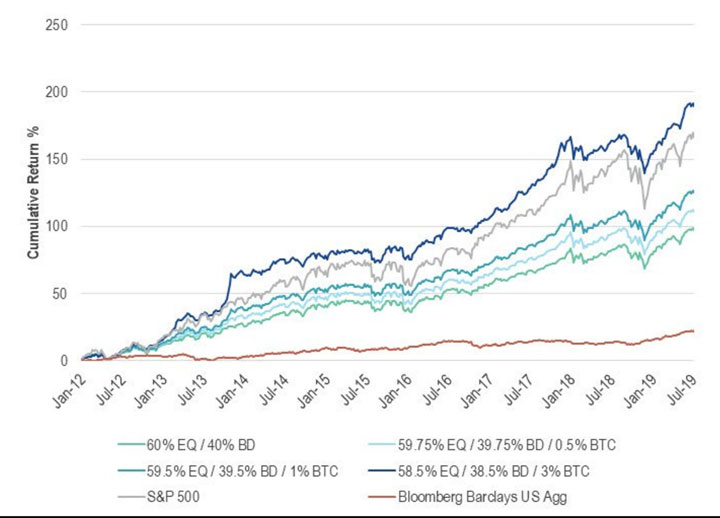

The following two images should illustrate why Institutions will want to own cryptos. The first graph shows a portfolio, with and without BTC. Having BTC dramatically changes the portfolio. Look what happens to a portfolio of 58.5% equities, 38.5% bonds, and 3% BTC when compared with the S&P 500?

The second graph shows the correlation between BTC and other asset classes.

Furthermore, newsletters are starting to talk about the death of fiat currencies. First, central banks are buying gold like crazy which is part of the gold rally. But gold is up maybe 20% versus BTC 250% this year. In addition, many countries now have negative interest rates on their bonds. In other words, people get paid to borrow money. That is not sustainable.

My Beliefs About Cryptoassets

- Cryptocurrencies are an uncorrelated asset class and institutions really want to get involved. Thus, if about 2% of the money currently in stocks and bonds (i.e., about $160 trillion worldwide) flows into the crypto market, then this asset class will move from a market cap of $285 billion currently to about $3.2 trillion. These are very conservative estimates, remember the performance chart with 3% BTC!

- If BTC continues to be at least 40% of the total crypto market cap, then its price will go up to more than $100,000 – but perhaps $500,000 is more realistic. The Winklevoss Twins who own more than a billion dollars’ worth of BTC say they wouldn’t sell even if it were to hit $350,000 per coin.

- On its way to that level, however, BTC will continue to have drawdowns in the range of 75%. You want to participate in the upside, but you also want to avoid the worst part of the drawdowns. For example, BTC hit $14,000 in the last bull market but is now just above $8000 – which is a decline of about 45%/

- You would risk only an amount you can comfortably afford to lose completely. You also need to be able to tolerate large volatility swings in your holdings.

- If these assumptions/beliefs are not valid for the future, then the system may show very poor results and could even lose money. You need to know the context for which these beliefs are useful (see below).

- Any investment in cryptos should be limited low single digit percentages. For a $100,000 portfolio, a $5,000 BTC position could grow to be worth more than $50,000. If the rest of the portfolio was relatively static, then the BTC position would then be 33% of the total portfolio. A long-term volatile position with a 33% size is a bad position sizing strategy (poor risk management), and it’s also a way to make a huge amount of money. But, assuming BTC’s very volatile nature continues you could assume that you would have to tolerate very large daily swings in your entire portfolio value because of your BTC position.

- The context in which these beliefs are true could change dramatically and then all bets would be off, i.e. you could lose most or all the money in your crypto position. For example, the development of a quantum computer would change everything about cryptocurrencies because 1) a single quantum computer could basically dominate all BTC production and 2) most cryptos would be subject to a 51% attack on their network by a quantum computer. Right now, that kind of threat is way too expensive for anyone to consider pursuing.

- Right now, the power struggle regarding Libra and those in power and the one between the SEC and those who do not wish for the SEC to regulate their coins does not make a favorable climate for most altcoins.

Binance’s departure from the US is a good example for belief #7.

Remember that the purpose of this report is not meant to give investment recommendations or to be predictive in any way. It is meant only to give you a status quo of the cryptoasset markets.

Until Novembr 15th, this is Van Tharp.