Highly Effective ETF and Mutual Fund Techniques

March 16-18, 2007

Raleigh, NC

Presented by Ken Long

Most people are doing the exact opposite of what the big funds are doing and they pay a big price for doing so. For example: you put money into a stock after hearing that a fund manager really likes it. However, by the time you hear about it, the fund manager is getting ready to sell.

But what if you could see what the big mutual funds are doing with their money well before they complete a transaction and jump in ahead of them?

Tharp's Thoughts

Market Efficiency Portfolio

February 21, 2007

By

Van K. Tharp

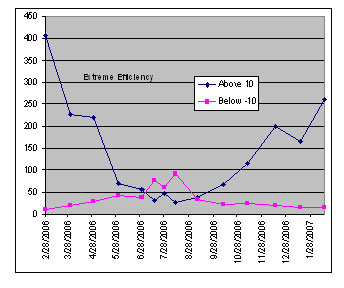

Efficiencies clearly show that the overall market can change quite quickly. Stocks have almost retraced the extreme high ratings of February 2006 when we had 406 stocks with ratings above 10 and only 11 stocks with ratings below minus 10. It was very hard to find a good short candidate. As of February 16th, 2007, the ratings were very similar. We had 260 stocks above 10 and only 14 stocks below minus 10. The efficiency ratings have gone up for five of the last six months. See Figure 1.

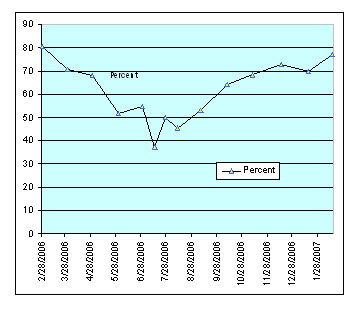

Let�s also look at our second way of measuring market efficiency � the percentage of stocks that have an efficiency rating above zero. This information has been charted in Figure 2. In February of 2006, 80% of all stocks showed a positive efficiency. By July 15th only 37.4% were positive, so it can reverse quite quickly. But now we are almost at a new extreme with 77.1% of the market being positive. In addition, we are also seeing nice movement from most of our portfolio.

Our portfolio looks excellent this month with everything being positive. We have four stocks showing better than 1R gains and one with over a 2.5R gain � the Spanish ETF (MWP). Our total portfolio shows a profit of $3894.19, compared with closed out losses of $4736.44. We�re not up yet, but we are moving there.

Table 1:

| Portfolio as of February 16, 2007 | |||||||||

| Stock | Entry | Cost | Shares | Stop | Price | Value | Profit | R-multiple | |

| Longs | |||||||||

| LQU | 54.05 | 1960.8 | 36 | $53.48 | $71.30 | $2,566.80 | $606.00 | 1.53 | |

| CXW | 42.33 | 1919.85 | 45 | $39.84 | $53.12 | $2,390.40 | $470.55 | 1.19 | |

| MWP | 35.54 | 1756.46 | 49 | $42.42 | $56.56 | $2,771.44 | $1,014.98 | 2.57 | |

| EWP | 52.12 | 1734.96 | 33 | $42.50 | $56.57 | $1,866.81 | $131.85 | 0.33 | |

| LFL | 57.8 | 1749 | 30 | $56.44 | $75.25 | $2,257.50 | $508.50 | 1.41 | |

| NU | 26.52 | 1765.32 | 66 | $21.79 | $29.05 | $1,917.30 | $151.98 | 0.38 | |

| CHL | 42.32 | 1750.12 | 41 | $36.34 | $48.45 | $1,986.45 | $236.33 | 0.6 | |

| ALB | 71.55 | 1732.2 | 24 | $62.54 | $83.25 | $1,998.00 | $265.80 | 0.67 | |

| Shorts | |||||||||

| JRCC | 9.54 | 1732.2 | 180 | $7.64 | $6.80 | $1,224.00 | $508.20 | 1.48 | |

| $3,894.19 | |||||||||

Most of the time, we�ve gotten out of trades because I found a better stock. Getting stopped out at losses bigger than 1R has a big impact on the portfolio. And we got stopped out of two positions during the month, both new ones. The first was a short position VCI. The market went up and we were stopped out early this month. The second was a mid-month addition, PLRO. We were stopped out of that within a few days. Both of those losses are approximately equivalent to the loss for the portfolio.

I made my first psychological mistake in the portfolio with the mid-month addition. I added a bulletin board stock, PLRO. We purchased it at the open at $4.55, and it immediately fell from there. We were stopped out at a 1R loss a few days later. I consider this a psychological mistake because 1) the stock had become parabolic and really didn�t fit our rules (we don�t buy stocks when the movement is parabolic). And second, it was a bulletin board stock that I was watching, rather than one that came from our screening. However, I�ve pointed it out because it shows how easy it is to make a mistake � even when you are showing your mistakes to thousands of people. It added over $400 in additional losses to our portfolio, which is about half the amount we are currently down.

This is probably a dangerous time for our portfolio as well because if the market is at an extreme and suddenly reverses, we could end up giving back much of our open profit. However, the market could also keep going up. And if that is the case, we would probably be profitable by next month. All of the closed out positions to date are listed in Table 2.

|

Table 2: Closed Positions On February 16th, 2006 |

||

|

Stock |

Profit Loss |

R-multiple |

|

FAL |

($2.28) |

(0.006) |

|

BSX |

($183) |

(0.457) |

|

DLX |

($184) |

(0.459) |

|

AETH |

($132.00) |

(0.330) |

|

AYE |

($56.95) |

(0.142) |

|

CG |

($66.72) |

(0.167) |

|

OGE |

($51.06) |

(0.128) |

|

WPI |

($315.08) |

(0.788) |

|

EBAY |

($381.78) |

(0.954) |

|

CHS |

($399.78) |

(0.999) |

|

HOV |

($346.09) |

(0.865) |

|

VTR |

($97.51) |

(0.244) |

|

LEE |

$64.04

|

0.160

|

|

JRCC |

$873.90

|

2.185

|

|

GYI |

($175.82) |

(0.440) |

|

SYX |

$137.24

|

0.343

|

|

CPY |

($303.60) |

(0.759) |

|

OMG |

($183.18) |

(0.458) |

|

ENR |

($130.36) |

(0.326) |

|

JRC |

$77.84

|

0.195

|

|

FMT |

($268.38) |

(0.671) |

|

MLS |

($655.26) |

(1.638) |

|

MRCY |

($201.60) |

(0.504) |

|

ASVI |

($352.58) |

(0.893) |

|

RHB |

($352.16) |

(0.903) |

|

VCI |

($471.27) |

(1.309) |

|

PLRO |

($414.60) |

(1.039) |

|

|

($4736.44) |

(12.04) |

|

|

|

(0.42) |

What about this month�s changes? I�m going to add one more positive efficiency stock, simply because I cannot find anything to short. The strongest stocks right now seem to be some of the foreign airlines. And the strongest stock we do not own is BA, in my opinion. However, our best performer is already a foreign airline, LFL, and I think this portfolio is already too exposed to add another one. (NOTICE THE STRONG DISCRETIONARY ELEMENT OF WHAT I�M DOING WHICH IS WHY THIS IS THE ONLY WAY TO TEST IT).

As a result, we are going to add a fund from another country. But this time we�ll move to Asia and pick the SGF, the Singapore Fund. We will add it at the open on Tuesday.

This is the second month in a row that I�ve only had to make a few changes to the portfolio. I hope that is a good sign.

Until next month�s portfolio review, this is Van Tharp.

$500 Discount Expires Today

Professional E-Mini Futures Tactics Workshop

March 3-5, 2007 - Raleigh, NC

Presented by D.R. Barton, Jr.

- Learn how pro traders take consistent profits from the e-mini markets.

- Don't become one of those traders who tries futures trading and loses a bundle by trading like the herd.

- Discover the tools and tactics that top traders use to gain a huge edge in these volatile and profitable markets.

Blinded by the Present

By D.R. Barton, Jr.

�The chief cause of failure and unhappiness is trading what we want most for what we want in the moment.� --unknown

Living in the current moment is generally a very good thing. Spiritual masters and writers throughout the ages have counseled against living in the past or worrying about the future.

And while staying in the moment is a good thing, obsessing about it can kill even a good trader. Placing too much importance on the current trade is a fault that Market Wizard William Eckhardt talks about in his famous interview in The New Market Wizards.

Eckhardt states, �What really matters is the long-run distribution of outcomes from your trading techniques, systems, and procedures. But, psychologically, what seems of paramount importance is whether the positions that you have right now are going to work.� (Emphasis is the author�s own.)

He goes on to state that this need to make the current trade work is so powerful that traders bend rules to try to will trades to work. In essence, this is the same as a trader's giving in to the �need to be right.�

The theoretical cure for caring too much about the current trade is pretty simple � follow your rules. (Or better yet, develop rules that have an edge in the market and follow them.) But the practical application is a bit tougher!

It�s easy to say that you need to follow your rules, but more difficult to implement. Almost all attempts to micro-manage trades tend to send us toward the human behavior of taking profits quickly and hanging onto losers. Both of which occur because we want to be right.

So how do we combat this micro-management problem as traders? One way is to make systems as mechanical as possible so that a computer or another trader can execute for you at your decision points.

But if you don�t have a staff or a strategy that is easily turned into computer code, then you need a way to keep from over-monitoring. Open your trade, place your stops (and profit targets or trails) and only allow yourself to check prices at set intervals.

Lastly, find a way to ingrain the belief that any one trade is unimportant. Your long term results matter, but this one trade doesn�t. If you can internalize that one thought, you�re well on your way to more consistent trading.

Great trading,

D.R.

D. R. Barton, Jr. will be teaching our New Professional E-Mini Futures Tactics Workshop, March 3-5, Raleigh NC. He will be joined by ace trader Christopher Castroviejo. To see what D.R. says about Christopher, click here.

A passion for the systematic approach to the markets and lifelong love of teaching and learning have propelled D.R. Barton, Jr. to the top of the investment and trading arena where he is one of the most widely read and followed traders and analysts in the world.

He is a regularly featured guest analyst on both Report on Business TV, and WTOP News Radio in Washington, D. C., and has been a guest analyst on Bloomberg Radio. His articles have appeared on SmartMoney.com and Financial Advisor magazine.

It is Tax Time Again...

We often get emails and calls from our clients concerning their taxes. As all of you know, Van is not an accountant or tax guy and we can�t really answer all of your questions. The best advice that we can give you is to refer you to one company that has specifically been in the business of helping traders with their taxes for close to ten years - Traders Accounting.

As an active trader, if you are having problems understanding what forms to use and how to file them and if you are interested in finding someone who will get your taxes done correctly and keep you out of trouble with the IRS, then please take the time to visit them and see what they have to offer.

www.tradersaccounting.com/2006tax

Just Play the Game

by Melita Hunt

Most of you know that we have a downloadable trading simulation game called Secrets of the Masters, which is designed to help you learn position sizing more effectively. All in all, it is just a game, yet I am astounded at the number of people that call in trying to �get it right,� analyzing it and wanting to �learn what to do properly� versus just playing the game.

The game is designed to be experiential, which basically means that you just play it over and over again (without costing any real money) until you get an internal feeling or understanding of the various things that can happen to you in the markets and how your decisions about position sizing affect the random scenarios that you find yourself in. The more you have the experience, the more you learn.

Yet there are so many detailed folks out there who are so intent on getting down into the nuances of how it works, what it should/shouldn�t be doing and trying their best to determine the statistics, numbers and algorithms and what it is likely to do next, that they lose the enjoyment and experience of just playing the game.

I wonder how many people do this with the markets? Are you a chronic �predictor� trying to get the markets right? Wanting to work out or know what they will do next? Well I�ve got some bad news for you, the market doesn�t know or care when you enter or exit it. It just does what it does and the answers aren�t going to come until after the fact.

But don�t get me wrong, I absolutely encourage learning as much as you can about trading, but it�s like swimming or riding a bike. The real experience comes when you jump in the pool or take off those training wheels.

And if it�s not trading, then where else is it in your life that you haven�t been willing to just jump in and play the game?

You can contact Melita at [email protected]

Join in the discussions on our blog and forum

Do Not Reply to this email using the reply button as the email address is not monitored, your email will not be seen. Please click this link to contact us: [email protected]

The Van Tharp Institute does not support spamming in any way, shape or form. This is a subscription based newsletter.

If you no longer wish to subscribe, Unsubscribe Here

Or, paste this address in your browser: http://www.iitm.com/privacy_policy.htm

The Van Tharp Institute

102-A Commonwealth Court, Cary, NC 27511 USA

800-385-4486 * 919-466-0043 * Fax 919-466-0408

Copyright 2006 the International Institute of Trading Mastery, Inc.