Last week, leaders from the U.S. and China effectively kicked any tariff tantrum down the road. This is likely going to be a long-running story but with that uncertainly moderated, a Trump’s tweet yesterday morning confirmed the posture (highlighting is mine):

Last week, leaders from the U.S. and China effectively kicked any tariff tantrum down the road. This is likely going to be a long-running story but with that uncertainly moderated, a Trump’s tweet yesterday morning confirmed the posture (highlighting is mine):

A Familiar Old Narrative Returns

A Familiar Old Narrative Returns

So with no new tariff worries in the short to intermediate term, what will the market’s focus turn to?

We saw it in the price action that started this week’s trading. The short-term market pullback was because of… (wait for it…) a really good employment report last Friday. The economy had produced 224k more jobs vs. the 160k expected. On Monday and Tuesday, traders were full of angst that this good news could trigger the Fed to forego an interest rate decrease. Hence, good economic news became bad news for the market.

The “good economic news is bad for the markets” meme is the very obvious tell that this period’s dominant market narrative is going to be whether the Fed monetary policy will accommodate or tighten.

This morning, Fed chair Powell’s prepared statement was released which included the phrase ”the economic outlook continues to dim”. Look at this Wednesday morning chart for SPY and see if you can tell when said statement was released?

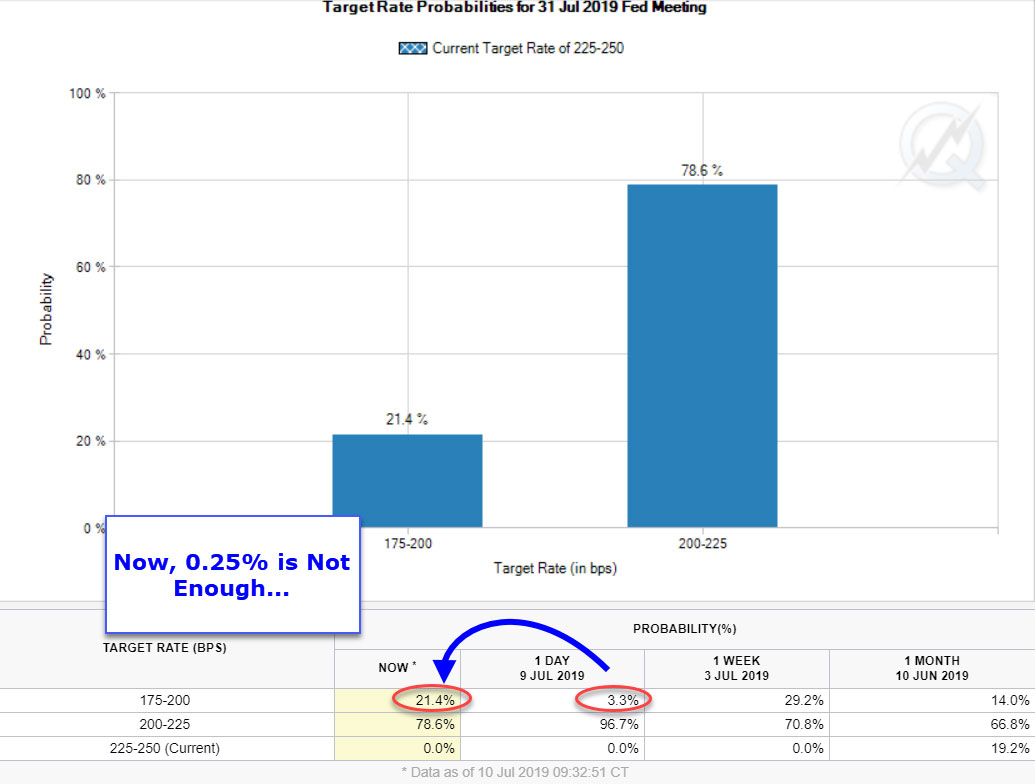

From a market narrative perspective, we can deduce that direct signaling of accommodative policy by the Fed is a good thing… but… many people have claimed that a 0.25% rate cut has already been priced into the market. So why the big pop this morning if Powell’s statement only confirmed what has been assumed? We get a clue from the futures market:

Yep — after the Fed released Powell’s statement, traders bid up futures contracts to hedge their exposure to future Fed rate changes. The probability of a 0.5% cut jumped from 3.3% to 21.4%!

Several Next Numbers

Under this narrative, we are firmly in a “next number” market. Traders and investors will be applying their “good numbers are bad” and “bad numbers are good” filter to every significant economic number between now and the July 30-31 Fed meeting. So it might be instructive to see what important economic reports will hit between now and then. Here’s a fairly useful list of what’s coming up:

- Wednesday 7/10/19 at 2 p.m. — Fed Minutes from the June meeting. Even after Powell’s testimony for the congressional subcommittee this morning, market participants will parse the release of the minutes this afternoon for any hints about future actions.

- Thursday 7/11/19 at 8:30 a.m. — The Consumer Price Index (CPI) will come out. Estimates are for a 2% inflation rate with the core rate that excludes food and energy coming in two-tenths lower. These numbers are so close to where the Fed would like them that it would take a big upward surprise (which the market would hate) or downward surprise (opposite reaction) to move the market.

- Tuesday 7/16/19 8:30 a.m. — Retail Sales report. With expectations low in this beleaguered sector, an upside surprise could happen. Continued weakness in this consumer spending indicator would make the market jump for joy since that spending makes up 2/3 of GDP and hence has the Fed’s attention.

- Friday 7/26/19 at 8:30 a.m. — Preliminary GDP estimate. Most analysts expect a quiet report in the 2.75% to 3.25% range, bracketing the expected 3.0% number, but with weakness to come in the second half of the year. Again, it would take a surprise outside the range to move markets.

- Tuesday 7/30/19 at 8:30 a.m. — The Personal Consumption Expenditure (PCE) inflation reading is usually lower than the CPI measure mentioned above and the PCE is a favorite of the Fed. It’s expected to come in at 1.5% below the Fed’s target of 2.0%. So even an “expected” number would be good news for the market.

- All the previous bits and pieces lead up to the big one — Wednesday July 31 at 2 p.m. — the next Fed Rate Decision.

Bottom Line

I have found that predicting Fed decisions has been a sum-zero game so I concentrate on reacting to what happens. But leading up to the July 31 announcement, there will be more market volatility than usual and I expect it to be slanted toward to positive side for stock market movements.

With the S&P 500 holding firmly above the June 21, 2019 all-time highs, pullbacks are to be bought. Since the June 3 market bottom, the strongest sectors over the past five weeks should continue to dominate: Technology (XLK), Communication Services (XLC) and Consumer Discretionary (XLY). One could do worse than expending your energy there …

Great Trading and God bless you,

D. R.