HO-HO-HO

Our 20% off End-of-Year Sale is Going on Now!

|

Items include:

To See the Items on Sale, Click Here

|

To all of our Wonderful Clients:

During this hustle and bustle time of year, we want to remind you to balance your holiday �to do� list of shopping, wrapping, traveling, cooking, cleaning and spending money with a �joy and meaning� list. What are the things that bring you joy and meaning? Spending quality time with family, playing games, reading a book, enjoying a glass of bubbly, looking at photos and reminiscing on good times or honoring departed loved ones.

Let go of the past year, let the next year take care of itself, and take the time to live in the moment! This is a fun and loving time of year � if you choose to make it that!

All of us here at the Van Tharp Institute wish you Holiday Cheer! We sincerely thank you for your patronage, feedback and support over the last year and hope that we are helping you to make your trading journey successful, lucrative and fun.

Happy Holidays!

With Love from Van and the Gang�

Is It Time to Slow Down?

Part Three

By

Melita Hunt

In this final installment of the Mind Body and Spirit series we look at more ways to nurture your Spirit.

Meditation

Most people have heard of the benefits of meditation and there is plenty of information all over the Internet in regards to various ways to meditate. Some people swear by it while others have great difficulty slowing down the chatter inside their heads. Rather than going into detail about meditation, I would prefer to just share my experience with you.

When I finally chose to take the time to learn how to do it, I can attest to the fact that it works for me. I feel rejuvenated, relaxed and much more effective after taking time to meditate. Initially, it was a slow process, I would fall asleep, or my mind kept talking to me or I was always too busy. I felt that I didn�t have the time to read the books or watch the DVDs (which is exactly why I needed it). Just to sit down and watch a candle (which was suggested to me) was boring or silly.

Determined to find a way, I chose to go and meet with a naturopathic doctor who just meditated with me. There was no pressure, he gave me guidelines, but didn�t make a big deal of it. We did three sessions together and eventually it just happened. My mind went blank, I wasn�t asleep but I wasn�t awake, I was just drifting and couldn�t really feel my body. My head would roll sometimes, but I felt light and when the session was over I really felt great, quiet but refreshed. I am now able to do this on my own at any time. It�s just choosing the time to do it!

If meditation interests you and you�d like to learn more, you can go to the following website http://www.srcm.org (there is never a charge) to learn the simple techniques that I am doing.

For those people who want a quick and easy solution. The following website has two to five minute meditations that you can close your eyes and listen to for a quick pick-me-up. Enjoy! http://www.orindaben.com/meditations/orinmeditations.htm

Listening

Peter, one of our clients, told me that while driving, he and his wife just listen to the trees or to the wheels turning and both of them really enjoy it. There is no need for radio, endless chatter, or noise, and it relaxes them both.

As someone that listens to the radio, CDs, lectures, workshops or chats on the phone while driving, this intrigued me. The car was just another office away from the office where I could get things done.

So I decided to try out Peter�s suggestion.

What a difference it made! By stopping and listening to subtle sounds I was surprised at how much I didn�t want to add any additional �noise� in my life. Now, more often than not, the radio stays off in my car and I never have a TV playing in the background at home.

We are bombarded with information day in and day out so whenever there is an opportunity to cut down the noise, why do we choose to add to it?

This simple �listening while driving� exercise led me to many other listening exercises. I�ll share three of them with you here:

Exercise 1: Close your eyes and relax your head back on a chair. Now concentrate on your breathing until you can hear it and block out any other sound by letting it float away in the distance. Just focus on the noise that is closest to your body, your own breathing. With extended practice, you may even hear your heart beat. Do this for three minutes and then add a minute each day. It may even become a simple form of meditation for you.

Exercise 2: Find the gap. There would be no sound without the silence in between, so whatever sound comes to your attention, choose to notice the silence parts. The gap between each keyboard stroke, the break between cars, the breath between words. Notice the silence, it is the polar opposite of the sound. By focusing on the silence, we are not focusing on the sound. If you can�t do this in the environment you are in, seek out somewhere that you can. By leaving noise behind, this exercise can bring peace, serenity and tranquility.

Exercise 3: Count how many sounds you can hear in a one minute period, start with those closest to you, in your ear, around your body and expand your hearing to the rest of the room, the building, outdoors, in the distance, then bring it back in and notice how many new sounds there are or ones that you didn�t notice.

How much sound or noise is beyond your control? A car horn, an airplane, strangers talking � Well, you can�t do anything about that. But how much was in your control?

Often we will ask the people around us (especially the kids) to be quiet, when in fact, there could be many unnecessary noises that we can eliminate ourselves so that we can actually appreciate and enjoy the sound of our children�s voices and laughter.

By implementing these simple listening and noise-reducing exercises and hearing what is around you every day, you can subsequently reduce the unnecessary noise that is in your control (think tone of voice or turning off the cell phone) and this may calm everyone down considerably.

The Mind

We�ve looked at ways to nurture the body and spirit while giving the mind a rest. In this last section, I�d just like to touch on one more subject that refers to the mind.

Being Positive

Where do your thoughts generally take you? Do you tend to think about the positive, good things in life or are most of your thoughts focused on the bad things and the problems that you or the world seem to have?

The power of positive thinking is a debated topic; however, I think that it is a very simple topic to discuss. If we can only focus on one thought at a time, and thinking about something positive makes you feel better, then why not think about something positive? It�s a no-brainer.

Throughout the day, if you are feeling overwhelmed, sad or irritable, then look at where your thoughts are heading. How can you shift it to something more favorable? What is a thought that will bring you happiness, or make you feel better? Bring that thing to mind and just notice the effect that it has on your mood. It doesn�t have to brighten considerably, but shifting your focus to a positive thought will most often shift your mood and if it�s practiced regularly, it can make a big difference in your overall well-being.

For the Tech Heads

For people that love technology and games, there is an incredible new tool called Journey to the Wild Divine. It is an interactive game, based on bio-feedback. While many video games focus on war games, destruction, using your mind, etc. Biofeedback is scientifically proven to have a powerful, positive effect on your emotional and physical well-being by teaching you to alter your brain activity, blood pressure, muscle tension, heart rate and other critical bodily functions.

So this fascinating game requires you to breathe, slow down your heart-beat and relax to actually make it work! Check it out at http://www.myaffiliateprogram.com/u/wdivine/e.asp?e=3&id=2988

As I said in Part One, there is no one that has to walk in your shoes or listen to the noises in your head; they are yours and yours alone. So if life is getting too fast for you, or passing you by, then only you can choose to do something about it.

I�ve given you an array of simple ideas for nurturing your body and spirit and giving your mind the break that it deserves! Observe your body, Move It, Eat Well, Hydrate, Nothing Time, Meditate, Listen, Be Positive.

I hope that you take the time to enjoy them. Now it�s up to you!

About Melita Hunt: Melita Hunt�s energy and enthusiasm is the cornerstone of her writing and speaking success. She has been associated with the Van Tharp Institute since 1999 and is currently the acting CEO of the company. Her diverse career has led her from an accounting background, to marketing and sales, real estate investing and coaching. She has traveled the world visiting over 30 countries and has worked throughout Australia, in London and now in the USA.

An avid reader and seminar attendee, Melita has a special interest in sharing her knowledge and inspiring people to be the best they can be. She has written a series of children�s bedtime stories and is author of a soon to be released adult parable titled The Wizard Within. You can contact Melita at [email protected]

The Power of the Well-Reasoned Ratio

by D. R. Barton, Jr.

I believe in technical analysis. One of the basic tenets of technical analysis is that �price includes the whole story.� This means that all of the news, past and present, plus the best collective forecasts of everyone trading a stock, currency or commodity is part of the current price of the stock.

Of course, news and other outside influences can rapidly change the price as it adjusts to include the new inputs. But many technical analysts do very well just by following the price alone.

But sometimes the market participants can reach extremes in their opinions. They tend to undervalue out-of-favor items and overvalue what�s popular.

Lately I�ve been looking at ratios to help in my understanding of the �normal� or historical value of various instruments. Let�s look at a couple of examples of how ratios have helped me understand a couple of markets better.

Gold Moves from Bargain to Fair Valuation

In September of this year I wrote a technical analysis chapter for an upcoming book on gold. At that time, gold had moved up to $470 an ounce. The S&P 500 index was also enjoying a bull run that dates back to 2003. But in Chart One, we see that gold was still undervalued vs. the S&P.

And you know that gold has run up $60 and ounce since that time. But again, the S&P has moved higher since September as well. How has their comparative valuation held up since then?

Wow! That�s a pretty serious move up for gold versus the S&P 500 in a very short time. And this is one of the reasons that gold is correcting now. It�s in a near term overbought mode. I�m still bullish long-term on gold, but we can reasonably expect a substantial pullback in gold�s price before it gets moving to significant new highs. (Editor�s Note: This article was written on 12/13 when the price of gold futures closed at $530.50/oz. Today, on 12/20/2005, gold is trading down to 491.30, so a big pullback has already taken place, with a bit more downside likely to come�)

Is Real Estate Always Moving Up in Price?

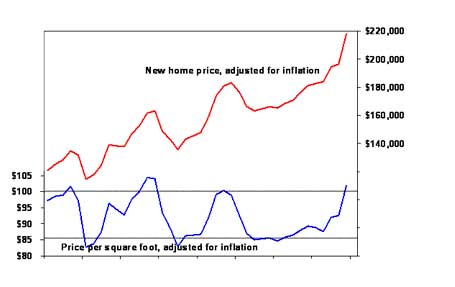

Here�s another ratio that paints a startling picture for the real estate hounds out there. We all know that real estate prices have trended up for as long as most of us have been around. But my good friend and market analyst superstar Dr. Steve Sjuggerud debunked the myth that �housing prices always go up� in a recent research piece. Here�s a chart from Steve.

Looking at the red line, home prices have definitely gone up - even when inflation is taken into consideration.

But here�s the kicker: as the median new home price has climbed, so has the size of the median new home. And when you throw the ratio of home price to home size into the mix, you can see that this ratio (the blue line in the graph) does not have a discernable uptrend over the past 40 years, but rather travels in a well defined channel. (Note also that price per square foot for new houses is reaching overbought levels�)

The rational use of ratios can give us insight that reaches beyond pure price studies and provide us with some great clues to what�s happening in the market. Next week we�ll look at some traditional price ratios studies and see how you might use them in your trading and investing. Until then...

Great trading,

D. R. Barton, Jr.

D. R. Barton, Jr. is the Chief Operating Officer and Risk Manager for the Directional Research and Trading hedge fund group. D. R. has been actively involved in trading, researching, and teaching in the markets since 1986. D. R. has taught extensively in many investment areas including intra-day trading, swing trading, and cutting edge risk management techniques.

His writing credits include co-authoring Safe Strategies for Fin-ancial Fre-edom and co-creator and contributing author on Fin-ancial Fre-edom Through Electronic Day Trading.

Some Feedback.

Author: Darren

Date: 12-07-05 23:06

I have recently started trading a small account about six months ago. I have read many of Dr. Van Tharp's articles and books and have applied many of his ideas to my trading system.

I would like any feedback on whether my results are good, bad, or just plain lousy.

My system has so far produced the following results:

1. Avg. Win/Avg Loss: 2.45

2. Percent Wins: 48.5%

3. Total Wins($)/Total Losses($): 2.45

4. Expectancy: 0.41

5. Largest drawdown: 6.33%

6. Percentage increase in account value: 25%

5. Number of trades completed: 54.

The initial account size has was $27, 500. Today, the account value is $34, 479.00.

I typically risk 1% of my account value and never have more than 5% of my account value exposed at one time. Also, at this time, I only trade equities listed on Nasdaq, Dow, or Amex.

Any comments or suggestions about my results would be greatly appreciated. Best regards to all and much success trading.

Reply To This Message

Re: Some Feedback.

Author: PMK

Date: 12-08-05 08:07

Darren,

Your results appear to be good (on a cursory inspection), although 54 trade and 6 months is not really long enough to assess the performance of any system.

How do these results match up to your historical testing/simulation?

How do these results match your objectives for the system?

One of the other important things is the completeness of a system rather than the actual results i.e. does it have all the components necessary for a trading system?

Lastly, how do you determine whether a stock is liquid enough to trade (and will have low spread and slippage)? Not all NASDAQ or AMEX stocks are 'tradable' (in my opinion).

Paul

Re: Some feedback.

Author: Ken Long

Date: 12-08-05 13:57

Darren: while you are following Paul's great advice and comparing your performance to your objectives and your benchmark (so that you know if your system is performing as designed/expected or if it's acting outside a statistically significant range of performance), here are some other observations:

In the same six months, the S&P 500 has returned 5%, with a max 6% drawdown, the NAS100 has returned 12% with about a 10% max drawdown, ILF (Latin America 50 largecaps) has returned 40% with a 20% max drawdown, and EEM (emerging mkts) has returned 22% with a 15% max drawdown.

So in comparison to a number of international benchmarks available to buy and holders, its seems that so far, so good, you are adding value to your investments thru your trading activity.

All the things Paul said apply, and your work isn't done, but you seem to be off to a good start !

Cheers!

Ken

Reply To This Message

Re: Some feedback.

Author: Bert

Date: 12-08-05 15:44

Darren,

You are off to an excellent start. A return of 25% in six months with only a 6% drawdown is impressive.

Based on your post I�m assuming you typically have a maximum of five positions open at a time. I�m no fan of diversification, and I�m often in fewer positions, but you might consider developing another system or two that has different performance characteristics under market conditions different than last six months.

Your system may not work under all market conditions (not a big problem in my view), so trading multiple systems is wise.

Bert

Reply To This Message

Re: Some feedback.

Author: Van Tharp

Date: 12-13-05 19:18

Hi Darren,

I'd suggest that you calculate your system quality number which is equal to

(expectancy/standard deviation of R)*7.349.

The last number is the square root of the number of trades.

If the number is above 1.65, then your system makes money at greater than a chance level.

If it's above 2.0, then it's a really good system.

And if it's above 2.5, then its a great system.

You probably have enough info now to sell, although we've basically had a flat to slightly up market. How would it do in a down market? Flat and highly volatile market (up or down over 3% every week), etc? These are questions you still need to answer.

Editors note: To read the complete unedited thread with all posts click the link below and look for the title: Some Feedback.

Special Reports By Van Tharp

Click below to read page one of each report, or to order.

Do Not Reply to this email using the reply button as the email address is not monitored. Please click this link to contact us: [email protected]

The Van Tharp

Institute does not support spamming in any way, shape or form. This is a subscription

based newsletter. If you no longer wish to subscribe, Unsubscribe

Here.