Today is my birthday. But instead of sleeping in and doing my normal morning meditation, I’ve been working on this update since about 8 am. I could have put it off until next Wednesday (since the newsletter was to be out yesterday) but enough important things are happening that I thought it was critical to get this out today.

Today is my birthday. But instead of sleeping in and doing my normal morning meditation, I’ve been working on this update since about 8 am. I could have put it off until next Wednesday (since the newsletter was to be out yesterday) but enough important things are happening that I thought it was critical to get this out today.

Market Summary

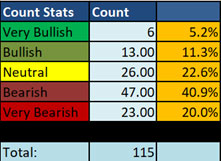

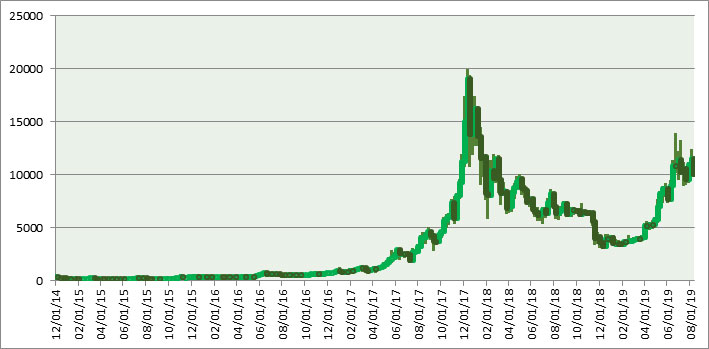

Cryptoassets started the year with three flat months followed by a strong uptrend until the end of June when the Bloomberg Galaxy Crypto Index (BGCI) hit a high for the year of about 600. The index began in early May 2018 at 1000. And if you backtrack it, it hit a high of 1650.2 on January 4, 2018. The GBCI was at 531.37, but today it stands at 400.71 — a drop of 23% in one month . The all-time chart still suggests a bull market, but it’s certainly in at least a correction. The peak in the index this year was on June 26th at 668.61

Bloomberg’s Index tracks ten major cryptoassets and Bloomberg started the index in May 2018 at 1000. Thus, the index has been active for over a year and is now just over 40% of its starting level.

The table below tracks the price of five major cryptoassets across three generations of the technology and I’ve also include GBCI prices:

- Bitcoin, a 1st generation crypto asset,

- ETH and NEO, 2nd generation cryptos, and

- Iota + Skycoin, 3rd generation cryptos

- Plus GBCI

Just because BTC is a 1st generation crypto does not mean it is likely to die off and be survived by the later generation cryptos. It’s hard (impossible?) to predict which cryptoassets will thrive or even survive as we move forward as there are so many variables in play. Technology, use case, adoption, support, and multiple other factors come into play. For now, we monitor these five cryptos because they represent several relevant aspects: public ledger — BTC, smart contracts — ETH+NEO, scalable contracts at minimal cost — IOTA+SKY.

1All of these prices are at the time we did this report and they can change dramatically in a single day. About 5 minutes after we got the BGCI chart, for example, the price dropped below 400. Date of the All-Time High Closes *Dec 16, 2017 ** Jan 13, 2018 ***Jan 15, 2018 **** Dec 8, 2017 ***** Dec 29, 2017 # Jan 5, 2017

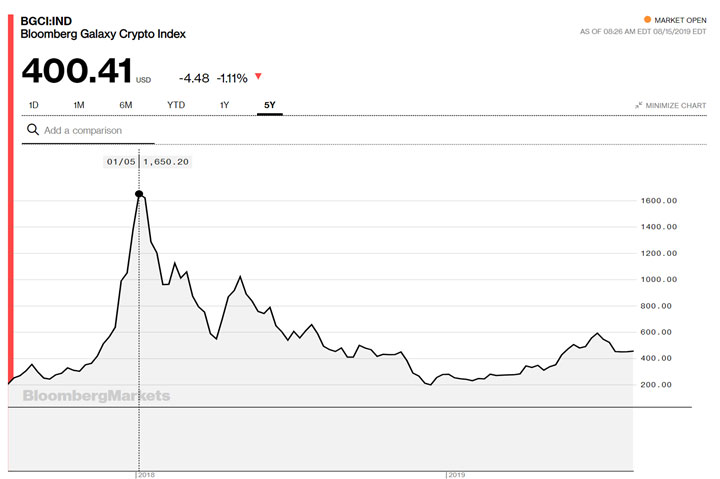

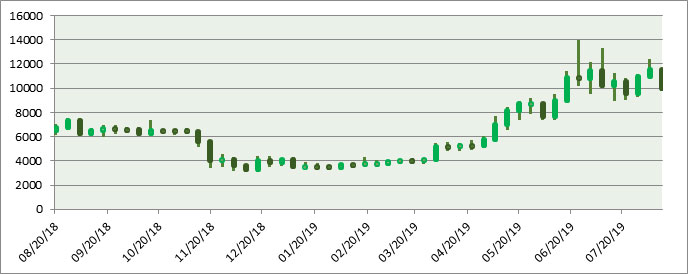

The altcoins (other than BTC) took a huge hit in the last 30 days. BTC, ETH, and NEO are up significantly since December, but Iota is just positive and Skycoin is down. I’m now running a regular SQN 100 program on BTC just to keep track. Here is what that study shows. First BTC has been rated strong bull since April 30th 2019 but it turned bull for three days at the end of July and it’s been just bull for the last two days — so five days since April 30th when it hasn’t been strong bull. The current score is 1.31, but it was at 3.17 on June 25th when BTC was at 12,355.06 and it was 1.85 last month at this time. That’s about 75 days. The current score is 1.85. In addition, 100 days ago BTC was 5819. Thus, BTC would have to be below that value for the SQN 100 to turn bearish. And in the next 30 days we could get a brief bear signal if it dropped below 8750 and it would clearly be bear below 7000.

I have 1991 data points for BTC right now going back to Mar 3, 2014. I calculate the 20 Day ATR% divided by the close as a percentage. The mean of our data is 5.34 and the standard deviation is 3.05. The smallest number is 1.127635 and the largest number is 22.913. That date was the 1st date that suggested that BTC was now neutral after the huge bull market.

The largest day was Feb 2nd 2018 — when the big bear market of 2018 was just underway. The smallest was Oct 5, 2016 — but most of the smallest numbers were in Oct 2016 and the largest number was the last data point we have on March 3rd 2014. March 2014 was bullish for cryptos and October 2016 was a bear market for cryptos. Thus, we might have an unusual phenomenon in cryptos where we get the highest volatility at close to market peaks. In the current bull market for BTC, it hit its peak in volatility on July 20th, 2017 at 12.80. The 20-day ATR% currently stands at 6.03, just a little above the mean.

The following two graphs show BTC on a weekly basis and since 2014.

The more recent chart shows that BTC is in a band with about a $4000 range to the band. And it’s currently at the low end of that.

One of the crypto newsletters that I get said that BTC had just had its biggest initial bull run in its history, but in July it said that it was now in a corrective phase that could take it down to as low as $7000 — a 50% correction. That price still doesn’t give us a bearish SQN 100. However, it more recently said in early August the correction phase is over — about the time BTC got close to $12K.

The market cap table below shows a similar pattern to the individual cryptos in the table above. The total market cap for cryptos is the highest it has been since June 2018.

* Bitcoin was as high as 90% of the market cap of all cryptos at the beginning of 2017 to as low as 32% at the top of the market. Part of the difference is that there are now nearly 2000 cryptocurrencies. So the number keeps going up even though the market cap goes down. ** This was the peak of the crypto market in terms of market cap. Data via Tama Churchouse, Asia West Investor email on 4/11/18

The data in both of these tables comes from www.coinmarketcap.com. Coinmarketcap.com publishes data for 2,315 coins but only 1902 coins have a market cap listed. Only 767 coins have a market cap bigger than $1 million, however, there is also some confusion about their data. They first list 1,165 coins with a market cap and then the remaining coins have a market cap shaded gray but I don’t know what that means and some of the gray coins have a market cap over $1M but I haven’t counted them. Also coin 1157 AAA has a market cap of $841, which the next coin below it has a market cap of $351,923. It probably doesn’t matter because I’m willing to assume that anything under $25M in market cap is junk.

If we look at the first section, which is not shaded gray, then:

- 767 coins have a market cap over $1M (814 last month)

- 260 coins have a market cap over $10M (311 last month)

- 142 coins have a market cap over $25M (170 last month)

- 57 have a market cap over $100M (70 last month)

You definitely should ignore any coins below $25 million in market cap.

Model Results

We are down to one spreadsheet that we plan to use to monitor cryptos and in it, we use price data from Tiingo (a paid data service). I will just be reporting from the results of that spreadsheet. That spreadsheet does the following: It looks for cryptoassets with (1) over $25 Million in Market Cap with (2) a daily volume over a million and (3) at least 100 days of data to collect the SQN. When we did, the MXM was the top crypto and it shouldn’t be because it clearly has a bear chart in CoinMarket Cap (CMC). We reported it as the top crypto last month, but we now know we had a data problem. We then decided to compare the data from Tiingo with CMC, and throw out any coins in which the data is significantly different between the two data services. You can get today’s data for free from CMC, but longer data subscriptions went from free to very expensive (over $700 per month) so our main data source is Tiingo.

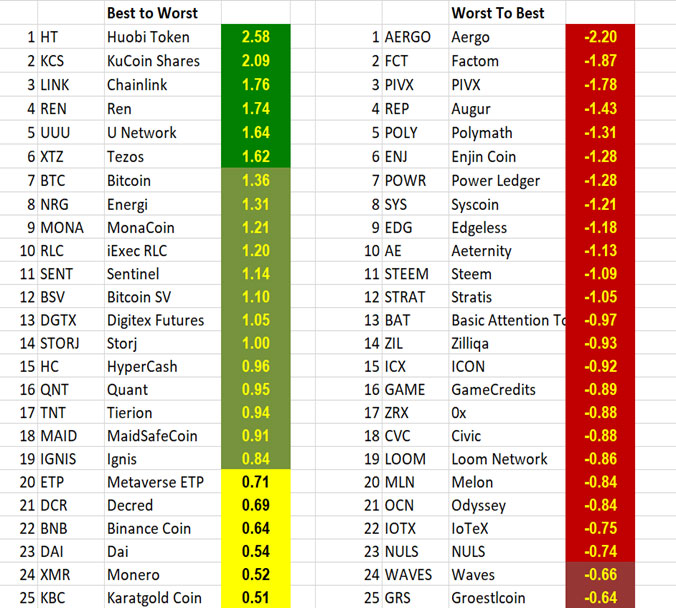

For a while we are dropping our classification of crypto types and just looking at the top coins. The chart below shows the 25 top and bottom cryptos.

Right now we are tracking 115 coins. Only 19 of them are bull or strong bull. Another 26 are neutral and 70 of them are bearish. We’ll explain why later in the update.

14 coins have a score above 1.0 and only 6 are strong bull. In the bottom 25, 23 are strong bear and 11 of them are below minus 1.0. Some of the bottom 25 include highly recommended coins (by newsletters) including FCT, POWR, BAT, ZIL, SYS, XRX, REP, and ICX. These are either super bargains (don’t buy anything when it is strong bear) or they are poor recommendations.

One of my favorite coins, CND, which we don’t track, is currently way below its issue price of 1 cent and 0.68 — which is close to an all-time low. I just checked the SQN 100 for CND at it was also -0.74 so just on the strong bear list.

I have a rule to never buy ICOs (and the SEC is making it easy on me by calling most cryptos securities), but in the past I did buy one CRPT. I think I got a 30% premium and I got 280 coins for about $100 — I was experimenting with buying an ICO. It took about 4 months after the close to get a listing and suddenly, I had a nice premium. However, it only took another few months before the price was below what I paid for it and that’s when I decided there was little value and too much risk in buying an ICO. It happened to be a good one and a newsletter recently recommended it. The sponsors were quick to tell everyone they went up 40% in value overnight (without saying why), but for me that got me to about break even and I’m below that again. We don’t track CRPT but its SQN is about 1.23 as a result of the newsletter recommendation.

Institutional Involvement & Supply

This is the year that I expect significant institutional involvement in cryptoassets. Here is what’s going on right now and in the coming months:

- Fidelity is now selling cryptos to its best clients (although the typical retail client cannot buy through them yet).

- TD Ameritrade plans to offer the ability to buy crypto assets soon.

- The same goes for E-Trade.

- Bakkt — the ICE platform allowing institutions to trade cryptos safely tested its 1st product, physically delivered BTC futures on July 22nd. I have no idea when it will be fully functional.

In May of 2020, the BTC protocol will only allow half as many new coins produced in each cycle. The average block generation time is 10 minutes (actually about 9 min and 20 seconds). Right now, 12.5 BTC are mined in each cycle, but on May 27, 2020, that will drop to 6.25 coins per cycle. This means the supply of new coins will drop just at the time when institutions will be wanting them more.

BTC usually rises about 200% in the year prior to a halving, however, I would expect the rise to be much greater in a roaring bull market which is possible for 2019-2020.

Facebook just introduced the idea of a new crypto token which it is calling Libra. Fed Chairman Powell said he had serious concerns about the crypto coin. But why wouldn’t he? Facebook will be printing its own form of money. He said he had serious concerns about privacy, money laundering, consumer protection, and financial stability. But it’s not really Facebook’s coin but the product of the Libra Association which Facebook’s CEO, Zuckerberg, founded. Libra has the support of Visa, PayPal, eBay, Lyft, Uber, and Spotify.

In response to all of this:

- Mark Cuban said “There’s going to be some despot in some African country that really gets upset that they can’t control their currency anymore, and that’s where the real problems start occurring.”

- Donald Trump said, “I’m not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based upon thin air. Unregulated crypto assets can facilitate unlawful behavior, including drug trade and other illegal activity.’… if Facebook and other companies want to become a bank, they must seek a new Banking Charter and become subject to all Banking Regulations.

Incidentally, about 1-2% of BTC activity probably involves illegal activities, whereas US dollar cash constitutes a huge portion of illegal activities. So, it’s just the powers that be trying to justify any actions they might take against something that threatens it.

To me this just shows the potential of cryptos to change everything, including power structures. But the powers that be are not willing to give up power easily. Anyway, Libra has introduced a negative (and probably brief) wrinkle into the BTC bull market.

However, there is a second and even more serious wrinkle to the BTC bull market and that’s the SEC position on cryptocurrencies being securities and under their regulatory control. Most of the world is still introducing new Cryptos through Initial Coin Offerings (ICOs). But, because of the SEC stance, are preventing US Citizens from owning it. Exchanges also face some liability here and as a result most of them are closed to US Citizens. One exception has been the world’s largest exchange, Binance. You could buy almost anything there.

But Binance now prohibits US Citizens from opening new accounts. Many of the altcoins as a result can only be purchased through Kucoin or a decentralized exchange (and these don’t have much liquidity). US account holders can no longer trade or deposit starting on September 12th but sometime this year Binance will open up a US Office. Binance is currently evaluating 30 coins to be listed on its U.S exchange; ADA, ATOM, BAT, BCHABC, BNB, BTC, DASH, EOS, ETC, ETH, HOT, IOTA, LINK, LOOM, LTC, MANA, NANO, NEO, PAX, REP, RVN, TUSD, USDC, USDT, VET, WAVES, XLM, XRP, ZIL AND ZRX.

And that’s what is happening to most of the altcoins and why they are in a bear market. Here are some approximate statistics from Binance. About 25% of their daily volume has been from the US. About 6% of their volume comes from Japan, but that might drop as Binance just moved from Japan to Malta as its primary headquarters. Malta is a crypto haven as they don’t tax their citizens on crypto profits. The really interesting aspect of Binance’s volume is that the 3rd largest sector of it comes from India even though it is illegal for Indian citizens to own cryptos.

I own a lot of CND. It’s an artificial intelligence coin that predicts prices for those who own a sufficient number of the coins. And this is not a recommendation for that coin, but rather an illustration of what is going on in the market. The people behind CDN (it’s a Russian group) claim their accuracy is now about 68% on their predictions. Their goal is to have a number of hedge funds using the coin, which could drive prices as high as 1000 times the current price. And if that is their goal, it would be a disaster if US Citizens could not trade it. And because of what is going on, right now it’s below the issue price of one cent. It takes a million to get the highest level of prediction, but right now that’s a $6200 investment. I asked them through Telegram what will happen when Binance is closed (and to me its closure to new US Citizens has already impacted the price) and they told me about the new Binance for US Citizens. However, they couldn’t guarantee that they’d be listed and it doesn’t look like they will be. So, expect a bear market for anything you cannot buy in the US — and that’s most of the altcoins and especially something like CND.

Grayscale has openings in its various cryptocurrency trusts, including GBTC, for accredited investors. The advantage of participating is that the shares always sell at a huge premium. GBTC is now about 30% and has been as high as 100%. The disadvantage of investing in Grayscale is that you cannot sell your investment for a year. And that’s a huge risk because who knows what will happen in a year.

Grayscale’s new trust for Ethereum, ETHE, has been open less than six weeks. The value of a share in last month’s update was about $218. However, in the first few days the price was as high as $600 and it’s currently still trading at about 100% premium at $37.51. It probably should sell at perhaps a 25% premium and that be about $20-$25. It just shows how stupid some people can behave when they purchase something at 1000% premiums or even the current 100% premium.

Grayscales ETCG fund, which invests in Ethereum Classic, is currently selling at about 11.90 which is about 100% premium. One of my signals to sell GBTC is when it is at 100% premium. I certainly wouldn’t be interested in the trusts that have 100% premium.

My Beliefs about cryptoassets right now.

- Cryptocurrencies are an uncorrelated asset class and institutions really want to get involved. Thus, if about 2% of the money currently in stocks and bonds (i.e., about $160 trillion worldwide) flows into the crypto market, then this asset class will move from a market cap of $285 billion currently to about $3.2 trillion. These are very conservative estimates

- If BTC continues to be at least 40% of the total crypto market cap, then its price will go up to more than $100,000 – but perhaps $500,000 is more realistic. The Winklevoss Twins who own more than a billion dollars’ worth of BTC say they wouldn’t sell even if it were to hit $350,000 per coin.

- On its way to that level, however, BTC will continue to have drawdowns in the range of 75%. You want to participate in the upside but you also want to avoid the worst part of the drawdowns.

- You would risk only an amount you can comfortably afford to lose completely. You also need to be able to tolerate large volatility swings in your holdings.

- If these assumptions/beliefs are not valid for the future, then the system may show very poor results and could even lose money.

- Any investment in cryptos should be limited to low single-digit percentages. For a $100,000 portfolio, a $5,000 BTC position could grow to be worth more than $50,000. If the rest of the portfolio was relatively static, then the BTC position would then be 33% of the total portfolio. A long-term volatile position with a 33% size is a bad position sizing strategy (poor risk management), and it’s also a way to make a huge amount of money. But, assuming BTC’s very volatile nature continues you could assume that you would have to tolerate very large daily swings in your entire portfolio value because of your BTC position.

- The context in which these beliefs are true could change dramatically and then all bets would be off, i.e. you could lose most or all of the money in your crypto position. For example, the development of a quantum computer would change everything about cryptocurrencies because 1) a single quantum computer could basically dominate all BTC production and 2) most cryptos would be subject to a 51% attack on their network by a quantum computer. Right now, that kind of threat is way too expensive for anyone to consider pursuing.

- Right now, the power struggle with regard to Libra and those in power and the one between the SEC and those who do not wish for the SEC to regulate their coins does not make a favorable climate for most altcoins.

Remember that the purpose of this report is not meant to give investment recommendations or to be predictive in any way. It is meant only to give you a status quo of the cryptoassets markets.

Until September 15th, this is Van Tharp.