Dr. Ken Long provided us the following charts yesterday to help demonstrate a variety of ways someone could have traded the market decline on June 25 and 26 using one fractal pattern of the many he teaches.

Dr. Ken Long provided us the following charts yesterday to help demonstrate a variety of ways someone could have traded the market decline on June 25 and 26 using one fractal pattern of the many he teaches.

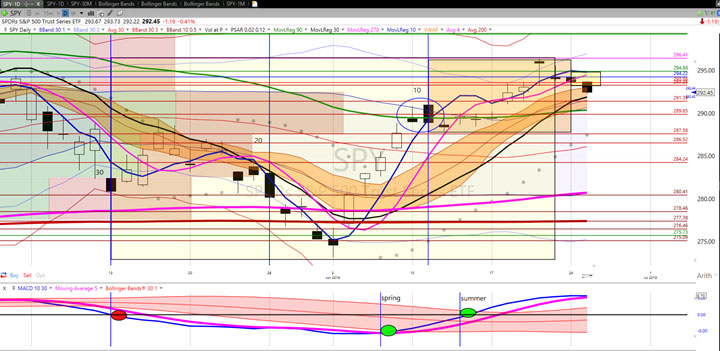

The first chart shows daily bars for SPY which indicates an initial pattern of decline after a peak. You can see this in the price bars as well as below in the “seasonal change” of the MACD. He calls this price pattern the “Collapsing Dragon” which alerts traders to the probability of downtrend starting.

The second chart shows the Collapsing Dragon pattern developing in the hourly bars which provides additional context for the downtrend as well as a very tradeable opportunity. The red dots depict possible short entries both on Monday, the 24th and yesterday morning, the 25th.

If you wanted to trade this pattern using 15 minute bars, the third image shows several potential short entries in yesterday’s morning session with the green dot representing the lunch time exit for the scaled entries.

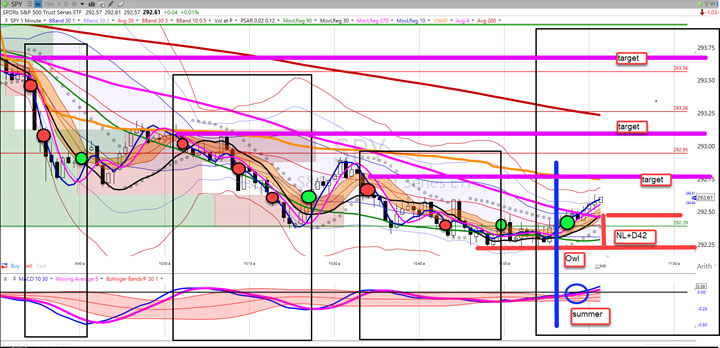

The last image shows the one minute SPY bars yesterday which would have provided three profitable short trades with scaled entries and then a long entry at the midday reversal. The purple horizontal bars represent significant price levels which would offer resistance to price rising but would also act as targets for the reversal. Ken is always assessing the reward potential in relation to the risk before putting on a trade. He calls this critical process “Framing the Trade”.

Ken prefers the tighter risk control and the more plentiful trade opportunities that the shortest timeframes provide. The Collapsing Dragon and the other patterns he trades, however, are fractal in nature and occur constantly in numerous timeframes. You can see this in the multiple trading opportunities above. Once you learn one of Ken’s patterns within his market framework, you can choose the timeframe to trade that makes the most sense to you – from minute bars to daily bars. What timeframe would work best for you?

To learn these patterns and the robust trading systems Ken has developed around them, sign up to attend his next Day Trading workshop. September may seem far away but Ken has new registrants start learning far in advance of the workshop start date with a substantial amount of pre-workshop study comprised of print and online video lessons.

During the workshop, Ken covers the finer points of the patterns, multiple case studies, trade management, and answers questions. In addition, Ken teaches his recommended step-by-step trader development process after the workshop for successfully developing your trading skills in a measurable approach. Ken also follows up with workshop participants through several live webinars (which are recorded) to help students continue their development and answer questions which come up after the live workshop.