How to Develop a Winning Trading System Workshop

$700 Early Enrollment Discount Expires Next Week

My research suggests that the problems people have in developing a trading system fall into five different categories.

The first three areas prevent traders from ever starting (or finishing) the development of a trading system. These are procrastination, computer/technology phobia and being overwhelmed by the whole process. The last two problems, perfectionism and judgmental biases in your thinking, tend to prevent the trader from coming up with a workable system.

Learn more about developing a winning trading system that fits you at our Systems Development Workshop.

Phoenix, Arizona

January 26-28, 2007

Tharp�s Thoughts

Market Update for January, 3 2007

1-2-3 Model In Yellow Light Mode

By

Van K. Tharp

Look for these monthly updates on the first issue of each month. This allows us to get the closing month data. In these updates, we�ll be covering each of the major models mentioned in the Safe Strategies book: 1) the 1-2-3 stock market model; 2) the five week status on each of the major stock U.S. stock market indices; 3) our new four star inflation-deflation model; and we�ll be 4) tracking the dollar.

Part I: Market Commentary.

2006s markets performed okay, and much better than I expected. The three major averages were up on the year. The Dow was up 15.6%, the S&P500 was up 13.6% and the Nasdaq 100 was up 6.8%. This is much better than I expected. However, gold was up 45.6% on the year and the CRB index was up 39.1% on the year. These are probably the best estimates of �real value,� so the US market lagged considerably. Furthermore, the dollar declined 5.6% against the major currencies of the world. Thus, the market�s gain must be put into perspective.

We have passed the rough part of the year and now is the time the pension money starts pouring into the stock market. In fact, the mutual funds have lots of cash flowing in so that is part of the reason the stock market was up in 2006 and that could easily continue in 2007.

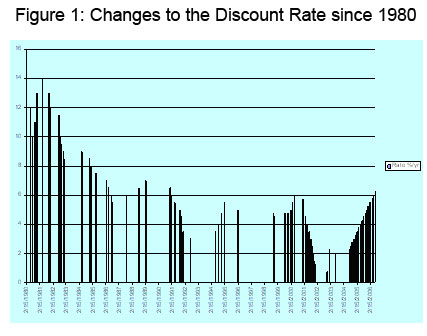

There is also another reason for short term optimism in this secular bear market. The 1-2-3 Model just switched to Yellow Light Mode. Under these conditions the market, on the average, goes up 10.9% per year. The Federal Reserve has not increased the discount rate since July 29, 2006. According to the 1-2-3 stock market model, when the Fed stays out of the way for six months that indicator turns in our favor. That happened at the end of the year on December 29, 2006. However, just to put things in perspective, look at the following bar chart of the discount rate changes over the last 25 years, shown in Figure 1. Notice that short term rates are as high as they have been in a long time. They are higher than their peak in 2000, which may have partially triggered the bear market. I don�t expect the Federal Reserve to lower rates because it must maintain some strength in the dollar, which continues to be weak because of the huge government debt and the negative flow of money out of the U.S. every year.

Now that the November elections are over, I�d expect that the real inflation data will begin to come up. Remember that gold was up 45.6% last year and the CRB was up 39.1% last year. Those are probably much better indications of what�s really happening to the value of things than the U.S. government indicator of inflation, the much manipulated CPI.

Incidentally, the Elliot Wave Theorist recently put out a chart of the U.S. Stock Market in terms of both gold and the CRB. And those charts were strongly bearish.

Next, let�s talk about the market making new highs which the DOW has done. During the bear market crash, the Dow Jones Industrials and the S&P 500 never retreated that much. This is because most mutual funds were invested in them and they never sold them off. They were quite happy to let their funds drop 20% or more during the market decline because that is what the major averages did.

Well, money is still pouring into pension funds (and thus mutual funds) and being invested in those two indices. Consequently, it is not surprising that the DOW is making new highs. But, ask yourself, what will happen when baby boomers start a net redemption of the retirement funds? It won�t be pretty for the mutual funds or the major averages that they use as benchmarks.

Part II: The 1-2-3 Stock Market Model IS IN YELLOW LIGHT MODE and that�s good for stocks.

As I said earlier, the Fed stopped tightening a little over six months ago, so we can now say the �the Fed is out of the way.� And that officially occurred on December 29th. Under red light mode, stocks typically go up, although not massively. The average yearly increase in the S&P 500 is about 10.9% during yellow light mode.

Let�s look at what the market has done over the last five weeks and compare that with where the averages were last year December 31, 2005. This is given in the next table.

|

Table

1: Changes in the

Major Averages |

||||||

|

Dow 30 |

S&P 500 |

NASDAQ

100 |

||||

|

Date |

Close |

% Change |

Close |

%Change |

Close |

% Change |

|

Close 04 |

10,783.01 |

|

1,211.92 |

|

1,621.12 |

|

|

Close 05 |

10,117.50 |

-6.17% |

1,248.29 |

3.00% |

1,645.20 |

1.49% |

|

Close 06 |

12,463.15 |

15.58% |

1,418.30 |

13.62% |

1,756.90 |

6.79% |

|

24-Nov-06 |

12,280.17 |

|

1,400.95 |

|

1,815.53 |

|

|

1-Dec-06 |

12,194.13 |

-0.70% |

1,396.71 |

-0.30% |

1,775.12 |

-2.23% |

|

8-Dec-06 |

12,307.48 |

0.93% |

1,409.84 |

0.94% |

1,786.21 |

0.62% |

|

15-Dec-06 |

12,445.52 |

1.12% |

1,427.09 |

1.22% |

1,808.56 |

1.25% |

|

22-Dec-06 |

12,343.21 |

-0.82% |

1,410.76 |

-1.14% |

1,748.61 |

-3.31% |

|

29-Dec-06 |

12,463.15 |

0.97% |

1,418.30 |

0.53% |

1,756.90 |

0.47% |

The market is continuing to rise and everything is up on the year. As of the end of the year, I don�t need to touch anything in the Efficiency portfolio because most of them look pretty good. As of the close of the year, 71.4% of the market consisted of positive efficiency stocks. And it is difficult to find a good shorting candidate based upon efficiency although JRCC seems to be doing okay for us.

Part III: Our Four Star Inflation-Deflation Model.

I now strongly believe that we are in an inflationary bear market and that our inflation rate is simply masked by government statistics.

So far our models have been telling us, that inflation/deflation is pretty steady, with a slight inflationary bias and that�s where secular bear markets tend to start.

So what�s our new indicator telling us about inflation? I�ve described the inflation model I�m using in these updates for over six months now, so instead of continuing to list the criteria here each month, click here to read more if it is new to you or you don�t understand it.

Okay, so now let�s look at the results for the last six months.

|

Date |

CRB |

XLB |

Gold |

XLF |

|

December 30, 2005 |

347.89 |

30.28 |

513.00 |

31.67 |

|

June 30th 2006 |

385.63 |

32.10 |

613.50 |

32.34 |

|

July 31st 2006 |

391.49 |

30.90 |

632.50 |

33.08 |

|

August 31st 2006 |

390.95 |

32.19 |

623.50 |

33.52 |

|

September 30th 2006 |

379.10 |

31.82 |

599.25 |

34.62 |

|

October 31st 2006 |

383.92 |

33.33 |

603.75 |

35.43 |

|

November 30th 2006 |

408.79 |

35.00 |

646.70 |

35.68 |

|

December 29th 2006 |

394.89 |

34.84 |

635.70 |

36.74 |

We�ll now look at the two-month and six-month changes during the last six months to see what our readings have been.

|

Date |

CRB2 |

CRB6 |

XLB2 |

XLB6 |

Gold2 |

Gold6 |

XLF2 |

XLF6 |

Total Score |

|

October |

Higher |

Higher |

Higher |

Higher |

Higher |

Higher |

Higher |

Higher |

|

|

|

|

+1 |

|

+1 |

|

+1 |

|

-1 |

+2 |

The results of this model are much more sensitive (I believe) than the model I presented in Safe Strategies for Financial Freedom. The model once again shows that inflation is winning.

Part IV: Tracking the Dollar.

The U.S. dollar is still looking weak. It was relatively flat for about six months and then it started a major fall against the Euro which is still going on. This is another reason that the Federal Reserve needs to keep rates high. When interest rates are high, people are attracted to the dollar. But when rates are falling, they will dump it quickly. The IMF has already said that the dollar, at current rates, is 35% overvalued. Can you imagine the impact of the dollar falling another 35%?

|

The Dollar Index |

|

|

Month |

Dollar Index |

|

Jan 05 |

81.06 |

|

Jan 06 |

84.44 |

|

Feb 06 |

85.22 |

|

Mar 06 |

85.17 |

|

Apr 06 |

84.05 |

|

May 06 |

80.77 |

|

June 06 |

81.66 |

|

July 06 |

82.09 |

|

Aug 06 |

81.33 |

|

Sep 06 |

81.75 |

|

Oct 06 |

82.52 |

|

Nov 06 |

81.62 |

|

Dec 06 |

81.00 |

Last

month I pointed out that the falling dollar had attracted The

Economist magazine to feature it on the cover.

Covers tend to make good contrary indicators and the market

did not fall much last month. (Incidentally,

I track the major currency dollar index and not the 17 major trading

partner�s index).

Right now there is no currency around to replace the dollar. It�s not going to be the Euro and I don�t think a major Asian currency becoming the world�s reserve is very close.

Until February�s update, this is Van Tharp.

About Van Tharp: Trading coach, and author Dr. Van K. Tharp, is widely recognized for his best-selling book Trade Your Way to Financial Fre-edom and his outstanding Peak Performance Home Study program - a highly regarded classic that is suitable for all levels of traders and investors. You can learn more about Van Tharp at www.iitm.com.

Trade Your Way to Financial Freedom

Now Available!

Why Should I Buy the Second Edition?

Over the years, I occasionally run across beliefs that seem to help people even more than those reflected in the first edition of this book. And after seven years, I�ve adopted many new, more useful beliefs. As a result, even though most of the core concepts have not changed, I believe that enough things have changed that I can help people even further with a new edition of this book. ~Van K Tharp~

Now 480 pages with three additional chapters including;

Mental Scenario Trading

Evaluating Your System

Using Newsletters as Trading Systems

Tracking Trader Types and How They Approach Their Craft

Trading and Christmas Presents (Part III)

by

D.R. Barton, Jr.

"I am giddy; expectation whirls me round. Th' imaginary relish is so sweet that it enchants my sense. " --William Shakespeare The History of Troilus and Cressida (Troilus at III, ii)

We've explored, over the past couple of weeks, how our expectation (or actually our need to expect) colors the process of receiving gifts. When we open a wrapped gift, it moves from being �anything� or a possibility, to being �something� or a cold hard reality. I have talked about how this process is much like the investigation of a new trading system or idea; as in the Shakespeare quote above, we�re so excited to investigate the idea (figuratively unwrapping it) that we can hardly wait to get into it. But when we�ve dug in a bit, we see that the idea, the �imaginary relish� has both positives and negatives. Discovering those negatives can become quickly disheartening.

How then do we keep this process, where unbounded hope turns into deep disappointment, from happening? I believe that we can do two things that will turn the process into a more objective and useful exercise. The first step is to manage our expectations, and the second is to set-up a useful discovery process that can measure the characteristics of the trading system that are most important to us. Through the use of these tools, our search for a useful trading idea can turn from an emotional roller coaster ride into a constructive � and still exciting � process.

Setting expectations for your trading system is one of the most overlooked aspects of this whole process. And despite the �emotional stability� slant that I have presented in the past couple of weeks, managing your expectations is really a very concrete exercise. It all begins with setting goals for your trading. This is the part of trading that most people want to skip. While goal setting can follow a set format, it is inherently personal (no one else can tell you what�s right for you). And it requires that most difficult of human endeavors � thinking. Developing your trading objectives (or at least the objectives for the system you�re working on) is a critical first step. In Van�s book Trade Your Way to Financial Freedom, Tom Basso (a successful money manager and a Market Wizard himself) said that one should spend 50 percent of his or her system development time on determining objectives. Let that sink in for a moment.

So if you are serious about beneficially managing your expectations for your next trading system, spend some serious quality time on developing your trading objectives � before you take the proverbial wrapper off of that new trading idea.

The best tool I know of for setting goals or objectives for trading is the third chapter of Van�s book, mentioned above. If you don�t have one of these books on your shelf, call the folks at IITM right now and order a copy of the new edition! And then go through chapter three in intimate detail. I obviously can�t go into the depth that the book provides in this short space. But here are some areas to consider (maybe you need some things to work on while the book is in the mail�):

� How much equity do you have to invest?

� What percent returns do you hope to achieve?

� How much of your equity are you willing to risk (in the form of drawdowns) in order to achieve your rate of return?

� How much time do you have available to spend on developing your strategy?

� How many hours a week will you apply to execute the strategy? How are you at working and strategizing by yourself?

� Do you need others for help in strategy development or for accountability and feedback?

These are just some basic thoughts from which to start your system investigation process. I strongly recommend the objectives setting portion of Van�s book mentioned above. But however you go about this step, don�t skip it or give it partial effort! Next week we�ll look at using some performance characteristics of the system itself that you can use to help you understand what is good and not so good about your prospective system.

Until then, I�d like to wish you all a Happy and Prosperous New Year!

Great trading,

D. R.

D. R. Barton, Jr. is the Chief Operating Officer and Risk Manager for the Directional Research and Trading hedge fund group. D. R. has been actively involved in trading, researching, and teaching in the markets since 1986. D. R. has taught extensively in many investment areas including intra-day trading, swing trading, and cutting edge risk management techniques.

His writing credits include co-authoring Safe Strategies for Fin-ancial Fre-edom and co-creator and contributing author on Fin-ancial Fre-edom Through Electronic Day Trading.

D.R. presents the Professional E-Mini Futures Trading Tactics Proven Strategies Workshop, Swing Trading Workshop and Professional Tactics for Day Traders Workshop. Each workshop is only held once each year.

20% Off Sale Will Expire Soon

Did you know that you could get 20% off our core products?

This is just one of the special bonuses that you receive when you pre-order the updated and fully revised edition of Trade Your Way to Financial Freedom (for a limited time only).

The book is only $19.77 and you'll save hundreds using the discount bonus!

Observing Your Own BE-havior

by Melita Hunt

The last subject that I wrote about was �giving� � being the Christmas season and all�and this is a follow up to that story. The basic premise was that there were three families that we adopted for Christmas with 15 kids in total. As of the last writing we were happily gathering and buying items that they had requested (many were just essentials that we use every day) and the following day we went to do the delivery before the kids arrived home from school.

With a truck load of goodies and in good spirits, we arrived at the first apartment. I put on a Christmas hat and had a great time being a mini Ms. Claus, chatting with the mother, holding the baby and talking to the 15 year old daughter about her aspirations to be a singer while happily running back and forth to our wide open cars carrying food and gifts. The family lived in a two bedroom apartment that housed 10 kids - yes you read right, 10 kids in one place, yet I could feel that the atmosphere was festive, thankful, loving and full of faith.

In comparison, the next home was really scary to me; before I even got out of the car I was fearful of my surroundings. I told my friend to lock the cars and we tentatively went to find the other two families who were living together in this neighborhood of boarded up houses (including their own) � we all exchanged uncomfortable pleasantries but I just wanted to unload the car and get out of there as quickly as possible (and wash my hands) and they seemed to feel the same way, looking at me like I was a snob. The atmosphere was icy.

So which place did I learn the most lessons? The behavior of the people at the first house was very thankful, whereas the people at the second house seemed to be thankless.

Actually, I learned a lot from both because they really got me thinking. I realized that it had nothing to do with the people. They were simply a reflection of my own behavior. I could�ve made my experience at either household whatever I wanted it to be.

In the first instance, I was being festive, loving and fun � enjoying every moment of my experience and that�s what I got back, and I was in a very low socioeconomic area at that time too. Whereas in the second instance I had made judgments before I even left my car. I didn�t even give it a chance. I didn�t put on my Christmas hat, nor did I think I was safe and it showed. I had acted as though I was doing them a favor � ouch � which isn�t the spirit of giving at all. I was the one being icy but I didn�t know it in the moment. I had made my bad experience �all their fault.�

So the lesson in all of this for me is to observe my own behavior in all instances as often as possible. If something isn�t the way I want it to look, how am I �being� in that moment and what needs to change? Am I making the situation worse? And if I don�t notice it in the moment, then that�s okay too, because lessons are always there to be learned whenever we�re willing to learn them.

You can contact Melita at [email protected]

Join in the discussions on our blog and forum

Do Not Reply to this email using the reply button as the email address is not monitored, your email will not be seen. Please click this link to contact us: [email protected]

The Van Tharp Institute does not support spamming in any way, shape or form. This is a subscription based newsletter.

If you no longer wish to subscribe, Unsubscribe Here

Or, paste this address in your browser: http://www.iitm.com/privacy_policy.htm

The Van Tharp Institute

102-A Commonwealth Court, Cary, NC 27511 USA

800-385-4486 * 919-466-0043 * Fax 919-466-0408

Copyright 2006 the International Institute of Trading Mastery, Inc.