$500 Discount expires NEXT WEEK

Proven Swing Trading Strategies

December 1-3, Phoenix, AZ

Presented by D.R. Barton and Brad Martin

Discover

15 Simple Secrets of Swing Trading Success-

Secrets That Can Help

You Maximize Your Profits.

Learn more...

Tharp�s Thoughts

Understanding The Efficiency Portfolio Testing

By

Van K. Tharp, Ph.D.

Next week we�ll be doing another update to the IITM efficiency portfolio, but before I do I�d like to explain what I�m doing and why I�m doing it. A few of our readers seem to think I�ve completely lost it with the portfolio testing. However, if you are one of them, then you might want to examine your own beliefs about the markets and what you believe it takes to develop a system, and most importantly why an educational process like this would press your buttons. For example, one reader writes:

�...the latest attempt with the efficient portfolio trading 'strategy' has bothered me for some time. Is this a joke? A test? An attempt at showing that if one discards all the advice and methodology that IITM offers one will fail?? Trading using a random non-proven strategy and modifying it as one goes along seems completely contrary to how I interpret what IITM recommends and teaches in general about system design and about trading processes and business plans�What does back testing tell you? You are not just grabbing stuff from thin air and pushing it into subscribers mailboxes, are you? Why would anybody want to see your "indicator" if you have no idea what it means? If you have not tested it at all? �

�Come on! I have had some hope that the stuff provided by IITM has been authentic and credible and the last year or so I have spent much time evaluating concepts and building my systems/methodology based much on ideas you have provided. This has been the way I have seen as offering the most potential so far. I have got some promising results but am not finished testing my system and business plan yet�.what is mentioned above though makes me actually doubt that what you say has any relevance at all. I really hope that is not the case. There are too much non-tested irrelevant comments out there anyway. I would not like to put IITM on that list.�

So first of all, thanks for your email; it gives me a basis for this article.

Now let me mention a few keys to trading success.

*

First, you can only trade your

beliefs about the market. You

cannot trade the �markets� as such.

Consequently, anything you do must go through your many

filters. If the

efficiency portfolio testing is pressing your buttons, it�s

probably a good thing. You

can learn something about yourself, so I�d suggest you take a look

inside and see what is going on. What is annoying you about it and

why?

* We�ve develop a very extensive process for helping people do this and the testing of the efficiency portfolio is actually part of the process. I�m not giving any trading recommendations�I�m simply illustrating some very early testing processes that I recommend you go through. And there is probably no better scrutiny for testing an idea than doing it in front of thousands of readers. Those processes (and I�m shortening it for this article) include:

o Deciding who you are and laying out your objectives. I did that in the early articles.

o Describing your beliefs

about the market is the next step.

I�m a strong believer in trading great trends and I believe

that such trends will continue.

And by the way, I�ve done extensive testing with

efficiency. I

described a methodology very similar to this for over a year in Market

Mastery during 2001-2002. My

point in doing so was to show that you could trade positive

efficiency stocks even during a bear market.

As an illustration, look at Autozone and DeLux Checking

during 2001. The testing

was profitable until we reached the bottom of the bear market when

there were no positive efficiency stocks.

In addition, I�ve been trading efficient stocks for a long

time with positive results and some of my best results have been

shorting negative efficiency stocks.

I�ve also taken one time period, selected a set of positive

efficiency stocks and traded it in real time with a 25% trailing

stop. In about six

months I made about 19% with that portfolio.

I was also trading negative efficiency stocks real time and

doing well with them that the same time.

Thus, I have extensive experience in real trading with this

concept already and I�m convinced it works.

What I�m not sure about is if being fully

invested according to the efficiency of the market works.

o The next step is to work out

how you want to actually trade. Then trade it or paper trade it to

see if it works for you. My

purpose in doing the efficiency portfolio is to illustrate an

example of this process. And

I�m trying out some new things such as selecting the number of

positive and negative stocks according to the efficiency of the

market. I BELIEVE that

this process that I�m following is much better than back testing

because you are actually doing it and can see what happens rather

than having the computer do things and spit out results that are

always replete with errors that you do not know about.

I�ve only changed the rules when it was clear that the

testing was not meeting my objectives because it was generating far

too many trades. If you

want to keep the trades longer, widen the stop and that�s what I

did. It�s still

generating more trades than I really want, but I�m going to

stick to these rules in the testing for a while.

However, this process allows you to get a real feel for how

your idea works in the markets and what could happen.

And you can even gather preliminary R-multiples for it.

This is the step that I�m illustrating in Tharp�s

Thoughts on a monthly basis.

o The next step, once you are

satisfied with the result of the preliminary testing is to really

trade the concept with small position sizing (perhaps for a year).

This is where you collect real R-multiples.

o And if you like the results, then you can trade the system with full position sizing.

Some people cannot trade anything unless it is somehow tested by a computer and the computer spits out positive results. However, this does not fit my personal beliefs system for all of the following reasons:

- I

don�t know of any good software for testing. NONE.

All of them have errors built into them and you also have the

possibility of data errors.

Thus, 1) I

would not trust the results of a computer back test and 2) I

would not trust the results if the back test rejected the system

not knowing if it was or wasn�t due to computer errors. It

could cause me to totally reject a great method.

However, I have back tested it to the extent that the

software I�m using will allow (see comment five below) and it

tests out very well.

- I

want to know the expectancy and the R-multiples generated by the

system. However, I

don�t know of any software that will give me that the way I

want it.

- The

key to success and meeting your objectives is position sizing.

Most of the testing software is designed to optimize

indicators, and does not even consider position sizing which is the key

factor in trading success.

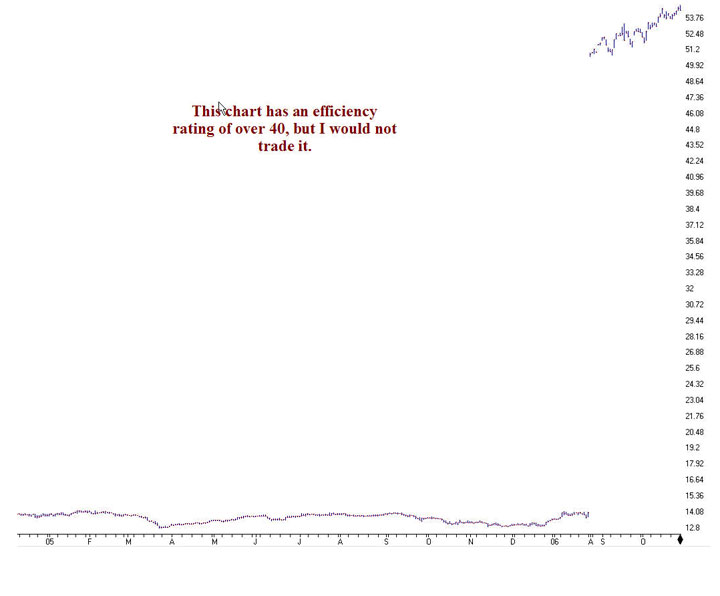

- What if the concept you are testing is very discretionary? Most good traders can come up with great ideas for trading, but they are very difficult to test because you have to figure out how to get the computer to think the same way you do. My efficiency concept is very discretionary and this is only way I know how to test it. I�m simply looking for a market that is going up in a nice straight line. The computer won�t give me that. However, it will give me a selection of 100+ stocks that I can look at and choose from. How can you test that with a computer? You cannot. The chart below illustrates one of the top efficiency stocks defined by my algorithm as of November 3rd. I would never trade anything that looks like that. So how could I test a portfolio that rejects those? Read my interview at the end of Trade Your Way to Financial Fre-edom to see what I say about software and back testing in general.

- I

currently use AIQ to screen for my stocks in the portfolio I�m

testing. AIQ has a

feature in which I can buy all the stocks with an efficiency

greater than some value that we�ll call X and sell it after a

fixed holding period. That

concept actually tests out very well, vastly outperforming the

S&P 500 during the same holding period.

AIQ claims it's one of the better methods they�ve seen.

But I would never trade most of the stocks that it is

testing such as the one in the chart above.

And the only way I know to reject those stocks is for me

to do it by personally looking at each of them.

- When you are testing the stock market over time, you�ll find that a) many stocks disappear over time and b) many new tickers also appear. In addition, stocks split and have dividends, all of which make the backtesting more complex or less accurate and often impossible to do.

I also want to say that people always equate the indicator or the setup with the system. And this is a total fallacy. I call it efficiency testing, but efficiency really refers to the straight line stocks that I like to trade. The concept I believe in is that what goes up will continue to go up. Furthermore, I believe (but with less certainty) that the smoother the line, the more it is likely to continue. I could use any trend following indicator to find stocks that have the �look� I want. I just happen to use efficiency.

I�d also like to mention that I do trade efficiency stocks in my personal portfolio. However, my criteria are much more rigid than the one I�m using in this portfolio. I might only find one or two that I really like each quarter.

However, efficiency does have the interesting quality by which I can measure the efficiency of the entire market and match my portfolio (percentage of long and shorts) to what the market is showing. In the portfolio testing (and again this is just to illustrate the testing process to all of you), I�m looking at the efficiency of the overall market�which might be 60% positive and 40% negative. Thus, I have to find the top six positive efficiency stocks and the bottom four negative efficiency stocks for the portfolio to be fully invested. Every week/month my portfolio could change depending on the efficiency of the market. How could one possibly back test that concept? I have no idea. However, I can look at it over time, like I�m doing in the newsletter and determine how useful it is.

My impression is that most people are finding the efficiency testing very useful. However, if it clashes with your beliefs, then examine why. And if you are still happy with your beliefs, then great�you can skip that article each month. However, if enough of you think it�s not useful, please let me know and I�ll stop doing it. Or, if you are getting value from the process, then we�ll keep going.

About Van Tharp: Trading coach, and author Dr. Van K. Tharp, is widely recognized for his best-selling book Trade Your Way to Financial Fre-edom and his outstanding Peak Performance Home Study program - a highly regarded classic that is suitable for all levels of traders and investors. You can learn more about Van Tharp at www.iitm.com.

Kick Start Your Trading Career

The Workshop Hierarchy

With our launch of the 2007 workshop schedule, now is a good time to address the topic of "What courses should I attend if I really want to become a great trader/investor?"

We get many inquiries here at the Van Tharp Institute from people just like you, who weigh the value and opportunity, versus the time, travel and expense that they have to incur to attend a trading workshop. Therefore, to make the choice easier for you (one way or the other), I thought it would be valuable to provide an outline of what our workshops are and how they fit together, so that you can make an informed decision as to whether attending a workshop is something that you would like to do. In addition I'm making you an exceptional offer at the end of this article.

Thankfully, our workshops have a great reputation both for their content and for the level of attendees that frequent our events. This incredibly high caliber of clientele just keep coming back. Time and time again, we see the familiar faces repeating or attending a new course both for the educational experience and the networking opportunities � so we must be doing something right!

Whether you are starting out on the trading journey or have been a trader for many years, there are fundamental strengths that will help you to be the best trader you can be and our goal is to give you the tools and materials to help you do just that.

Van K. Tharp has close to 25 years of experience coaching traders, and in conjunction with his world class instructors, they have put together a trading curriculum that is unrivalled in the industry.

I. Foundation Workshops � Tharp Fundamentals and the Backbone of Great Trading

Although these workshops are called Foundation Workshops, they are definitely not basic. We name them that simply because they provide the core material that everyone who wants to become a great trader should master. We regard them as the starting point for your trading education regardless of your background or trading experience. Also, these core workshops are just as valuable for the short term trader as they are for the long term trader because what you learn is not dependent on the market traded, nor the timeframe.

- Blueprint for Trading Success

- Peak Performance 101

- How to Develop a Winning Trading System that Fits You

These courses will help you master yourself, understand what you need to do for profitable trading, learn to develop a blueprint for trading/investing success, and learn how to develop systems that fit who you are

II. Specific Strategies and Proven Techniques in Various Trading Styles

Once you have a solid foundation and understand a new way of thinking about trading and investing, then we offer many courses that will give you a technical background and help you fill in the details that you will probably want. Can you take these courses without the foundation material? Yes you can, but doing so is like learning how to write a specific computer program without even knowing the basics of computer programming or understanding the potential mistakes that you could make.

- Proven Swing Trading Strategies

- Professional E-Mini Futures Tactics

- Highly Effective ETF and Mutual Fund Techniques (this is essentially our course for learning great stock market trading techniques).

- Professional Day Trading Strategies

III. Pre-requisite Material

We have one course and one program that definitely require other pre-requisite courses, so we�ve put these at the last level.

- Advanced Peak Performance 202 (Peak 101 is a pre-requisite).

- The Super Trader Program. (Peak 101 and Dr. Tharp�s approval required).

This week we�ll take a look at our Foundation Workshops:

How Our Courses Work

1. The Blueprint for Trading Success Workshop is the ultimate course to provide you with exactly what you need to master trading success, whether you are a full-time professional who wants a solid foundation or someone who would like to make a lot of money trading/investing and eventually move into trading full time for yourself. Dr. Tharp will walk you step- by- step through a series of 52 pertinent questions designed to get you thinking strategically about your trading. He will touch on all of the specific areas that you need to address, in the order that you need to address them. You will walk away from this workshop with a business plan outline and an understanding of why you want to trade, how you want to trade, the specific steps that you need to take to create a winning trading plan that works in any market condition and what type of trading systems you want to incorporate into your plan. You�ll also learn some of the key things that you need to personally master in order to be successful. You will learn how expectancy, position sizing, R-multiples, objectives, the big picture and other Tharp concepts fit together. After this workshop, you will know where you need to delve next to increase your profits and success in the markets.

2. Peak Performance 101. We have identified two types of people that frequent the Van Tharp Institute � those that believe that trading is purely technical and a learned skill (those people tend to head for the Systems and Strategy workshops first and eventually join us at Peak 101), and those who already know that their thoughts and beliefs play a huge role in their individual trading results. The bottom line is that we can prove that trading is largely psychological and that you must master yourself if you want great trading results. Peak Performance 101 is Dr. Tharp�s core psychological workshop and his most famous course for over 15 years. This is the workshop for anyone wanting to know how great traders think, behave and act so that they get consistent and profitable results, without stress. In this workshop, not only will you learn what makes a great trader great, but you will also find out what is holding you back. Whether it�s overtrading, not pulling the trigger, over confidence or lack of confidence, or just making mistake after mistake � there are many ways that people sabotage their market experiences. Taught exclusively by Dr Tharp, this workshop is designed to break down any barriers that you may have, as well as teaching you specific tasks and strategies that will improve your trading results overnight.

3. Developing a Winning Trading System that Fits You. We meet many people every year who spend small fortunes buying other people�s trading systems, and following their recommendations and ideas � yet they still don�t win in the markets. Is it because we think that we can�t do it ourselves? Or is there a holy grail that a few have mastered and when they do they won�t share it? Well, Jack Schwager, after writing Market Wizards and The New Market Wizards concluded that the secret was to develop and trade a system that fits you. And that�s what we help you do in this course. Don�t be confused with thinking that �creating a system� is having the technical know-how to develop a cutting edge software program. That�s great if you have that skill, but that is not a proper trading system. Anyone can create one if they have the knowledge and commitment to do it. In this workshop, you will learn the key components of a trading system (there are more than most people realize), how and why they are needed, and how to use position sizing to help you fulfill your trading objectives.

Summary

As you can see, these are the three core workshops that form the basis of Dr. Van Tharp�s work. But it takes commitment and discipline. Once you know how you think and why, uncover what you really want to achieve with your trading and then develop a specific plan to make it happen. You can fit workable trading systems into that plan and you�ll be well on your way to success as a trader. From there, you can look at specific trading strategies that might fit with who you are and add them to your arsenal. For example, many such techniques are taught in the upcoming swing trading workshop. We�ll look at some of the Specific Strategy Courses next week.

|

We want you to win in the markets, so if you are really serious about taking your trading to the next level, we are offering a time limited Three in One Package to these foundation workshops. You will be paying LESS THAN HALF price for each workshop. Buy any two of the Foundation Workshops outlined above and you can attend the third one absolutely FREE. You have 2 years to attend the workshops and some of them will be scheduled back- to- back to help with travel arrangements. |

All the Best,

Melita Hunt

Van Tharp Institute CEO

A

Review of Market Models:

Value

Investing with

Benjamin Graham

by

D.R. Barton

Warren Buffet�s mega-success has given his mentor, Benjamin Graham, quite a popularity resurgence especially in book sales.

But before your run out and load up on Graham�s books, understand that they�re not the easiest books to read. They�re very dense and perfunctory (for the most part). With that being said, there is lots of good information in them.

Graham had a definitive way to answer the question, �When is a company a good value?� He used the Net Current Asset Value (NCAV) of the company. He believed that this number tells us the near-term financial picture of the company. The NCAV of a company is simply the current assets (cash plus assets that are reasonably expected to be turned into cash within one year during the normal course of business) minus total liabilities.

Graham was such a proponent of this measure that most folks call the NCAV, when calculated on a per share basis, �Graham�s Number�. Graham believed that you could safely buy a stock when it traded at or below 2/3 of Graham�s Number.

In our book Safe Strategies for Financial Freedom, we added extra screening criteria to find stocks that have some healthy ratios and as a way to limit the field of stocks for which you need to calculate Graham�s Number.

For those of you who haven�t yet bought Safe Strategies for Financial Freedom (and I hear there are three of you that still haven�t), the screening criteria are below. (But for Pete�s sake, go to Amazon and pony up $16.57 for the book already! Or, you can get a commemorative copy at the Van Tharp Institute website, signed by all three authors�)

Anyway, here�s the table of screening values:

|

Criteria for Screening Stocks Selling at 60% of NCAV |

||

|

Variable |

Criterion |

Comments |

|

Stock�s price per share |

Should be above $3.00 |

Low priced stocks are risky. |

|

Price to Book Ratio |

Should be below 0.8 |

|

|

Price to Cash Flow |

Should be positive, let�s say P/CF greater than 0.1 |

Requiring positive cash flow eliminates many high-risk companies. |

|

Price to Sales |

Less than 0.3 |

Most stocks meeting Graham�s criteria have prices to sales ratios below 0.2 |

|

Debt to Equity Ratio |

Less than 0.1 |

Most good NCAV stocks do have some debt. |

|

Average Daily Volume |

10,000 shares per day minimum |

A good rule of thumb: a stock should have average daily volume of at least 100 times the # of shares you�ll buy |

Next week we�ll take a look at some free online screeners you can use to run these values and what�s showing up currently. Until then,

Great Trading!

D. R. Barton, Jr. is the Chief Operating Officer and Risk Manager for the Directional Research and Trading hedge fund group. D. R. has been actively involved in trading, researching, and teaching in the markets since 1986. D. R. has taught extensively in many investment areas including intra-day trading, swing trading, and cutting edge risk management techniques.

His writing credits include co-authoring Safe Strategies for Fin-ancial Fre-edom and co-creator and contributing author on Fin-ancial Fre-edom Through Electronic Day Trading.

D.R. presents the IITM Swing Trading Workshop and Professional Tactics for Day Traders Workshop. Each workshop is only held once each year.

Join in the discussions on our blog and forum

Do Not Reply to this email using the reply button as the email address is not monitored, your email will not be seen. Please click this link to contact us: [email protected]

The Van Tharp Institute does not support spamming in any way, shape or form. This is a subscription based newsletter.

If you no longer wish to subscribe, Unsubscribe Here

Or, paste this address in your browser: http://www.iitm.com/privacy_policy.htm

The Van Tharp Institute

102-A Commonwealth Court, Cary, NC 27511 USA

800-385-4486 * 919-466-0043 * Fax 919-466-0408

Copyright 2006 the International Institute of Trading Mastery, Inc.