How to Develop a Winning Trading System Workshop

My research suggests that the problems people have in developing a trading system fall into five different categories.

The first three areas prevent traders from ever starting (or finishing) the development of a trading system. These are procrastination, computer/technology phobia and being overwhelmed by the whole process. The last two problems, perfectionism and judgmental biases in your thinking tend to prevent the trader from coming up with a workable system.

Learn more about developing a winning trading system that fits you at our Systems Development Workshop.

Phoenix, Arizona

January 26-28, 2007

Does Your Curve Climb?

John P. Strelecky

What you�re about to read will sound simple. That�s the point. Often we confuse complexity with power. We think because something is simple that it can�t be powerful. That�s not the case. Archimedes said �Bring me a lever long enough, and a fulcrum upon which to place it, and I can move the world.�

A lever is nothing more than a stick, and a fulcrum is nothing more than a rock. It doesn�t get much simpler than a stick and a rock. Nonetheless, that simple invention changed the world.

The following information can change your world. I see it happen with my clients every day. And, it�s not a whole lot more complex than a stick and a rock.

As a trader you�ve probably experienced the highs and lows of trading. The question is �Does your curve climb?�

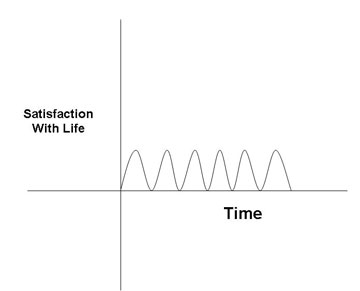

Most people go through life � both their trading life, and the rest of their life � like the following illustration. Over time they have highs, and they have lows. But in general, their highs are about the same high, and their lows are about the same low. They just oscillate between these two points.

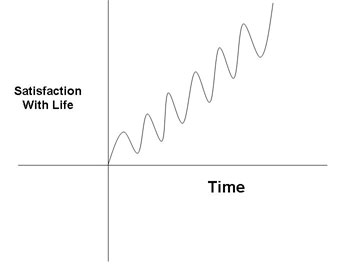

The secret to living a successful life�both trading and otherwise � is to have a curve that doesn�t just go on over time, but that climbs over time. It�s called an ascending life curve and looks like the one below. As time goes by, the person doesn�t just oscillate between a set of highs and lows, they keep reaching new highs.

Everybody has lows. It happens. Even when you�re on the right journey, and heading in the direction, there are still lows.

But the point is, when you�re on an ascending life curve, at some moment in time, your lows are now higher than what used to be your highs.

So how can you make your curve, a climbing one? Here are three steps.

1. Figure out your "Big Five for Life�

You can�t get where you want to go, if you don�t know where that is. And your curve can�t climb if you don�t know what would make it climb.

So here�s a great exercise to help with that.

Ask yourself "what are the five things you want to do, see, or experience in your lifetime before you die?" The five things that if you did, saw, or experienced them, then on your deathbed, you could say your life was a success as you have defined success for yourself.

They could be one time events like climb Mt. Kilimanjaro in Africa and watch the sunrise, or making half a million dollars in a year through your trading. They could be ongoing things like having a loving relationship with your spouse or kids, or having a life where every day you are free to do whatever you want because your passive income is so substantial that you never have to work again.

It doesn�t matter what you choose. What does matter is that they really are the five things that if you did, saw, or experienced them you would feel like you had truly fulfilled your life.

It�s amazing how busy our lives can get. Sometimes so busy, that we lose sight of why we�re doing everything we�re doing. What used to be a means to an end is now so encompassing, that we can�t remember the end. We lose sight of where we want to go and why. Our curve can�t climb when that�s the case.

So take a few moments right now, and figure out your big five for Life.

2. Get Smart

The smarter you are about being successful, the more likely you are to succeed. Find the top experts who have already done, seen, or experienced your Big Five for Life, and learn what they did.

Too many of us suffer from Mad �How� Disease. That�s when we take a look at where we�re at in life, and where we want to go in life, and then ask �How do I get there?� Asking �How?� is problematic because it�s full of learning curves, obstacles, barriers, and all kinds of other things that eat up our precious time and energy.

Faster success, and a more rapidly climbing life curve, comes when we ask �Who?� not �How?� Get smart about who has done, seen, or experienced your Big Five for Life, and then imitate what they did. Remember, it�s not about spending all your time and energy on the means to the end � it�s about enjoying the end goal. A few hours with the right who, can save you years of frustrating effort.

3. Execute

Knowledge that doesn�t get put into action just takes up space in our brains. When we apply what we�ve learned though, our curve starts climbing. At a minimum, once a month apply one new piece of information you�ve learned.

Maybe it�s something you learned from a book about how to tweak your trading methodology. It could be a piece of insight you gleaned from spending a few minutes on the phone with a who you met.

The point is, if nothing changes � nothing changes. But once one thing changes, the whole system usually benefits and your curve can climb.

Mark down what you applied, and then each time you go to apply a new piece of information, review your whole list. That way you can see how much progress you�re making, and you won�t forget to apply the information. It�s amazing how often we learn something, apply it, see the benefits, and then forget to keep applying it.

Like I said at the start, it�s simple and, intensely powerful. Good luck!

If you liked what you just read, then use the author - John P. Strelecky - as a who. Join him for his two-day event on � How to Find, Live, and Fund Your Ideal Life. (http://www.whycafe.com/upcomingworkshops.htm)

John is the international best selling author of �The Why Cafe� (www.whycafe.com). �He has shared the best seller list with among others, Mitch Albom (Tuesdays with Morrie/The Five People You Meet in Heaven), Malcolm Gladwell (Blink/The Tipping Point), Thomas Friedman (The World is Flat), and Stephen J. Dubner (Freakonomics). Through his books, CDs, articles, and appearances on television and radio (and even at Van Tharp Institute events) John has helped millions of people make their curves climb.

Trade Your Way to Financial Freedom

Why Should I buy the Second Edition?

Over the years, I occasionally run across beliefs that seem to help people even more than those reflected in the first edition of this book. And after seven years, I�ve adopted many new, more useful beliefs. As a result, even though most of the core concepts have not changed, I believe that enough things have changed that I can help people even further with a new edition of this book. ~Van K Tharp~

Now 480 pages with three additional chapters including;

Mental Scenario Trading

Evaluating Your System,

Using Newsletters as Trading Systems

Tracking Trader Types and How They Approach Their Craft

Trading and Christmas Presents

by

D.R. Barton, Jr.

During this holiday season, let�s take a little break from our exploration of market models. I�d like to share some thoughts about why so many good and even great trading ideas, strategies and systems are tossed out before they�re even given a chance to work.

We love to expect, and when expectation is either disappointed or gratified, we want to be again expecting. --Samuel Johnson

I learned some valuable lessons all over again this Christmas season. And whether you celebrate Jesus� birthday with vigor (like the Barton family) or follow some other tradition during this season, you�ll be familiar with the psychology of �gift getting�.

At one of the Christmas messages at our church, Pastor Bo (his real name) truly uncovered the mystery of �gift getting� for me. And almost simultaneously, his insights revealed the essence of one the biggest trading problems that I believe we all face. But more on that later; for now, let�s focus on the gifts.

Everyone loves getting presents. (Sure, we all know some old curmudgeon who has become a jaded gift-getter -- Dickens didn�t invent Scrooge out of thin air.) But I mean deep down inside where the part of us that�s still a little kid just drools about getting a gift. Pastor Bo (I�m serious, that�s his real name) unlocked the secret to our delight with presents. He said that when we get a gift�the wrapped kind�it is pregnant with possibility. It could be ANYTHING. It puts us in that greatest of all mental states: HOPE. As Samuel Johnson said in the opening quote, �We love to expect.� While that present is still mysterious and wrapped we are full of hope�the hope that it is just what we want. The hope that it will thrill us. The hope that unexpected joy (or greatly anticipated joy) is just around the corner.

And then we open the package. The thing that only an instant ago was filled with unlimited possibility turns into a finite reality. ANYTHING becomes something. HOPE becomes certainty. Expecting becomes knowing. The finest glass slipper, the most spectacular magic wand, or what was once our heart�s desire can�t help but degrade into a disappointment in that brutal transition. I have seen this in my children. I have witnessed it in adults. And I have felt it in my very soul. Perhaps Christmas is much less about gift getting and much more about an annual rekindling of hope. For me, it�s about a hope that lies in a manger. For you, it may be a hope for renewed ties with family and friends.

So what do we do with the recurring theme where our exciting ANYTHINGS keep turning into mundane somethings every time we take off the wrapping paper? Van has helped me understand that I am responsible for what I feel when I open up the present. I choose joy over disappointment and contentment over yearning for instant gratification.

Have you ever taken the proverbial wrapping paper off of a trading idea? That which seemed so exciting and full of possibility suddenly becomes disappointing and fraught with shortcomings. This same dissolution of hope that we see in our gift getting forms one of the key psychological barriers that many traders face. I�d like to explore this concept with you in the next few weeks.

D. R. Barton, Jr. is the Chief Operating Officer and Risk Manager for the Directional Research and Trading hedge fund group. D. R. has been actively involved in trading, researching, and teaching in the markets since 1986. D. R. has taught extensively in many investment areas including intra-day trading, swing trading, and cutting edge risk management techniques.

His writing credits include co-authoring Safe Strategies for Fin-ancial Fre-edom and co-creator and contributing author on Fin-ancial Fre-edom Through Electronic Day Trading.

D.R. presents the Professional E-Mini Futures Trading Tactics Proven Strategies Workshop, Swing Trading Workshop and Professional Tactics for Day Traders Workshop. Each workshop is only held once each year.

20% Off Sale

Did you know that you could get 20% off our core products? This is just one of the special bonuses that you receive when you pre-order the updated and fully revised edition of Trade Your Way to Financial Freedom (for a limited time only).

The book is only $19.77 and you'll save hundreds using the discount bonus!

What�s so funny�?

by Melita Hunt

When is the last time that you had a really good laugh?

Today I wanted to write about laughter, simply because I went to an event where we were encouraged to start laughing aloud for a continuous 4 minutes. There was no rhyme or reason to it other than to feel good; we were just told to start laughing. Do you know how hard that is? Initially I felt like an absolute goose, but I did it anyway. Feeling self conscious I looked around at everyone else and they seemed just as tentative as I was so I started with a giggle, then I gave a fake laugh and finally I just did my best to keep going while silently wondering how many minutes had passed and how long I had to keep up the charade (yep � I even did the eye roll a few times).

Well all of a sudden the real laughter kicked in, out of nowhere, and before I knew it I was doubled over belly laughing at nothing at all, really laughing. It was easy to just laugh and laugh and I couldn�t care less what it looked like or who was looking. Everything was hysterical � and by the end of 4 minutes my sides were aching and my cheeks were sore but I felt great and smiled for a long time afterwards and so did everyone else in the room.

We all know the benefits and great effects of laughter so I certainly don�t need to bore you with the details. I mention it simply to remind you that any day and particularly at the end of a challenging week, laughter is always available in some form or another and there is nothing better than helping those little endorphins to kick in! So I encourage you to just try it sometime, for no particular reason.

Go on, have a laugh�

Always laugh when you can. It is cheap medicine

Lord Byron (1788 - 1824)

You can contact Melita at [email protected]

Join in the discussions on our blog and forum

Do Not Reply to this email using the reply button as the email address is not monitored, your email will not be seen. Please click this link to contact us: [email protected]

The Van Tharp Institute does not support spamming in any way, shape or form. This is a subscription based newsletter.

If you no longer wish to subscribe, Unsubscribe Here

Or, paste this address in your browser: http://www.iitm.com/privacy_policy.htm

The Van Tharp Institute

102-A Commonwealth Court, Cary, NC 27511 USA

800-385-4486 * 919-466-0043 * Fax 919-466-0408

Copyright 2006 the International Institute of Trading Mastery, Inc.