Wishing all of our readers a happy and prosperous holiday season!

How to Develop a Winning Trading System Workshop

$700 Early Enrollment Discount Expires Soon.

My research suggests that the problems people have in developing a trading system fall into five different categories.

The first three areas prevent traders from ever starting (or finishing) the development of a trading system. These are procrastination, computer/technology phobia and being overwhelmed by the whole process. The last two problems, perfectionism and judgmental biases in your thinking, tend to prevent the trader from coming up with a workable system.

Learn more about developing a winning trading system that fits you at our Systems Development Workshop.

Phoenix, Arizona

January 26-28, 2007

Market Efficiency Portfolio

December 15, 2006

By

Van K. Tharp

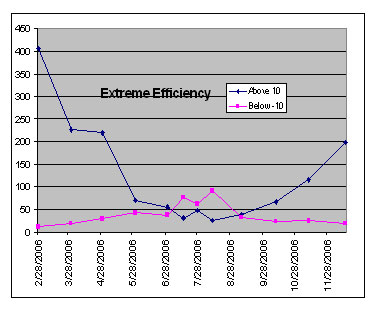

Efficiencies clearly show that the overall market can change quite quickly. In February of this year the market was amazingly strong in terms of efficiency. We had 406 stocks with ratings above 10 and only 11 stocks with rating below minus 10. It was very hard to find a good short candidate. However, the market was not into new high ground as it is now. By August, the market moved as low as having 26 stocks above +10 to its current value of 39. Stocks below minus 10 moved from only 11, to as many as 91. Today, things have reversed and there are 199 stocks above +10 and only 19 below -10.

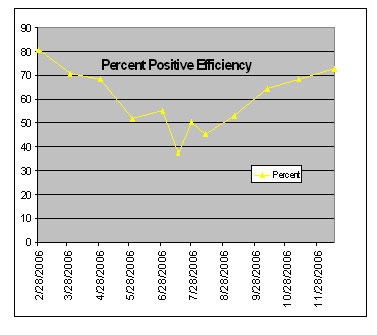

There is another way to measure the efficiency of the market. What percentage of stocks have an efficiency rating above zero? This information has been charted in the second figure. In February of this year, 80% of all stocks showed a positive efficiency. By July 15th only 37.4% were positive, but as of December 15th, we�d moved back to 7.28% efficiency. Last month we had two positive efficiency stocks that took off. I hope that will continue for some time. So far, it hasn�t been a good market for efficient portfolios, positive or negative.

Our best stock last month was MWP, which was up 1.5R last month. LQU, which has been one of the few stocks we�ve held, is also up more than 1R. Overall, our long positions did fairly well with only two going down. However, we were stopped out of two of our three shorts: ASVI on December 15th at $17.35 and RHB on December 7th at $14.89.

The market is now biased toward positive efficiency by 73% (versus 27% on the negative efficiency side). And the number of stocks with positive efficiencies is greater than the number of negative efficiencies by a factor of 199 to 19. Therefore, I decided to only have two negative efficiency stocks and 8 positive efficiency stocks. We will not be selling anything in our current portfolio that has not been stopped out. As a result, I will only be adding one short and one long position this month. This will be the first month with only a few changes, which is what I was hoping to have for most months.

The new long:

Albemarlbe (ALB), at 13.35 efficiency, purchased at the close on Monday 18th at $71.55.

The new short:

James River Coal Company (JRCC), at a minus 10.54 efficiency, also purchased at the close on Monday 18th at $9.54. JRCC was a best closed out trade so far and it is again looking like one of the best negative efficiency stock around.

Our closed out loss totals minus $3685.55, including commissions. All of the closed out positions to date are listed in Table 1.

|

on

December 15th, 2006 |

||

|

Stock |

Profit Loss |

R-multiple |

|

FAL |

($2.28) |

(0.006) |

|

BSX |

($183) |

(0.457) |

|

DLX |

($184) |

(0.459) |

|

AETH |

($132.00) |

(0.330) |

|

AYE |

($56.95) |

(0.142) |

|

CG |

($66.72) |

(0.167) |

|

OGE |

($51.06) |

(0.128) |

|

WPI |

($315.08) |

(0.788) |

|

EBAY |

($381.78) |

(0.954) |

|

CHS |

($399.78) |

(0.999) |

|

HOV |

($346.09) |

(0.865) |

|

VTR |

($97.51) |

(0.244) |

|

LEE |

$64.04

|

0.160

|

|

JRCC |

$873.90

|

2.185

|

|

GYI |

($175.82) |

(0.440) |

|

SYX |

$137.24

|

0.343

|

|

CPY |

($303.60) |

(0.759) |

|

OMG |

($183.18) |

(0.458) |

|

ENR |

($130.36) |

(0.326) |

|

JRC |

$77.84

|

0.195

|

|

FMT |

($268.38) |

(0.671) |

|

MLS |

($655.26) |

(1.638) |

|

MRCY |

($201.60) |

(0.504) |

|

ASVI |

($352.58) |

(0.893) |

|

RHB |

($352.16) |

(0.903) |

|

Sum |

($3,685.55) |

(9.248) |

|

Avg. |

|

(0.370) |

Our active positions, prior to the new buys are shown in Table 2.

| Stock | Entry | Cost (includes $15 comm.) |

Shares | Stop | Price | Value | Profit | R-multiple |

| Longs | ||||||||

| LQU | $54.05 | $1,960.80 | 36 | $43.24 | $66.06 | $2,378.16 | $417.36 | 1.06 |

|

Table 2: Portfolio on December 15th Close |

||||||||

| CXW | $42.33 | $1,919.85 | 45 | $33.86 | $46.11 | $2,074.95 | $155.10 | 0.39 |

| MWP | $35.54 | $1,756.46 | 49 | $28.43 | $47.95 | $2,349.55 | $593.09 | 1.5 |

| EWP | $52.12 | $1,734.96 | 33 | $41.70 | $54.20 | $1,788.60 | $53.64 | 0.14 |

| PBCT | $44.62 | $1,755.18 | 39 | $35.70 | $44.83 | $1,748.37 | ($6.81) | -0.02 |

| NU | $26.52 | $1,765.32 | 66 | $21.22 | $28.00 | $1,848.00 | $82.68 | 0.21 |

| CHL | $42.32 | $1,750.12 | 41 | $33.86 | $39.92 | $1,636.72 | ($113.40) | -0.28 |

| Shorts | ||||||||

| ERES | $6.33 | $1,744.74 | 278 | $7.60 | $6.37 | $1,770.86 | ($26.12) | -0.07 |

| $1,155.54 | 2.93 | |||||||

Thus, our portfolio shows open profits of $1155.54, but our closed trades have a total loss of $3685.55. I�m not happy with that, but that�s what it is.

Six Month Evaluation of the Method

At the six-month period, I�d have to call these results dismal. So let�s look at what the market has done during the six months and what we might expect from the portfolio as a result of that. This will allow us to determine if what we are doing is flawed, or if it still has some potential.

When we started testing in the summer, the market was negative. There were more negative stocks than positive. Thus, we were largely short. What happened was that the negative tendency reversed itself dramatically and the market then became very positive. In the summer we could not find too many positive efficiency stocks. Now it�s difficult to find any negative efficiency stocks. This doesn�t bother the portfolio when the trend persists, but it is a disaster when the trend changes. For example, if the market were to suddenly turn around and become very negative while we have eight long positions, it would be a total disaster for the portfolio.

The second thing that has happened in the portfolio is that we haven�t found persistent trends in the stocks we�ve picked. For example, quite often, the market will go up, but negative efficiency stocks will continue to go down. This also hasn�t happened. People have been �value hunters� and they�ve been buying the worst performing stocks. When this happens, it�s also bad for the portfolio. Thus, my overall conclusion is that the system still works but that market conditions have not supported the method. I hope that over the next six months our results will turn around.

Until next month's portfolio review, this is Van Tharp.

About Van Tharp: Trading coach, and author Dr. Van K. Tharp, is widely recognized for his best-selling book Trade Your Way to Financial Fre-edom and his outstanding Peak Performance Home Study program - a highly regarded classic that is suitable for all levels of traders and investors. You can learn more about Van Tharp at www.iitm.com.

Trade Your Way to Financial Freedom

Now Available!

Why Should I Buy the Second Edition?

Over the years, I occasionally run across beliefs that seem to help people even more than those reflected in the first edition of this book. And after seven years, I�ve adopted many new, more useful beliefs. As a result, even though most of the core concepts have not changed, I believe that enough things have changed that I can help people even further with a new edition of this book. ~Van K Tharp~

Now 480 pages with three additional chapters including;

Mental Scenario Trading

Evaluating Your System

Using Newsletters as Trading Systems

Tracking Trader Types and How They Approach Their Craft

Trading and Christmas Presents (Part II)

by

D.R. Barton, Jr.

Whatever your holiday practice, I hope and pray that you and your family are blessed during this special time! The Bartons in Delaware will be celebrating Jesus� birthday with great vigor. May your celebration, whatever traditions you follow, be filled with love and joy.

Now � onto today�s article!

"There is hardly any activity, any enterprise, which is started out with such tremendous hopes and expectations, and yet which fails so regularly, as love." --Erich Fromm

Last week we discussed the good and bad side of opening presents. The bottom line of that discussion was this: When you have a present in front of you, all pretty and wrapped, it can be ANYTHING. But the moment you unwrap the package, it turns into SOMETHING � it changes from an abstract representation of hope to a concrete thing, complete with strengths AND weaknesses. It�s this transformation from abstract hope to concrete reality that I�d like to delve into more deeply and then discuss how this relates to our trading.

What do blind dates, your next golf shot and new trading systems all have in common? Perhaps it is the alluring sense of expectation that they all elicit. There is a tantalizing �could be� imbedded in the unknown. Our natural sense of childlike optimism fuels this fire of what �could be.� (And we all have this wonderful childlike optimism; some have chosen to suppress it more than others, however�) Tonight�s blind date �could be� the most attractive and interesting person I�ve ever met; the next swing of the golf club �could be� the perfect five iron onto an elevated green surrounded by sand traps; that trading strategy I just read about �could be� the answer to all my financial prayers. And it seems the longer that we have to consider the unknown, the higher we place that unknown thing on a pedestal. Our expectations grow in proportion to the time that we have to consider its incredible potential.

So is a new trading system really like a blind date? All I can say is that it is apparent that Mr. Fromm, the psychoanalyst who gave us our lead quote (above), obviously never traded! So many people that I�ve talked to get shivers down their spine when they read through the systems listed in the classified ads of a trading magazine. Like a proverbial kid in a candy store, they have trouble picking. After ordering the system, the expectation builds in direct proportion to the length of the wait for its arrival. (It would be interesting to do a study to see how what percentage of customers pay for expedited shipping!) But what happens when we take the wrapper off the system? ANYTHING becomes SOMETHING. We start to find the flaws, the caveats, and the tradeoffs. I wonder how many good and useful systems have been tossed out because they did not live up to unreasonably high expectations. Don�t get me wrong � careful review and a healthy amount of cynicism is required when one investigates the merits of a system. But many a strategy has been cast aside not because it failed to make money, but because it failed to fulfill emotional and intellectual needs. Next week, we�ll look at some useful ways to set expectations for your next trading strategy, idea, or system.

D. R. Barton, Jr. is the Chief Operating Officer and Risk Manager for the Directional Research and Trading hedge fund group. D. R. has been actively involved in trading, researching, and teaching in the markets since 1986. D. R. has taught extensively in many investment areas including intra-day trading, swing trading, and cutting edge risk management techniques.

His writing credits include co-authoring Safe Strategies for Fin-ancial Fre-edom and co-creator and contributing author on Fin-ancial Fre-edom Through Electronic Day Trading.

D.R. presents the Professional E-Mini Futures Trading Tactics Proven Strategies Workshop, Swing Trading Workshop and Professional Tactics for Day Traders Workshop. Each workshop is only held once each year.

Did you know that you could get 20% off our core products?

This is just one of the special bonuses that you receive when you pre-order the updated and fully revised edition of Trade Your Way to Financial Freedom (for a limited time only).

The book is only $19.77 and you'll save hundreds using the discount bonus!

Giving

by Melita Hunt

�Tis the season�.to write a heading such as �giving� and I guess I could�ve come up with something much more original. However, it simply is a time to focus on giving.

Usually, I tithe through regular charitable channels or donate to a cause or goodwill, or drop things off somewhere; but I realized this year that by just writing a check I�m not really getting as �connected� as I could to the GIFT of giving. So this year I am having a completely different experience. I was asked to be involved in �adopting a family� for Christmas and we ended up with three families, fifteen kids in total.

Over the last week, I have been buying, collecting or finding things for these specific children, everything from clothes, underwear, to toys and food. And I have had a wonderful time doing it. The Van Tharp Institute Board Room is overflowing with �stuff.�

And one of the gifts that I have received in return (not that I was expecting one) is to really see where my money goes every day. I live in a world where I think nothing of buying a Starbucks coffee, or going out for drink with friends, tipping people, spending thousands of dollars on travel and education, and even a ridiculous $10k + in car maintenance this year. What an eye-opener. And I am not being a martyr here, nor am I saying that I am going to change my lifestyle significantly, because I enjoy it and I enjoy what I do.

But there is a real blessing in appreciating what every dollar is doing and being thankful that I have it in the first place. I have just felt first hand, how a hot coffee can convert to diapers for a small child. To stop and make a conscious decision about buying and not just doing it purely out of habit, has been a gift this year that is priceless to me.

If I get nothing tangible for Christmas, it really and truly doesn�t matter because the gift really is in the giving.

Happy Holidays and Blessings to you all...

You can contact Melita at [email protected]

Join in the discussions on our blog and forum

Do Not Reply to this email using the reply button as the email address is not monitored, your email will not be seen. Please click this link to contact us: [email protected]

The Van Tharp Institute does not support spamming in any way, shape or form. This is a subscription based newsletter.

If you no longer wish to subscribe, Unsubscribe Here

Or, paste this address in your browser: http://www.iitm.com/privacy_policy.htm

The Van Tharp Institute

102-A Commonwealth Court, Cary, NC 27511 USA

800-385-4486 * 919-466-0043 * Fax 919-466-0408

Copyright 2006 the International Institute of Trading Mastery, Inc.