Stock Clearance Sale

Save 20% on these items before we do our year-end inventory counts

Offer ends day after tomorrow, Friday, June 30th

|

Items include:

To See the Items on Sale, Click Here

|

Paper Trading Stinks:

Here's a Much Better Way

by D.R. Barton, Jr.

President, Trader's U

"Practice does not make perfect. Only perfect practice makes perfect."

-- Hall of Fame Football Coach Vince Lombardi

I'm pretty sure the two boys were speaking English. After all, one of them was my son. And aside from a touch of Latin this year in 5th grade, he has had no training in foreign languages. But the words being uttered were certainly Greek to me...

"L1 right arrow L1 left arrow analog stick right". This was a complete and comprehensible sentence to the two guys in my basement. I whipped out my "English to 10-year old boy," dictionary and found that the phrase meant either, "I'm hungry - do you have any Cheetos?" Or, "In video game football, this is the series of keystrokes required to blitz a linebacker when you're in a prevent defense..."

Video games are a huge part of most children's (and many adults') lives these days. The boys were playing a video game called "Madden 2004". This is state-of-the-art football gaming. The graphics and action are so life-like, it's almost like watching an actual game on TV.

My son Josh and one of his school friends were enjoying a heated game of video football. And Josh, though not a bad video gamer, was a bit under-matched against his school friend, who is a self-declared video addict. He spends most of his non-school time parked in front of a PlayStation 2 game console. And he's really good at most of the games, including video football.

A funny thing occurred when we went out into the yard with a real football. Josh's video addict friend couldn't catch a ball even if it hit him right in the hands. For all of his skill on the video console, he had no practical experience playing the real game! And it showed in his results. In contrast, Josh glided around the yard snatching balls out of the air with ease. All because he had practiced with a real ball and played in real games.

Many beginning traders and investors find themselves in the same position as Josh's friend. They've practiced and practiced using a technique called paper trading, but when they start trading for real they find that the vast imaginary wealth they amassed while paper trading has very little to do with trading in the real world.

Let's take a look at why paper trading is a poor way to practice. And then I'll suggest some simple but effective ways to make big improvements in the way you play the trading and investing game.

Everyone's A Genius When They Paper Trade

I've heard countless stories of people who racked up fantasy fortunes while paper trading. There's nothing wrong with that. The problems come when people put real money in the market after their magical run-up in the paper world. Let's look at why paper trading often does more harm than good.

I believe that I've developed a very useful model for understanding the process of trading and investing. There are three pillars to this model: trading psychology, trading systems and trading craft. Let's look at how paper trading prepares you, for better or worse, in all three areas.

Trading too big, too soon. The place where I believe that paper trading does the least to prepare a trader is in the area of tradecraft. I consider position sizing and trade execution to be parts of this broad area. The number one problem with paper trading is that it gives people a false sense of security. They see huge profits racked up and then jump right in with huge positions, looking to grow their account as quickly as possible. This is the exact opposite of the best trading practices. And it has led many accounts to a quick demise if other problem areas pop up while these huge positions are on.

It's also easy to see that paper trading does little to help you learn the execution side of the business. Learning a trading platform and how to enter orders is not rocket science. But almost everyone I know (including me!) has hit the buy button when they meant sell or vice versa, or entered 5,000 instead of 500 shares. These kinds of mistakes cost real money. But the real execution costs that are not captured in paper trading are slippage (the difference between the price you wanted and the price you actually got) and the cost of not getting executed at all. While these costs can be estimated in paper trading, most people don't have a good feel for the effect these costs have on the bottom line. And until you get caught trying to get out in a fast market that's moving against you, it's hard to really understand the frustration of watching money slip away.

Trading psychology - you can't learn to control your emotions if you never have any. In the area of trading psychology, paper trading falls far short as a teaching tool. You really won't know how it feels to trade until you have some money on the line. There is a huge difference between writing down a trade on paper and seeing it move against you, and watching a real loss rack up against you. Many people feel that the most important aspect of trading and investing is maintaining discipline through the emotions that are generated while trading. You just don't get even 1% of those feelings when you are paper trading.

And speaking of discipline - when paper trading, it is far too easy to fudge the data, give yourself favorable fills, play the "I meant to do that" game and take advantage of other hindsight biases that make your trading results much better than they would have been in real life. Let's face it, when paper trading, we yearn to succeed. We want to prove how smart we are, and that we can conquer this difficult task. And this leads to conscious and subconscious bending of the rules. And all of the problems that come up in real trading can easily be overlooked by skipping an entry on the trade log or by a quick flick of the eraser.

Applying system rules - at last a place where paper trading is useful! The last pillar of good trading is developing and applying a trading system or strategy. And finally, we see the one area where paper trading is helpful. But to make paper trading a beneficial tool here, it really needs a new name, and a modified function. Let's call it paper testing. And let's use it to track system performance in real time using some other measure than money. I like to track points when I'm following a new set of system rules to see how it performs in real time. I can track points in stocks, commodities or Forex trading. And when I'm compiling my data and looking at points won or lost, I can be more objective because my mind doesn't immediately think about the house at the beach I can buy with all of those paper profits!

A Much Better Alternative to Paper Trading

So if paper trading isn't the best way to test a new system, what should you do? Try this five-step approach:

- Develop and back test your system or strategy. This can be done with computer software or by hand, looking back at charts.

- Do real-time testing on live data. Keep track of points won or lost and not dollars and cents!

- Instead of paper trading, use real trading, in very small size, to practice. Stock traders can trade 10 share lots. Commodity traders can trade e-mini contracts and forex traders can trade mini forex contracts.

- Once you have been consistently profitable, only then can you ramp up your trading size.

- Ramp up slowly!

Paper trading is not evil. It just isn't the best way to practice trading. Just like Josh's video-playing friend, you can only learn the real game if you step onto the field.

Author D.R. Barton, Editor of Early Warning Stock Predictor, was the guest at Business Morning w/ Jim O'Connell - Mr. Barton gave an overview of current inflationary problems in U.S., global markets and why the market has been registering very high volatility. View the video clip: Report On Business

Article reprinted with permission from Mt. Vernon Research�s SmartOptionReport.com

Make your plans now for upcoming workshops.

Back to Back workshops are color coded below

| How to Develop a Winning Trading System |

Aug 25-27, 2006 |

Raleigh, NC |

| Day Trading |

Sept 16-18, 2006 |

Raleigh, NC |

| Peak Performance 101 |

Sept 23-25, 2006 |

SYDNEY, AUSTRALIA |

| How to Develop a Winning Trading System |

Sept 27-29, 2006 |

SYDNEY, AUSTRALIA |

| 17 Steps To Become a Great Trader |

Oct 23-25, 2006 Includes a networking dinner at Van Tharp's home, October 25th |

Raleigh, NC |

| Mutual Funds & ETFs |

Oct 27-29, 2006 Includes a networking dinner at Van Tharp's home, October 25th |

Raleigh, NC |

| Peak Performance 101 |

Nov 3-5, 2006 Includes a networking dinner at Van Tharp's home, November 5th. |

Raleigh, NC |

| Peak Performance 202 |

Nov 7-9, 2006 Includes a networking dinner at Van Tharp's home, November 5th. |

Raleigh, NC |

A Review of Market Models: Momentum Indictors for Divergence

by D. R. Barton, Jr.

In last week�s article, we got an overview of momentum indicators and talked about their use as an overbought or oversold indication. This week we�ll look at using momentum indicators to spot divergences between price and the prices rate of change.

But wait � this won�t be a mathematics discussion. (Anytime we start talking about rate of change, people�s eyes roll into the back of their heads�)

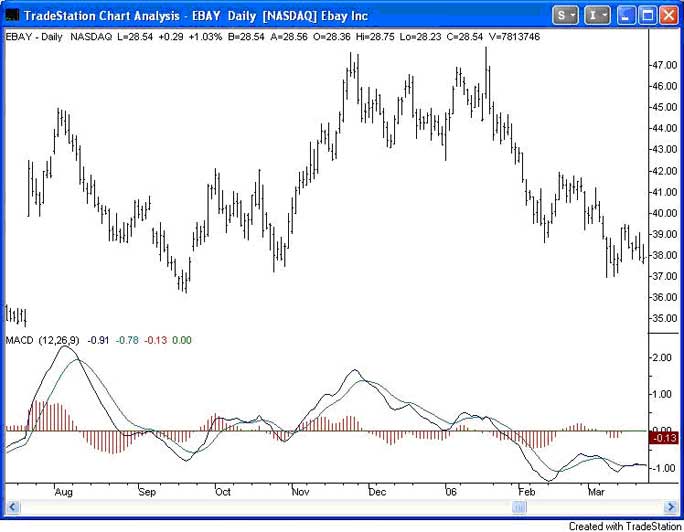

Let�s review a way to visually spot divergences. Take a look at the chart below.

Ebay made a double top at the right of the chart just below the 48 dollar level. Now look at the price action leading up to the two peaks. Notice that the run up to the first top went from 36 all the way to 48. It was almost straight up. The second run up went only half as far (from 42 to 48) and bounced all over the place getting back up there.

It�s clear that the rise to the second peak was much more laborious and was done with much less good ol� fashioned �oomph� that the first push.This difference will show up in almost any traditional momentum indicator. Let�s take a look using MACD

in the chart below.

In late November of 2005, the first side of the double top was made with MACD lines approaching 2. In late January 2006 when the second peak of the double top was formed, the MACD barely got up to 0.5. This is a clear case of momentum divergence � price tests an old high while MACD gets nowhere near the levels it achieved during the first price peak.

Do Traders Use Momentum Divergence?

Is it theoretically credible? Yes � very much so. Most momentum divergence is easy to understand visually as well as mathematically. It gives us an indication of a very real phenomenon � price reaching a target at a slower pace than

before.

Who�s it most useful for? Traders and investors looking for a tool to help them understand the possibility of market turns.

How Fanatic are the fans? Once again, pretty modest. As with most standard technical tools, little cheerleading is needed to convince people where momentum indicators are effective.

Is it being used by real-life traders? Yes. Most traders that I know keep their eye on their favorite divergence indicators. There have been many famous double tops and bottoms that were called because of momentum divergences � including the broad market double bottom in October of 2002.

Next week we�ll continue our series with another market model.

Until then�Great Trading!

D. R. Barton, Jr. is the Chief Operating Officer and Risk Manager for the Directional Research and Trading hedge fund group. D. R. has been actively involved in trading, researching, and teaching in the markets since 1986. D. R. has taught extensively in many investment areas including intra-day trading, swing trading, and cutting edge risk management techniques.

His writing credits include co-authoring Safe Strategies for Fin-ancial Fre-edom and co-creator and contributing author on Fin-ancial Fre-edom Through Electronic Day Trading.

D.R. presents the IITM Swing Trading Workshop and Professional Tactics for Day Traders Workshop. Each workshop is only held once each year.

From the Van Tharp Mastermind Forum:

Do I Need Money Management if my System has Buy and Sell Signal?

Author: emk

Date: 06-14-06 08:49

I know a complete system should have already incorporated money management. But, if I trade one contract of something, and my system has already got buy and sell signal, do I still need money management, such as stops? If stops are necessary, how about a target? I read a lot about those R-multiples, and got a little confused about the purpose.

Reply To This Message

Re: Do I Need Money Management if my System has Buy and Sell Signal?

Author: PMK

Date: 06-14-06 09:00

If you just use buy and sell signals (i.e. no stops) and trade 1 contract then your estimated initial risk is 100% of capital (assuming your broker liquidates your positions rather than giving you a margin call when all your capital is used up).

Thus for each trade your R multiple is ($Profit or loss) divided by account size.

Risking 100% per position is not generally considered sound position-sizing (1-3% is considered 'normal' by many traders).

Like they say in poker 'Going all in works every time..... except once.'

Hope this helps

Paul King

PMKing Trading LLC

Reply To This Message

Re: Do I Need Money Management if my System has Buy and Sell Signal?

Author: emk

Date: 06-14-06 09:10

My view is that if the stop loss order based on money management is in conflict with buy and sell signal, what do I do?

Reply To This Message

Re: Do I Need Money Management if my System has Buy and Sell Signal?

Author: PMK

Date: 06-14-06 09:16

They are two separate components of a trading system.

For a complete system you must have:

Beliefs/Idea/Hypothesis

Objectives

Market selection

Instrument selection

Setup

Entry

Position-sizing

Exits

The stop loss is a risk-management exit. The buy and sell signals are primarily entry conditions (but can also be used as an exit signal for an existing position that has not been stopped out if you want to).

Paul King

PMKing Trading LLC

Special Reports By Van Tharp

Click below to read page one of each report, or to order.

Do Not Reply to this email using the reply button as the email address is not monitored, your email will not be seen. Please click this link to contact us: [email protected]

The Van Tharp Institute does not support spamming in any way, shape or form. This is a subscription based newsletter.

If you no longer wish to subscribe, Unsubscribe Here

Or, paste this address in your browser: http://www.iitm.com/privacy_policy.htm

The Van Tharp Institute

102-A Commonwealth Court, Cary, NC 27511 USA

800-385-4486 * 919-466-0043 * Fax 919-466-0408

Copyright 2006 the International Institute of Trading Mastery, Inc.