You may have heard prognosticators talking about the “January Barometer” with trite phrases like “as the S&P 500 goes in January, so goes the year.” I even had a very respected TV personality say that to me on air this week in a format where I couldn’t “clarify” the misnomer… so don’t believe the hype.

You may have heard prognosticators talking about the “January Barometer” with trite phrases like “as the S&P 500 goes in January, so goes the year.” I even had a very respected TV personality say that to me on air this week in a format where I couldn’t “clarify” the misnomer… so don’t believe the hype.

History is full of strategies that worked for a time, became ineffective, and were subsequently abandoned. We can find examples in product development, marketing, and even comedy. But the easiest place to understand this phenomenon might be in military battlefield tactics. From the ancient times when armies employed bows, arrows, and horses in battles, no real significant technological advances came to the military until gunpowder was employed in the 13th century.

So for thousands of years, military tactics were of paramount importance on the battlefield. And one of the most famous, effective, and enduring formations was the Greek phalanx. In this formation soldiers packed densely together with interlocking shields and used long spears. The strength of the phalanx lied in its unified and seemingly impenetrable front.

Armies made variations to the original rectangular formation but the phalanx as a dominant military formation reached its peak effectiveness under the command of Alexander of Macedon (better known as Alexander the Great). He brought this military strategy to its zenith using a combination of unbalanced phalanx formations, his ability to move troops quickly, and brilliant field leadership.

Then, following closely behind the death of Alexander, came the death of the phalanx. The phalanx proved ineffective in the face of the faster and more flexible three-line Roman Legion formation. The Roman conquest of the Greek city states and the rest of the known world followed.

Like the rise and fall of the phalanx as a military strategy, the famous January Barometer has come to the end of its useful life. Just as the agile Roman Legion overwhelmed the phalanx, quick and volatile markets have killed the January Barometer as well.

The January Barometer — Many Will Discuss It, Few Will Understand It

As we begin the month of February, pundits continue writing and talking heads continue talking about the January Barometer in glowing terms. Don’t be sucked in by the hype.

The indicator was first presented by Yale Hirsch in 1972 and lives on in the Stock Trader’s Almanac, authored by Hirsch and his son. I keep an up-to-date copy of this tome on my desk and find it has many useful references. This particular indicator, however, has gone the way of the phalanx — once useful but now only of historic interest. Let’s dig into the numbers to see why.

On the surface, the January Barometer has had an impressive track record with an 86.8% accuracy claim over the past 65 years. That’s the number you’ll hear quoted over and over again. It is calculated in this simplistic way — if January presents a positive return for the S&P 500, the January Barometer predicts that the full calendar year will be positive. For a down January, look for a down year.

The indicator makes an interesting exception. For any year that the market moves less than 5% in either direction — that year is counted as neutral or flat which counts for neither in support of or against the track record (which is a reasonable exception). Given this caveat, the January Barometer has only predicted the direction “wrong” nine times in the last 68 years. That’s a credible job for an indicator predicting up and down years. That is, until we look at its recent performance.

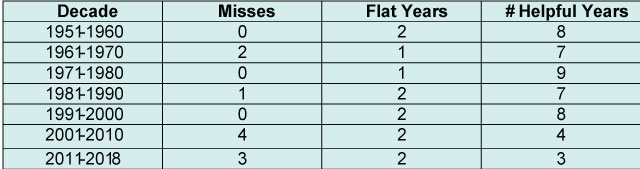

If we break down the January Barometer signals into decades and look to see how many times it has been correct out of each 10 year period, then we can start to see a problem. Let’s look at how many misses (an up January as part of a down year or vice versa) and how many flat years there have been per decade. Once we subtract misses and flat years from 10, the indicator can claim to be helpful for the remaining years in the decade:

As you can see, the usefulness or efficacy of the indicator has dropped off drastically in the lats eighteen years. In fact, the indicator has only been useful in 7 out of the last 18 years. While this sample is too small to be statistically significant, it does raise the question as to whether a once robust indicator has any effectiveness in predicting market direction. As we shall see next, the problem goes even deeper.

Perhaps there has been a change in the investment behaviors that drive markets. Plus, the tax selling of stocks from December that turns into January buying is not as significant a factor as it once was. Regardless of whether underlying investing practices have changed, the structural nature of the markets has changed. Since 2000, the markets have become more volatile and large-scale direction changes occur more quickly and go further. Let’s dig one level deeper into the logic flaw that makes the January Barometer a truly broken indicator.

The January Barometer’s Flawed Logic

The Stock Trader’s Almanac judges the January Barometer by using calendar year results, when those gains (or losses) already contain the January returns. It’s a bit like saying that a football team that outscores its opponent in the first quarter is likely to win the game — but you don’t include the first quarter score in end result! Here’s why…

If you used the strategy to trade each year, you would have to buy on the first trading day of February and exit on the last day of December, sitting out the month of January each year. That strategy, over the last 18 years, results in a loss of -7.6% (even though earned a whopping 40.1% return in 2008!). So as a trading strategy, the January barometer is actually a fade (meaning you make money if do the opposite of what it says).

The January Barometer may have had a good run “back in the day”, but in today’s faster news cycle driven market, it’s not even useful for cocktail talk. It’s just a bad indicator.

Great Trading and God bless you,

D.R. Barton, Jr.