Trade Alongside Ken Long in His Back to Back Workshops

A note to readers: This article is from a past publication and may contain outdated information, missing links or images.

Ken provided the following analysis in March 2012. Though slightly dated now, it continues to show the level to which he researches the market and how he successfully adapts his trading to remain successful—regardless of what the market is doing.

In the last four months, the market has gone through major state changes. Any single trading strategy has likely had periods of outperformance and periods of possibly dramatic underperformance.

We saw a viciously sideways market whipsaw longer-term traders and market timers with oscillations of 8% to 12% per leg. Volatility began to steadily drain out of the market and by late December a stealth bull was born that was strong enough to produce an unusually large gain in the last 40 trading days and pull well out of the sideways chop around the 200-day moving average. Strength in the U.S. has shifted from large-cap dividend payers to the techs and small caps featuring the biotech and homebuilding sectors, while Europe and Asia have chopped around on worsening economic news.

Do you want to know how I navigate these treacherous waters? I have overlapping systems in multiple time frames that opt-in when market conditions are favorable for the rule set and go off-line quickly when the edge is gone.

Traders employing this adaptive strategy need a disciplined approach to evaluating market conditions that trigger specific systems and the emotional resilience to endure the transition periods. In late December’s stealthy baby bull market, the group of traders I trade with found numerous high reward-to-risk trades. The Renko style charts express price change in standard-sized units of 1 ATR, while the Keltner channel is using a 30-period look-back and a boundary of plus-or-minus 2 ATR around the mean to define “normal” conditions. We looked for reversal to the mean when price changes reversed outside the “normal channel,” just to name one strategy.

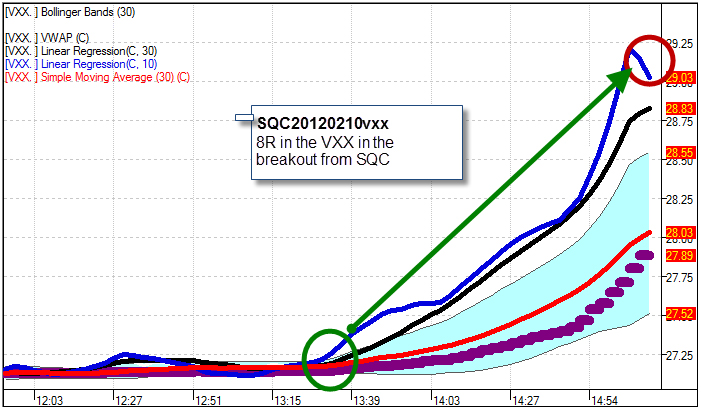

The chart below shows an example of one high reward-to-risk trade that came at the start of a late-day move. Because of the recent market low volatility, there had been some intraday system “shocks”—perhaps from options buyers seeking to quickly hedge portfolios. This triggered an avalanche of buying pressure in the VXX ETF that allowed tactical traders to benefit from sharp volatility spikes. This 8R VXX trade lasted a couple of hours for our traders at the last live trading workshop I hosted in Kansas City. In all honesty, this is larger than my average trade with this system, but I find that the more I prepare for possible trades like this, the “luckier” I get. In this example, we call this pattern SQC, or a breakout from a “Sideways Quiet Channel.” We hid the candlesticks and took our signals from regression line crossovers in order to get clearer signals. The VXX ETF moved from 27.25 to 29.25 in a matter of 90 minutes, and we were able to frame an initial trade on a small initial stop of 0.25.

Like all successful trades, this one required discipline, resilience, attention to detail and bulletproof routines. The Mechanical Swing and Day Trading Workshop and the Live Discretionary Trading Workshop offer traders a week of focused, purposeful learning and practice—precisely what you need to improve performance in any market condition.

After teaching these workshops several times, I put together the top 11 benefits I’ve heard from previous attendees:

- Learning how to hedge longer-term positions.

- Using multiple time frame analysis.

- Leveraging setups from swing and monthly systems for intraday trades.

- Using high-volatility moments to improve reward per unit of time.

- Finding out how to prepare daily in a disciplined way in order to improve your luck.

- Practicing trading with focused accountability.

- Practicing rapid adaptation of trading ideas.

- Trading frequently, which helps traders get over the novelty of trading and find what will work for them in a sustained trading practice.

- Gaining live feedback with multiple perspectives from other traders.

- Collaborating with other trusted traders using a common language for trading.

- Forming a new network and partnerships.

Methodologies of effective learning are an important part of my professional role and my personal research. Over the last few years, I attribute more of my trading advancement to one factor over all others: trading with a group of other traders. I believe adult learners learn best in a collaborative environment surrounded by supportive and like-minded individuals. You will get to experience this Mastermind group environment first-hand in the Live Discretionary Workshop.

I asked attendees what benefits they thought they’d received from trading in a group, and these were some of their replies:

L.H.:

- New trading methods.

- Different interpretations of market/price patterns.

- Examples of real trades.

- Identifying trade opportunities.

- Seeing other traders grapple with emotional control and trade execution issues. Trading can be lonely.

M.H.:

“The Power of the Mastermind: the collective experience is that the wisdom and knowledge of the group VASTLY exceeds what you could find in your individual studies in the market. The ability to put out an idea, opinion or thought into a group of trusted, egoless individuals and get real-time feedback and opinions is highly valuable. The interactive nature of the chat room allows you to evolve your opinions/thoughts/ideas in real time.

“One can contribute as much or as little as one wants. Usually, you see people start in the group and ask a lot of questions. Over time, they become resources within the group as well.

“A vast number of market and trading approaches all with the same underpinnings (position sizing™ strategies, risk management, all the Ken Long ones: preparation, intentional thought, etc). You can trade how you want within the framework.”

A.G.:

- Keeps me in touch with other traders.

- Opportunity to grow as a person as well as a trader.

- Learn from the power of the Mastermind.

- Learn when not to trade.

- Improve methodology and results.

- A positive and challenging environment.

- Expands personal limits.

W.R.:

- Cross-pollination of disciplines.

- Corn trading from one trader, options from another, and silver from a third.

- Multiple observations.

- Graphics of trades (chart prints).

- Collegial atmosphere and genuine effort to help.

- Real trades!

- Thought experiments.

- Process-driven discipline.

- Egos seem to be left at the door.

- Access to uploaded files of multiple descriptions.

As you can see, trading with a group provides numerous benefits and is highly effective and stimulating.

Cheers,

Ken Long

Ken Long: Ken started his collaboration with Van Tharp in the late 90’s. Ken, a professional trader and systems developer, has a large offering of workshops, trader groups and hundreds of free resources.

Tortoise Capital Management takes a descriptive statistics-based approach to global equity market analysis, focusing on low risk, high reward systems that provide individual traders a robust edge. Tortoise Capital develops complex trading systems and regularly conducts workshops and seminars on stock markets with a focus on short- and intermediate-term trading systems that use Exchange Traded Funds, large-cap stocks and futures contracts. Connect with Ken HERE.