$700 Discount Expires Next Week on Peak Performance 101 Workshop

Seven money-making benefits

Awaiting you at the Upcoming Peak Performance 101 Workshop.

You�ll thoroughly understand how these three key ingredients can control your life. Most of all, you�ll know how you can control them.1. Learn the three ingredients of success.

2. Understand the components of a low-risk idea. You must understand what makes up a low-risk idea. It�s not what you think.

3. Understanding why position sizing is so critical to your bottom line results! Think how calm you could be, knowing that your risk is always the same.

4. Learn 15 ways to develop rock-solid discipline in your trading. Real winners maintain discipline that allows them to charge ahead of others in the field.

5. Learn Dr. Tharp�s Ten-Task model for successful trading and investing. You�ll have tools at your disposal that the average investor or trader never even thought about.

6. Learn how to act quickly with sureness and confidence. You�ll learn how to develop the kind of confidence only the best traders and investors have.

7. Learn how to develop a plan for trading that will set you way above the crowd. Gain an edge over amateur investors. Dr. Tharp understands these disciplines. He is an expert at coaching others to use them.

Learn More About Van Tharp's Core Workshop

Don�t Be Tempted by Offshore Tax Shelters

By Jim Crimmins, President, Traders Accounting

When it comes to financial planning, the internet has done wonders to level the playing field between wealthy corporate fat cats and the rest of us. With the click of a mouse, we can now plot our own financial course using the same instruments that were only available to a wealthy few a generation ago.

But sailing with the big boys can also run your financial ship aground if you succumb to the Siren song of offshore tax shelters.

The image of Daddy Warbucks tucking millions away into an offshore account to avoid taxes is an enduring one in American society. Our better selves may realize that tax dodgers only place a burden on the rest of us to carry a greater share of the financial burden of society, but who doesn�t long to keep a little more of their earnings after the taxman cometh?

Today, thanks to the internet, offshore tax shelters are just a mouse-click away. For fees of $2,500-$3,000, hundreds of virtual brokers, accountants, attorneys and other middle men will gladly help you set up offshore trusts and accounts in such tax-free sovereign nations as the Bahamas and Belize, just like the big boys.

Transferring your assets offshore is not illegal - but doing so for the purpose of avoiding taxes is. And with the Internal Revenue Service rededicating itself to enforcement these days, it�s a particularly risky move now.

Don�t Look There, Look Here

No one knows precisely how many U.S. dollars have been transferred into offshore tax shelters, or what they�ve cost American taxpayers in lost revenue. Tax Justice Network, a group opposed to the practice, estimates that $1.6 trillion in North American wealth alone may be held in offshore accounts today. One expert estimates the cost to taxpayers from U.S.-held offshore accounts could run as high as $50 billion annually.

Given that the IRS recently outsourced debt collection to recover a measly $1.4 billion over the next decade, it�s a good bet they�re fixing to considerably ramp up their pursuit of the $50 billion that has quietly slipped offshore. In fact, the main purpose of the outsourcing pilot program is to free up IRS agents to more aggressively pursue larger tax debts.

What is particularly troubling to Uncle Sam is the ease with which middle-class Americans can now transfer their assets to a tropical tax haven. What was once a cumbersome and expensive way for fat cats to trim their tax burden is now an easy, affordable and perhaps even more clandestine process than ever before.

The IRS recently investigated Equity Development Group, a Dallas-based offshore investment company formed in 1999 that has represented some 900 clients, primarily through its website. The investigation found that Samuel Congdon, who the company lists as founder, was the sole employee of the company. While the firm listed offices in Dallas and the Bahamas, Congdon admitted the latter was nothing more than a mailbox.

A Senate subcommittee that subsequently subpoenaed Congdon�s client list concluded in a written report that Congdon �willfully remained ignorant of his clients� motives for moving money offshore.� That business approach, the senators say, allowed Equity Development Group to operate �in apparent compliance with federal law while facilitating potentially illegal activity.�

Among Congdon�s practices that the subcommittee found suspect was an �offshore calculator� on his website that compared the difference in growth between a U.S. investment account and one held offshore.

The IRS admits that prosecuting middlemen like Congdon can prove exceedingly difficult. That�s because offshore accounts are typically structured to make it unclear who actually owns them. For a fee of $6,200, Equity Development Group even established �shelf companies� for clients who wish to appear to have been using offshore accounts for several years.

The fact that offshore account brokers like Congdon operate on a �don�t ask, don�t tell� basis won�t help their clients should the taxman come calling. Although the IRS did not levy any new taxes against Equity Development Group as a result of its investigation, it left the door open to pursue their clients.

Offshore tax strategies, risky for any investor, are particularly so for traders. Why? Because as a trader, you have already been awarded a unique �trader tax status� which allows you, among other things, to deduct all your business expenses and forego the �wash rules� if you elect the mark-to-market accounting method.

Such special dispensations don�t come easily from the IRS, nor are they worth jeopardizing by trying to shelter money offshore. Lose your trader status and you start a domino effect that could put you out of business entirely, depending on your tax circumstances.

About Jim Crimmins: Jim Crimmins is the founder and President of Traders Accounting. Jim worked with one of the largest and well-known educational organizations of the stock market where he became a master on entity structuring and developed a network of experts in the trading arena.

Jim has become a nationally known speaker on tax strategies, entity structuring, and lifestyle change. He delivers over 30 talks a year throughout America as well as speaking in several chat rooms each month. At Traders Accounting, they help minimize your exposure to both taxes and risky tax-related behavior. Remember: there are no free lunches when it comes to taxes (though they can help you deduct a few). They�ll help keep your financial ship on course and well away from such potential calamities as offshore tax shelters. You can learn more at TradersAccounting.com.

|

|

||

| 17 Steps to Becoming a Great Trader* | October 23- 25 | Raleigh, NC |

| How to Trade Mutual and Exchange Traded Funds* | October 27-29 | Raleigh, NC |

| Peak Performance 101* | November 3- 5 | Raleigh, NC |

| Swing Trading Workshop | December 1- 3 | Phoenix, AZ |

|

*Includes a dinner with Van Tharp Check out our combo pricing. By attending back-to-back courses you save even more. |

||

Learn More...workshop descriptions, dates, pricing...

A

Review of Market Models:

Value

Investing � Marty Whitman

by

D.R. Barton

Marty Whitman. If you do any value investing, few names are as respected as his. And for good reason. Whitman�s Third Avenue Value Fund has returned 16.32% per year since 1990.

The Third Avenue Value Fund is run with a mantra of four key value components for companies in which they invest:

1. Super strong financial positions

2. Reasonable managements

3. Understandable businesses

4. Price that represents a meaningful discount from their estimate of what the company would be worth were the business a private company or takeover candidate.

I think it�s pretty easy to see that the fourth item is the 20% that brings 80% of the results. So the big question is this: �How does Third Avenue Value Fund evaluate price?�

Whitman has pointed out in a quarterly letter to investors that, �No attempts are made to predict what near-term prices will be�� This means that they don�t look at any technical analysis, even for entry or exit timing. (My guess is that someone with green eyeshades on does some help with entry timing once they�re ready to pull the trigger. Whitman is a big picture guy, but he�s no dummy�)

But the fund�s approach to company valuation is much more even-handed. While Whitman eschews Graham and Dodd�s advice to ��not take the asset-value factor seriously,� he also does not rely solely on asset valuation taking, instead, what he calls a balanced approach.

What this means is that Third Avenue Value Fund always uses �book value� as their starting point for analysis, but rarely uses it as the only tool. They traditionally use various other characteristics to adjust their view of book value, including portfolio holdings (the appreciation of which are not captured as earnings), the value of undeveloped land, and future revenues for contracted rents or insurance premiums, just to name a few.

In short, Third Avenue Value Fund does good old-fashioned leg work to plow through 10K�s and then digs deeper into the business model to find areas that aren�t adequately reflected in either the book value or earnings picture.

Once they�ve identified a candidate, it�s likely to stay in their portfolio for a long time, and stocks are typically only removed if their underlying fundamental picture changes.

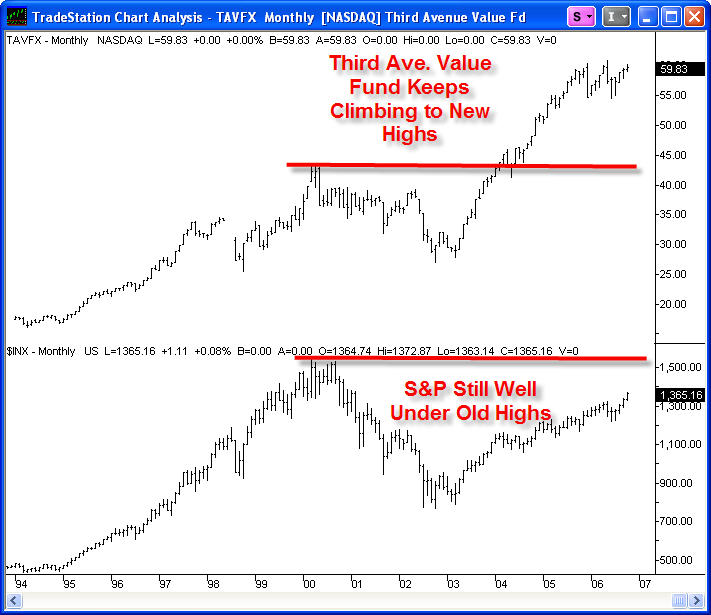

Can you apply Whitman�s techniques to your portfolio? If you are a patient, long-term investor, chances are that you can. You could even consider including Third Avenue Value Fund (TAVFX) in your portfolio and let Whitman and his staff do the digging. The fund has performed impressively with its recent highs reaching more than 40% above the spring of 2000 highs. Here�s the chart:

Great Trading!

D. R. Barton, Jr. is the Chief Operating Officer and Risk Manager for the Directional Research and Trading hedge fund group. D. R. has been actively involved in trading, researching, and teaching in the markets since 1986. D. R. has taught extensively in many investment areas including intra-day trading, swing trading, and cutting edge risk management techniques.

His writing credits include co-authoring Safe Strategies for Fin-ancial Fre-edom and co-creator and contributing author on Fin-ancial Fre-edom Through Electronic Day Trading.

D.R. presents the IITM Swing Trading Workshop and Professional Tactics for Day Traders Workshop. Each workshop is only held once each year.

Concentrating on Profits Will Lead to Losses

Have you ever wondered why you can paper trade successfully, but fail miserably when real money is at stake? The reason is simple: the trader who concentrates on profits will have difficulty winning, as will the investor who concentrates on losses.

When investors concentrate on the rewards of what they are doing, their behavior becomes rigid and less accurate. They become results oriented rather than solution oriented, which means they are more active and more careless.

In fact, many traders, when reflecting on their previous trading activity, realize they would have become better traders sooner without the hindrance of early success. Early profits teach bad habits that are extremely difficult to unlearn.

The solution? Concentrate on doing your best, not on your immediate profit and loss. Have a set of rules to guide you in the market and concentrate on following those rules.

Also join in the discussions on our

Trading Forum,

a place for traders and investors to share ideas and learn from each other.

Do Not Reply to this email using the reply button as the email address is not monitored, your email will not be seen. Please click this link to contact us: [email protected]

The Van Tharp Institute does not support spamming in any way, shape or form. This is a subscription based newsletter.

If you no longer wish to subscribe, Unsubscribe Here

Or, paste this address in your browser: http://www.iitm.com/privacy_policy.htm

The Van Tharp Institute

102-A Commonwealth Court, Cary, NC 27511 USA

800-385-4486 * 919-466-0043 * Fax 919-466-0408

Copyright 2006 the International Institute of Trading Mastery, Inc.