What to Look for In Rare Stamps

By

Van K. Tharp, Ph.D.

We probably had more people respond asking for more information on rare stamps than any other topic I�ve written about. That sort of surprises me since there was little interest in a teleseminar on the topic. People have asked all sorts of questions such as 1) Can you find me a good broker to buy stamps for me? 2) What should I buy? 3) What�s the next step?

Stamps have always been considered a hobby, not an investment. So let me first tell you how not to approach it. Commemorative stamps that you buy at the post office have not been an investment of any value at any time in my life, and I�m 59 years old. In fact, one dealer tells the following story about a lady who approached him with $10,000 in sheets of commemorative stamps. He offered her $8,000 and suggested that she put the money in CDs, which at the time were yielding 14%. It would only take her two years to get back the face value. She, of course, refused hanging on to her precious stamps. That offer was made almost 25 years ago. The $8,000 would have doubled several times over since then, but the stamps today are still worth $8,000 � except that the value of the dollar has depreciated considerably since that offer was made.

The only stamps that have value are rare stamps. If you bought rare stamps many years ago, then you would have a collection with considerable value. But most people would rather have many stamps than rare stamps. And that�s not the way it works.

First consider only collecting 19th century U.S. stamps and definitely nothing after 1930. For example, the current Scott specialized catalogue of U.S. stamps has numbers through 3929 and it doesn�t cover all of the issues of 2005. However, there is nothing that is really rare after the first 600 numbers.

However, within those first 600 stamps there are many examples of which less than 1,000 copies of the stamp are known to exist. And that�s my definition of rare.

If you decide, after reading this article, that rare stamps are for you, then I recommend that you adhere to each of the following criteria:

- Only buy certified stamps.

- Pay attention to the condition of the stamp because the price is determined by both the rarity and the condition of the stamp.

- Learn enough about the stamps you are collecting so that you become a wise investor collector.

- Buy only from dealers or auction houses that you trust.

Buy Only Certified Stamps

When postage stamps first came out, there were not that many new stamps, but there were many differences in the printings. The differences are quite subtle, however, and it often takes an expert to tell the difference. And even experts can be fooled.

For example, the third major stamp issued by the United States government has the following numbers in the current Scott catalogue: 5, 5a, 6, 6b, 7, 8, 8a, and 9 � and those are just the eight Major varieties. Those stamps basically all came off the same sheet of stamps. There are just subtle differences between the stamps that are printed.

The Scott catalogue gives the following definition for type 1 (i.e., Scott 5):

�Has complete curved lines outside the labels with �U. S. Postage� and �One Cent. The scrolls below the lower label are turned under, forming little balls. The ornaments at the top are substantially complete.�

However, when we move on to the next type, type 1b (i.e., Scott 5a) there is a subtle difference:

�the balls below bottom label are not so clear. Plume like scrolls at the bottom label are incomplete.�

And, just to confuse you even more, Scott 5, 18, and 40 are all type 1. Those three numbers differ primarily in the perforations.

Since the margins on these stamps are very narrow and the edges of the stamp are usually cut, it is extremely difficult to tell the differences unless you are an expert at doing so. But Scott 5 is worth about $55,000, compared with $7,500 for Scott 5a, or $160 for Scott 7. Those are huge price differences for subtle differences in the stamps. Thus, you need to make sure that an expert has authenticated what you buy.

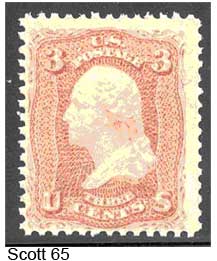

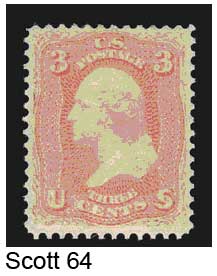

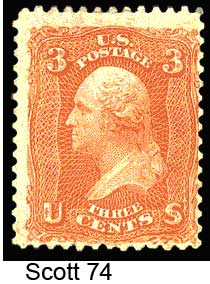

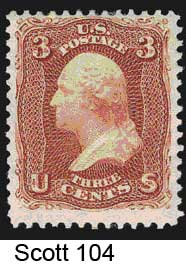

Other stamps are different only because of the color of the stamp. But it is extremely difficult for the average person to tell the difference without having some standard against which to compare the stamp. For example, consider the five stamp pictured below.

The first one is rose (Scott 65). The second one is rose pink (Scott 64). The third one is lake (Scott 66). The fourth one is scarlet (Scott 74), and the fifth one is brown red (Scott 104). There are also three other colors that this same stamp could have (pigeon blood pink, red rose, and dull red) which can change the value of the stamp. Are you that good with colors? In fact, people have reported numerous pink stamps that were misnamed 65, instead of 64. Thus, there is another reason to only buy certified stamps.

|

|

|

Some of the same stamps could also have grills on the back of them. For example, the first stamp pictured with an A- grill is 79, with a B-grill it is 82, with a C grill it is 83, with a D- grill it is 85, with a Z-grill it is 85C, with an E-grill it is 88, and with an F grill it becomes 94a. The grills are each a different size and you must be able to tell the difference. For example, the picture below shows the back of a stamp with a Z-grill. And the stamp happens to be 85A, which Bill Gross just used a $2.9 million dollar plate block to trade for.

Lastly, it is very easy to alter one stamp to look like another. And the difference in value can be huge. I don�t have the time to get into this topic, but it�s another reason that you should only buy certified rare stamps.

Condition Is of Paramount Importance

The two primary services that certify the authenticity of rare stamps also grade them from 1 to 100. And there is a huge difference in price between a SUP98 (superb, nearly perfect) stamp and a FR10 (faulty) stamp. Professional Stamp Experts (PSE) originally started grading stamps about four years ago. When the system first came out, about 5% of the stamps submitted for a certificate asked for the stamp to be graded. Now about 85% of all expertise stamps are graded by PSE. In fact, the standard has become so widely accepted that now the other major certification service, the Philatelic Foundation, has also started grading stamps using the same standards.

Stamps are first classified into Used, Unused-Never Hinged, Unused � Original Gum, Unused � Partial Gum, Unused No Gum (or No Gum As Issued). Each of those classifications are then graded based upon how well they are centered and then points are subtracted for any faults observed. You can write to PSE at P.O. Box 6170, Newport Beach,CA 92658 for a free copy of their stamp grading guide and a free copy of their Stamp Market Quarterly, which gives the price of stamps at various grades.

How important is grading? Well, let�s look at one of the stamps pictured above, Scott 64, the pink stamp. That stamp used in FR10 condition would sell for about $125. In VG50 condition, it would sell for about $340. In VF80 condition, it would sell for $850. And in SUP98 condition, it would sell for $5,000 or more. That�s a huge difference in price based upon condition. But rarity is also a factor because there are not many copies of 64 in VF80 or better condition.

Learn About Stamps Before You Invest

To do well in any area, you need to learn a lot about that area � make it your niche. Consequently, I�ve listed a series of books that I think are a must for your library if you want to really be serious about 19th century rare U.S. stamps:

- The Macarelli Identification Guide to U.S. Stamps: Regular Issues 1847-1934 by Charles Micarelli. Scott Publishing Company, 2001. Available on Amazon.

- The PSE Guide to Grading Stamps. I�ve already told you how to get this one.

- The Buyers Guide: Getting the Most for Your Stamp Dollar! By Stephen R. Datz. You should be able to get this one from Amazon.

- Top Dollar Paid: The Complete Guide to Selling Your Stamps by Stephen R. Datz. Again, you can order this from Amazon.

- Robert E. Siegal Auction Galleries, Catalogue Number 804: The Robert Zoellner Collection. This catalogue cost about $100 from Siegel, but it was the only complete collection of U.S. stamps ever sold at auction. It has pictures of every stamp and goes into incredible detail about many of the stamps. Go to www.siegelauctions.com to see this catalogue and email them to order it.

I�ll write one or two more of these updates in future issues of Tharp�s Thoughts. In those articles I�ll tell you how to get started and some of the supplies you�ll need and how to get them. I�ll also give you my suggestions for some of the stamps you should focus on and some recommended dealers.

Incidentally, if you are willing to invest in rare world stamps and just want a nice portfolio with a guaranteed 15% return within three years and a potential 600% return, then I�d suggest that you read the latest issue of Sjuggerud Confidential for Steve�s recommendation. The dealer is Stanley Gibbons in London, whom I referred to Steve, but Steve has done all of the research and gotten them to put together a way that you can just invest. The stamps will remain with Stanley Gibbons and they�ll put together the portfolio. As a result, I personally would not want to participate. I want my stamps with me and I also want to know a lot about the stamps I buy. But for some of you, Steve�s offer may be perfect.

About Van Tharp: World�renowned trading coach, author and psychologist Dr. Van K Tharp, is widely recognized for his best-selling book Trade Your Way to Financial Fre-edom and his outstanding Peak Performance Home Study program - a highly regarded classic that is suitable for all levels of traders and investors.

The Key to Success

By

Van K. Tharp, Ph.D.

Have you ever started a project that really got you excited? And you knew that it would make a significant difference not only in your own life, but in the lives of many others as well. I�ve been working on such a project.

For many years, I�ve known that good traders possess certain qualities that less successful traders lack. Good traders assume total responsibility for their results (which means that they can learn from their mistakes instead of constantly repeating them), and they have the commitment to do whatever it takes to be successful. Typically through that commitment, they develop other things that lead to their success, such as sound strategies that they thoroughly understand and that fit their personalities. They also develop great business plans that guide them through the trading journey. And lastly, since they know that they are the source of their success, they constantly work to improve themselves. And through that self-improvement, they weed out self-sabotage and develop what I call a strong top-down discipline.

Becoming a great trader isn�t easy, but I believe that it�s totally possible for anyone who is willing to work on themselves and really commit to the task.

True, trading is not for everyone because it does take a lot of work. But isn�t that the case for most worthwhile things? Think about your current profession. If you are a medical doctor, you went through 16 years of regular school, four years of medical training, and then a residency. You were up to your ears in debt, but the net result was that you had a highly-regarded profession. It�s probably the same for you if you are an engineer, an attorney, an IT professional, or any of many other noteworthy professionals. You probably worked diligently to get where you are now.

Trading, at first, seems to be a lot easier. All you have to do is open up an account, buy and sell, and make a profit. That�s how most people begin�and most people fail. And the reason they fail is that they don�t have sound strategies, a business plan, or top-down discipline. And they think the reason that they lose money is because they are unlucky, or they haven�t found the Holy Grail.

But that�s not the reason at all. It�s because they haven�t done the work necessary to prepare them for success, as I have just described.

So that�s where my insight comes in. I recently thought to myself,

�What if I can put together a series of worksheets that gives everyone a jump start on the entire process? And what if I put those worksheets into a three day workshop, so that when people are finished they will know exactly what they need to be successful?�

Well, I�ve spent the last two months developing the 17 Steps To Becoming A Great Trader Workshop. The workbook has been put together, and I�ve been sending it out to some close associates to see what they think. And guess what! They are all as excited about it as I am.

Are you committed to being a successful trader/investor? If so, then I hope you�ll join me in this new process. For some great information on this new course, click here.

Recurring Loss Patterns

Author: Amy

Date: 12-08-05 10:18

I could use some psychological feedback from everyone:

I have one simple problem with my trading that repeats and that I cannot seem to get shake. Specifically, I will have several days profit in a row (5-7) where I enter and exit all trades rather well, and then I will have one single day in which I lose all my gains and then some. On the day I lose, I average down too much and too far and refuse to take the loss until it is painful. By then, the loss exceeds my gains, both financially and emotionally.

I have read Dr. Tharp's books, I have been trading for 18 months so I am no novice, I have a trading plan, and I am well aware of this shortcoming. So why do I continue to do this????

If I cannot master this one failing, then all the technical and fundamental books in the world won't help me. Does anyone have any advice?

Thank you,

Amy

Reply To This Message

Re: Recurring Loss Patterns

Author: PMK

Date: 12-08-05 10:44

There are 2 parts to this answer. The one you want to hear and the one you don't.

The one you want to hear is that you should not add to a losing trade, and always have a pre-defined exit point that is your maximum loss that you ALWAYS stick to. This way no losing trades can ever get out of hand. But if you have been trading for 18 months you already know this.

The one you don't want to hear is that maybe you are getting the results that you actually want (i.e. losing). Have you considered that something in your psychology or personality is causing you to make these large losing trades. It could be fear of success, it could be low self esteem, it could be punishing yourself for something else in your life you don't like. If your reaction is 'You must be nuts, of course I don't want to lose' maybe you need to think about it a little more.

Do you have written objectives for your trading that you truly believe you want to achieve?

We all have to be completely honest with ourselves about what we want out of trading, and sometimes finding this out can be a painful and difficult process (but sometime enlightening as well).

Maybe Van can lend some of his expertise to this question.

Hope this helps

Paul

Reply To This Message

Re: Recurring loss patterns

Author: Ken Long

Date: 12-08-05 12:59

Amy: I offer these thoughts with much respect.

You have a number of days in a row when I presume you are following your rules, and then after a period of success, you violate your rules and get burned. Maybe you ought to look at how you can create that ""First disciplined day after a loss" mindset fresh at the start of each trading day.

It reminded me also of holiday weight loss resolutions, when we have our best energetic discipline after we have put on the weight. And then it becomes hard to sustain the effort and we relapse. In the moment we eat the extra piece of pie, we know we are violating the rules and we know we will pay for it when we get on the scale but the feeling in the moment outweighs the rational brain's knowledge and objections. So, there does seem to be an emotional basis for our behaviors in that case.

I'd look for the emotional link you experience in the moment of trading after a period of success and euphoria, when your emotional brain tells you that this time it's

different and that it's ok to bend your rules, while the tiny rational voice you can hear is getting outvoted by your emotional brain.

How can we ingrain habits at the unconscious level so that the possibility of violating our rules

doesn't even come onto the agenda?

I have had success with "Parts" [this is a term from the Peak

Performance material] where I look for the emotional rush in other domains of my life, and reduce trading to a boring business that is intellectually satisfying, like chess.

To extend on what Paul suggested: what's the emotional satisfaction you feel in the moment of breaking rules? Why do you like that so much?

Where else can you get that feeling that's not so costly?

Make a tiny adjustment and get 'er done!

Cheers!

Ken

Reply To This Message

Re: Recurring Loss Patterns

Author: Van Tharp

Date: 12-13-05 19:10

I've written a couple of articles in Market Mastery on self-sabotage that might give you some clues. However, what I can guarantee is that the problem is not on the level you see it. It's several levels down.

First, a hint for how to help me, or another coach, find the real issue and thus the solution. What are the feelings you have when this happens?

The core feelings. You might just feel them for a second and then bring up another set of feelings. But those core feelings are the key to the picture. And then I need to know what is associated with them from your past.

Possible ideas and I'm just plucking from air here:

1) You don't feel worthy of profits.

2) You have a ceiling that limits your profits.

3) You are getting even with someone. Mom? Dad? Someone else?

Those are a few common patterns I've seen, but you have to do what I suggest to find the solution.

Editors Note: As Always...read the complete and unedited thread at the link below. Look for the title, "Recurring Loss Patterns?" to read many more posts on this topic.

Special Reports By Van Tharp

Click below to read page one of each report, or to order.

Do Not Reply to this email using the reply button as the email address is not monitored. Please click this link contact us: [email protected]

The Van Tharp

Institute does not support spamming in any way, shape or form. This is a subscription

based newsletter. If you no longer wish to subscribe, Unsubscribe

Here.