Mid-Term Elections Are Over – Now What?

by D.R. Barton

With all of the talk about the U.S. mid-term elections, I wanted to give my take on my expectations for markets from here.

In the just completed elections, the GOP lost control of the House to the Democrats as expected. The big surprise, however, was that the GOP picked up at least 4 seats in the Senate – a 2 standard deviation surprise. The markets have responded positively to this (and in fairness, some of the upside comes from moving past the election uncertainty).

With the elections behind us, I see seasonal tendencies having a particularly strong influence on the markets now. I realize that we have headwinds out there – tariff troubles, bearish moves by big tech stocks and rising interest rates, to name just a few. But with the major uncertainty of the mid-terms behind us, my technical, fundamental, and seasonal analysis show that we have a good probability of equity markets finishing strongly into year’s end.

Let’s start to dig into why.

Presidential Cycles and Market Returns

I spent almost all of yesterday (election day) at Fox Business Studios in New York where I was asked to weigh in on the elections’ impact on the markets on two different shows. It was a carnival-type atmosphere – and election days should be big news days.

The seed for this article did not come so much from what I said on air but was planted instead when the president’s son, Eric Trump, asked me in the studio’s green room about stock market returns after mid-term elections. He had his numbers right (an average of 15% rise in stocks) but his timing was a little off – thinking that the pop happened almost immediately. Pretty good stuff.

Throughout the rest of the day, I found out that the concept of Presidential cycles for markets is widely talked about but not widely believed. In an upcoming series of articles, I’ll give some wide-ranging support for the validity of the presidential cycle. Knowing that analysis is coming, today I’d like to focus on this particular quarter (three-month period) in the presidential cycle.

Presidential Cycle Data

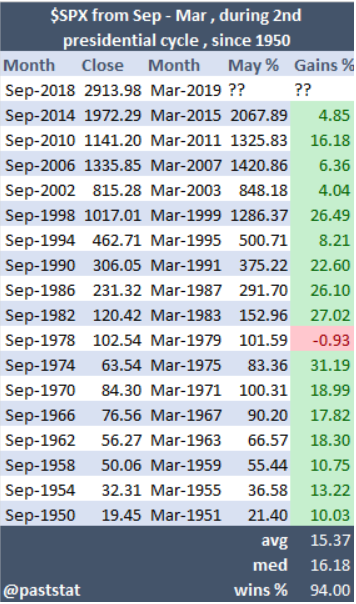

Here’s some great data from the folks at paststat.com on the six months starting at the end of September and ending the end of March for this period of the presidential cycle:

Market history shows an average return of more than 15% for this six month period with only 1 in 17 of the occurrences since 1950 coming in negative (and just barely so).

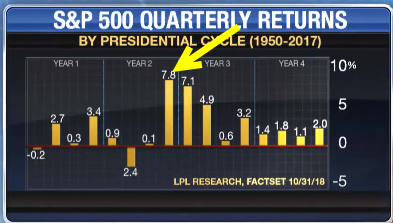

Getting even more granular by looking at the average quarterly returns throughout the four-year presidential term, this data from LPL Research shows that the current quarter (ending December 31) has the strongest performance out of all sixteen in the presidential cycle:

In future articles, I’ll provide some more details supporting the validity of presidential cycle in the markets including peer reviewed academic papers and some well-known money managers who use the cycle.

For now, I’m looking for more market upside into the end of the year, along with some ups and downs as tariff issues are wrestled to ground.

I always enjoy hearing your thoughts and comments! Please send those to me using drbarton “at” vantharp.com

Great trading and God bless you,

D. R.

[…] I have no idea if this is remotely worth even a second glance but it makes strange reading. Why would the US market go so crazy upwards? Counter to these stats why would this continue with the market hitting an all time high so recently? Do these second half presidents take the brakes off the FED?Here’s a link to the article: https://vantharp.com/trading/2018/11/07/mid-term-elections-are-over-now-what-by-d-r-barton/ […]

Thanks for any other fantastic post. Where else may just anyone get that kind of info in such an ideal approach of writing?

I have a presentation next week, and I’m at the look for such info.

Check out the rest of our blog https://vantharp.com/trading/ for more articles like this one

Good post. I learn something totally new and challenging on websites I stumbleupon every day.

It’s always useful to read through articles from other writers and use a little something

from their web sites.

Check out the rest of our blog https://vantharp.com/trading/ for more articles like this one

We are able to only live when on the planet. Never waste yourself clinging onto something that will simply disappoint you.

I was very happy to uncover this great site. I need to to thank you

for your time for this fantastic read!! I definitely

appreciated every part of it and i also have you book-marked to see new stuff in your site.

I blog often and I genuinely appreciate your information. This article has really peaked my interest.

I’m going to book mark your blog and keep checking for

new details about once a week. I opted in for your RSS feed as well.