In May 2018 Bloomberg announced that they had formed a cryptocurrency index, which is significant for a few reasons. First, Bloomberg only caters to institutional clients so their index is their first step to widespread institutional involvement. Secondly, in early 2019 we will see ETFs for both BTC and ETH. Chances are Bloomberg’s index will form the basis for a cryptoasset index-based ETF in the next two years. In that same time period, we are also going to see the SEC end its war with ICOs and end its argument that anyone raising capital with the promise of a profit is selling a security. In addition, the SEC will allow regulated exchanges for cryptoassets to open sometime in the next two years. After that, institutions will move significant assets into the cryptoasset markets and the eventual market cap will probably be in the neighborhood of 20 trillion dollars.

The British are considering outlawing crypto assets, so their situation might be worse than the US with the SEC thinking that every ICO might be a security in disguise.

Last month I said that big news should be coming out this month, since November 2018 was the target for Intercontinental Exchange (ICE), which is the firm that owns the NYSE among many other exchanges to come out with its institutional platform for cryptos called BAKKT. ICE is developing Bakkt in conjunction with Microsoft and Starbucks. Institutions typically cannot hold their own assets, someone else has to hold them for them. And there are all sorts of issues around security etc. that have to be overcome.

Most institutions would love to have some exposure to cryptos because they are totally uncorrelated with other assets, such as equities. In addition, they give the potential for huge gains, which is exactly what pension funds have been looking for in their portfolios.

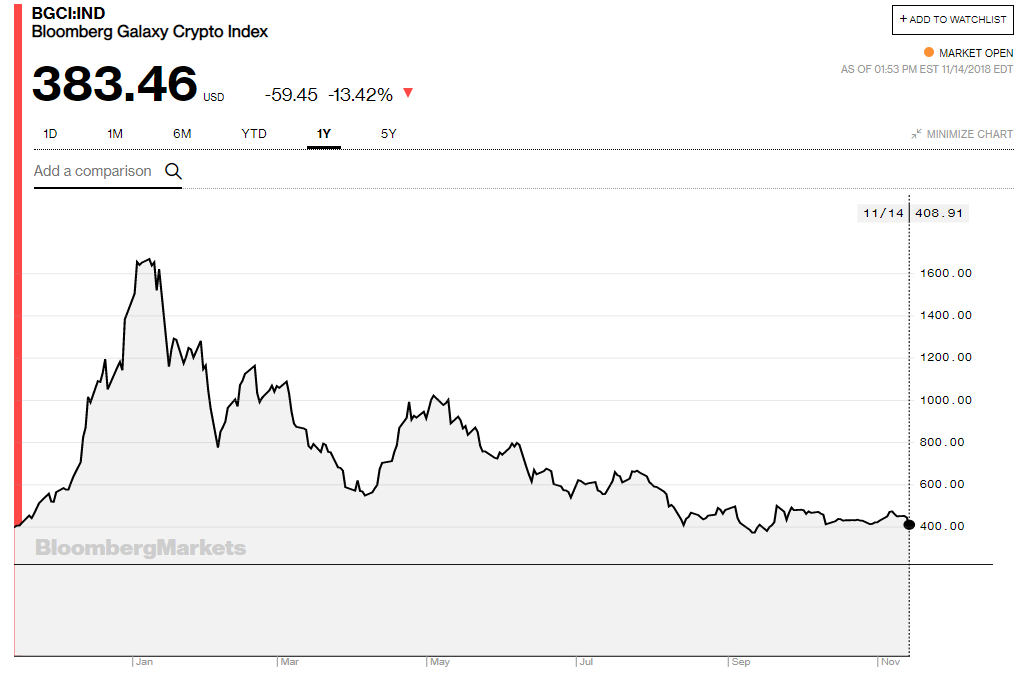

Now let’s take a look at the Bloomberg Index, the Bloomberg Galaxy Crypto Index. The index tracks ten major cryptoassets: Bitcoin (BTC), Bitcoin Cash (BTC), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC), EOS (EOS), Ripple (XRP), and three privacy coins DASH (DASH), Z-Coin (ZEC), and Monero (XRM). They started the index in May at 1000. It reached a high of 1020.73 on May 4th but the index shows a clear downtrend and it’s probably dangerous to invest in the asset class until we at least have two months of stable prices. Here is a graph of the index to date. Last month the index as at 399.94. This month it is slightly higher at 435.01.Two straight up months might be a good buying signal. In fact, the index has been fairly flat for several months.

Bitwise also has opened a HOLD 10 private index fund that you can actually invest in. The only difference between this index and the Bloomberg Index is that the Bloomberg Index holds Ethereum Classic (ETC) while Hold 10 has Stellar (XLM).

For some reason, BTC is down a lot as I write this and that’s reflected in the index which has been both quiet and flat.

Crytocompare also has an index of ten coins and it includes, Bitcoin, Ethereum, Ripple, Bitcoin Cash, EOS, Stellar, Dash, Cardano, and Tronix. So here Cardano and Tronix are different.

The table below shows Bitcoin, a 1st generation crypto asset, plus two second generation crypto assets ETH and NEO, and two third generation crypto assets (Iota and Skycoin). BTC is basically just a ledger whereas Ethereum and Neo both enable smart contract execution based on the ledger. Finally, IOTA and Skycoin are important because they combine smart contracts with huge scalability and zero transaction cost. Just because a crypto is third generation, however, doesn’t mean it will survive and dominate earlier cryptos. I’ve also added the prices for these coins on Jan 15, 2017 to put the current crash into perspective.

* Bitcoin was as high as 90% of the market cap of all cryptos at the beginning of 2017 to as low as 32% at the top of the market. Part of the difference is that there are now nearly 2000 cryptocurrencies. SO the number keeps going up even though the market cap goes down.

** This was the peak of the crypto market in terms of market cap. Data via Tama Churchouse, Asia West Investor email on 4/11/18

The data in both of these tables comes from www.coinmarketcap.com. Coinmarketcap.com now lists 20985 cryptos, but it only gives a market cap for 1735 coins (but that’s up by almost 100 coins over last month). The lows ranking being for Bolenum at $146. Probably everyone reading this could afford to buy the entire supply if there is a market for it. There are actually five coins with a market cap of under $300. But my favorite coin (in the junk category) is one with the name of PonziCoin with a total market cap of $2756. Anyone want to buy that one. What a name to give a coin.

Notice that the market cap on October 16th has fallen over 70% since January 8th when we first started doing the crypto monthly update.

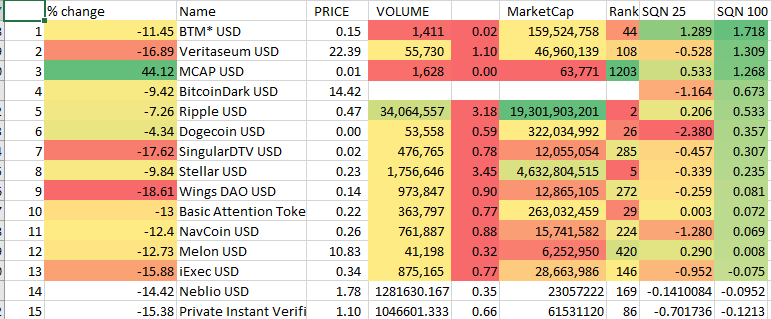

Yahoo Finance now lists prices for about 100 cryptocurrencies so I can run some of my normal studies on the data. I’m only looking at those coins for which there is at least 100 days of data – which does not include every crypto in the top 100 list by market cap. However, we have not updated the number of cryptos since we started.

This month three cryptos, like last month, have an SQN 100 over 1.0 and all the top 15 coins have positive scores. A number of major coins (Stellar, Ripple, Bitcoin, ZenCash) are all positive. But this is yesterday’s data and BTC has dropped about $600 today. This data will probably quite different at the end of the day. However, the data certainly don’t show an uptrend so it doesn’t really matter.

I recently saw that Fidelity would be opening up a crypto desk for institutional investors in 2019. So this again is more news suggesting that 2019 could be a huge bull market again.

Cryptos are generally hated and big money is trying to take the market over by scaring people out. Generally, they are doing a good job because this is a very strong bear market. When the institutions believe they have sufficient control and size of the market, they will let the price rise and you can expect to see the first Bitcoin ETF. People will get excited again at that time. See the other article with this month’s update for what is really going on in the crypto universe.

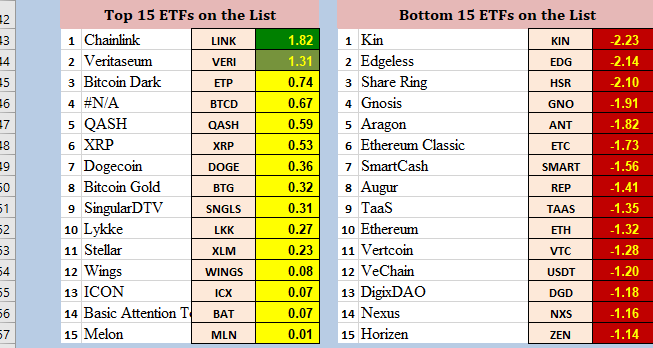

In my crypto market model, I have a different listing for the top 15 and the bottom 15 cryptoassets. The table above uses Yahoo data and the table below uses coinmarketcap.com data. In the next few months, we expect to integrate this information, but for now, I’ll just report both sets of data separately. However, it will probably take some time as Coinmarket cap now wants to charge $700 to use their data, so we will switch to another source.

Notice that our second listing also has all 15 coins with positive numbers. However, only two coins are green and that might change with today’s crash in the crypto market. The bottom 15 coins are all red and there are some major coins there such as ETH and ETC.

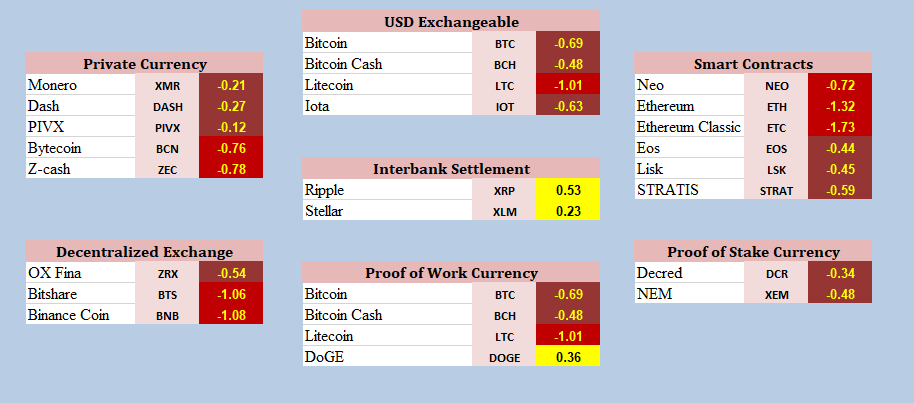

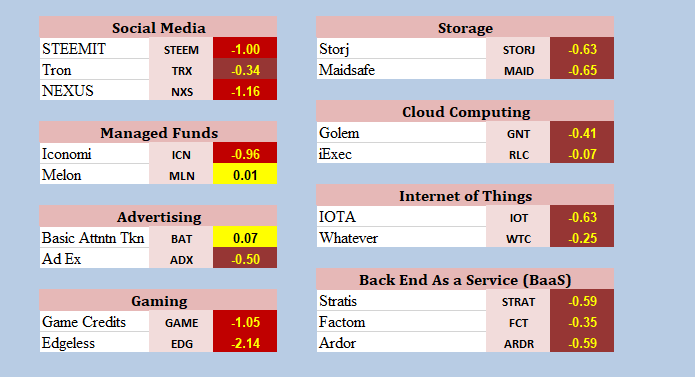

We have also classified the coins by type. We expect to improve in time this very preliminary version.

The next chart doesn’t show anything exciting with only two yellows.

As I’ve said before, the blockchain is an institutional revolution, not a technological revolution. Right now institutions determine value and have all the power. Blockchain technology is likely to change all of that by allowing decentralized groups determine value. Institutions (and here I include big countries), however, will not give up their power easily. Right now, there is a conspiracy going on to keep prices down so that big institutions can accumulate as much as possible while they scare the average guy out of the market.

I haven’t changed my mind about 2019 being a SUPER year for cryptocurrencies. All of the following should happen shortly.

Bakkt, the global digital asset exchange being put together by the Intercontinental Exchange, owner and operator of the New York Stock Exchange, will launch in Dec (I think Dec 18th). Its launch will provide institutional money managers with custody solutions and a regulated, secure platform.

A new partnership is in the works between TD Ameritrade crypto exchange ErisX. ErisX will be similar to Bakkt. TD Ameritrade has over 11 million funded customer accounts with $1.2 trillion in assets under custody.

In addition, Fidelity is planning on a platform to launch new crypto products. Fidelity is even bigger than TD Ameritrade, with 27 million customer accounts and $6.9 trillion in assets under custody.

What’s going on in the sudden drop in cryptoassets over the last few days?

Coinbase has now listed BAT and ZRX. That’s good news for those tokens because it means that the SEC does not consider them to be tokens under the current SEC regulations. The SEC plans to go after both tokens that it considers to be securities and exchanges that list them. And what better time to do this than right before institutions want to pile into the crypto market. Here I’m making a big assumption that the SEC is a tool that big money can use to control prices. This assumption may or may not be valid.

It appears that the SEC is preparing to take down my cryptocurrency exchanges and ICO project. Apparently, there are many pending cases in the hands of the SEC right now. These enforcement actions are usually kept confidential until they are resolved.

Stephanie Awakian, co-director of the SEC’s enforcement division confirmed that dozens of investigations are now underway and they expect many more in the future. (This, by the way, is why US Citizens are not allowed to participate in most ICOs these days and why many overseas exchanges will not open accounts for US customers.

Many ICO projects are on thin ice with the SEC. And this could cause an even bigger drop in confidence from investors and thus in crypoasset prices. This will probably continue until the SEC provides clear guidelines for what is and is not a security.

And you have to ask yourself, is this a legitimate enforcement or an attempt through big money to driver cryptoassets prices even lower through 2018.

Bitcoin Cash is due to have a hard fork on November 15th. If you own the crypto you should have it in a wallet or an exchange where you’ll get the full benefit of the fork. It has gone up considerably because of the fork, but now its dropped by over 24% in just 24 hours. If you have your coins in an appropriate place, then you’ll get the new coin BCH SV on a one to one basis. The consensus opinion seems to be that the new fork will become the major coin and the older coin will become much weaker.

And what’s going on appears to be an argument between two of the whales in the BTC market. Craig Wright, who claims to be the real Satoshi Nakamoto (the pseudonymous creator of bitcoin), leads one factor. Wright reportedly mined over 1 million bitcoin in the early days of the network. At today’s prices, that’s about $5.5 billion.

Roger Ver, often called Bitcoin Jesus and another early advocate of bitcoin leads the other faction. And what’s going on is these two titans differ over the direction of Bitcoin Cash after the fork. So it’s not even about bitcoin, it’s about the fork that happened yesterday in BCH.

Ver supports updating the Bitcoin Cash network to implement increased scaling and smart contract options. Wright considers these changes unnecessary and wants to return to the original Bitcoin protocol. According to what I’ve read, the split is a high-stakes game of chicken. Ver and his followers want to upgrade the network to allow for faster transaction times. Wright and his followers, who are purists, do n’t want to change the protocol at all.

This type of nerd war has happened before. The first nerd war saw three major price breaks in 2017. There was a massive shakeup in confidence. But remember that BTC crossed $20,000 at one point after that war ended.

Right now, investor sentiment is very poor and people have lost 80% of the value or gone bust if they were stupid about it. Thus, it doesn’t take much to really cause people to panic. And more people are actually involved in the crypto market today than in 2017.

So, the bottom line is that it’s just a game of chicken as Wright threatens to sell a lot of BTC that is causing people to panic. And I’m sure major institutions would love Wright to follow through on his threat. Perhaps they are even working together to drive down the price some more.

Bottom Line:

1) Cryptos have a lot of advantages including:

Self-sovereignty of your assets (you control your assets, not some bank).

Tamper-proof accounting (data on the blockchain can’t be corrupted or falsified).

Confiscation resistant (it’s difficult for governments to seize crypto assets).

The ability to verify data (without the need for a “trusted” third-party).

The ability to transfer assets (including money) and records nearly instantaneously and at low costs.

2) I don’t know what Bitcoin is going to do for the rest of the year. But I would guess the next Bull Market will probably start when ICE comes out with its platform for institutional investors to be able to buy cryptos. That is supposed to happen next month.

3) I don’t like BTC because it is too slow to send, too expensive to send, and it it’s currently using up about 1.5% of the world’s electricity and this will get much worse. But I still wouldn’t be surprised to see it have a $50K plus valuation soon.

4) I don’t know if the second and third generation crypto assets (Iota and Sky) will be the primary vehicles of the future. If they survive, I’m sure there will be lots of changes through forks.

5) I am convinced that blockchain technology is absolutely here to stay and that the revolution taking place will be the biggest in my lifetime. It will change everything.

6) One commentator on cryptoassets says decentralization is an absolute must for any cryptocurrency. This is true if it is too meet its long-term goals and become an institutional revolution. But remember that in the near term institutions will try to take it over and lack of decentralization will actually be a plus for them.

7) 2018 is currently a difficult year because of a lack of clarity around cryptoassets’ status. To some agencies, they are a form of security. To the IRS (and most national taxing authorities), they are property, which means a tax event occurs as soon as you sell any. For example, if you use a bitcoin debit card to buy coffee, you have just created a tax event. Cryptoassets need the $600 exclusion rule that applies to FOREX before it can become a major alternative to other currencies.

8) In addition, while crypto projects are in their infancy and these small companies have to deal with the SEC, it will be difficult for them to explode into broad adoption. Huge legal issues hamper innovation.

9) There will be ETFs for both BTC and ETH at some time in 2019. When that happens, their prices will explode and the crypto market, in general, will take off big time. Yes, the SEC has turned now numerous requests for an ETF, but it will not turn down the CBOE request that will be coming soon.

10) I’ve offered to help my staff create their own crypto portfolio but most are too reluctant to do anything. Only my personal assistant and one other staff member have set up one.

11) It’s getting really close to the time to set up a crypto-asset portfolio. If ICE does come out with its platform next month that will be the start of the next bull market.

12) Finally, many of the best traders/investors in the world became that way because of a huge edge and because they were the in the right place at the right time. Cryptoassets offer that kind of edge.

13) We are holding a special workshop for the Super Traders at this year’s summit so that they can participate in this revolution. And I’ve lowered the requirements for them to attend.

Until December update, this is Van Tharp. I thought November might be exciting but perhaps that will now be December.

If you didn’t see already Vantharp.com has been overhauled. You’ll find this week’s article on the new site posted as a blog. Registered users can make comments on blog posts.

Excellent web site you have got here.. It’s difficult to find high-quality writing like yours these days.

I really appreciate individuals like you! Take care!!

Superb conquer! I’m going to newbie as you change your web site, how will i subscribe for a web site web-site? A consideration helped me a applicable cope. I’m a bit more IC Markets familiarised in this your own over the air offered brilliant very clear thought