Van

Tharp Didn�t Invent Risk Control�

He Just Perfected it.

New DVD Format - Ready for Shipment!

OFFER EXPIRES Today - Nov. 30, 2005

Save $50

Is It Time to Slow Down?

Part Two

By

Melita Hunt

Further to the topic of slowing down in this fast-paced world (see Part One), it is imperative to look after yourself if you want to be a peak performer. So today we�ll continue to look at ways to nurture your Body and start to look at exercises for your Spirit too.

Eating Well

What did you put into your mouth today?

Some people will laugh at that question, but I�m deadly serious about it. Do you really pay attention to what you eat? Most people claim to be responsible people, but whenever an ailment occurs, we tend to look outside ourselves for what could have caused it, rather than considering what we�ve actually been doing to cause it. This is especially prevalent as we come into the winter months.

So back to the original question: What did you put in your mouth today and over the past week? Was it the very best source of nutrition for your body?

We all have our days of eating badly or enjoying treats (especially for those celebrating Thanksgiving) and there is nothing wrong with that. However, it�s when these bad habit days start to outnumber the good-eating days that we really need to stop and make some changes.

It�s easy to reach for the fast food, treats, or to get that extra kick from another cup of coffee. Unfortunately, these bad habits just exacerbate our busy days, yet we continue to do them, especially during stressful times. But to what end?

One of the foundations of physical balance is diet and although there is endless debate on the subject of food, nutrition, and diet, we are all smart enough to know the difference between what is good for us and what is harmful.

Why not simply choose to cut down on sugar (and count how many items that you eat each day that contain sugar), cut down your caffeine intake, know when you�re using alcohol as a relaxant, try removing dairy from your diet for a week and maybe do the same with red meat or even wheat products. You don�t need to do it all at once, but eating differently will enable you to observe which foods work for you and which foods tend to make you feel sluggish or irritable, especially when you start eating them again. It�s all trial and error. Taking the tempting food and drink away and replacing them with healthier alternatives is a great way to start.

Good nutritious food is the fuel for our body and it is especially important to put the right fuel in when stressful things are creating overload. An excellent book on this subject is Foods that Harm and Foods that Heal. (click to link to Amazon)

It is no measure of health to be well adjusted to a profoundly sick society ~ Krishnamurti

Hydrate

Although we all have different diets, there is one thing that we have in common� we need water. Water is critical for good health. However, it�s often the most overlooked nutrient. That�s right, nutrient. You may not think of water along the same lines as food, but it is. Your body relies on water for just about every function, and it�s as important to your well being as eating plenty of fruits and vegetables. So stay hydrated!

As with diets, there are many different views and ideas on how much water is the ideal amount. The general rule is still 8 x 8-ounce glasses a day. Do not count caffeinated drinks like coffee, tea, or sodas when you are determining your water intake because they actually have a dehydrating effect on your body.

Develop a habit of drinking one glass of water as soon as you wake up (the hint is to have it next to your bed before you go to sleep), one at each meal, and one at bedtime. If you don�t like the taste of plain water, try flavoring it with lemon, lime, or orange.

If you are away from home for most of the day, buy or fill a couple of drink bottles with your water for the day. Make sure you drink at least two of them by early afternoon.

The easiest way is to just have a large (1 liter) bottle of water on your desk or in your car and reach for it at every opportunity. If you get into this habit and finish that bottle one or two times a day, you�ll wonder how you ever lived without it! And room temperature is the easiest to drink. Salute!

Water is the driving force of all nature - Leonardo Da Vinci

Caring for Your Spirit

�Connection to something which is greater than myself� is my definition of Spirit. Whether you call it God, Spirit, Higher Power, Soul, Consciousness or have no name at all, it is that part of us that is not thinking, nor is it physical. It�s that third portion of the Mind, Body, Spirit trio that actually knows what the body is doing and notices what the mind is thinking.

We think with our mind, we toil with our body and we connect with our Spirit � in whatever way works � through prayer, quiet time, solitude, listening etc�

So if you cannot remember the last time that you had peace, joy and abundance flowing through you, then it is quite possible that you haven�t taken the time to care for your Spirit. Maybe it�s time for you to do so.

Nothing Time

Nothing time is nothing time. And nothing more�

It is time when you just sit quietly and do nothing. (And for anyone out there that is debating whether this is possible�Well, you�re thinking too much.) This is not meditating, or thinking or planning. It�s just quiet time.

When was the last time you set aside some free time to do nothing? If you are constantly busy and wearing yourself thin then taking time out can be quite rejuvenating. This can be especially difficult for people who believe that they are �missing out� or not being productive unless every moment is filled. Be aware if this relates to you.

Instead of incessant �doing�, just block out a period of time, let people know that you are unavailable and not to interrupt you. If possible, drive or walk to a park, a beach, a pleasant place � even leave work early and drive somewhere where you can sit in your car in solitude. If indoors, choose a room, an area or a chair that you really like and just go and sit quietly by yourself.

If you�re outdoors, feel the sun, the breeze, listen to the trees, birds or water. Do not think about the past or future. Do not read, listen to music, watch TV, write anything, eat or do anything. Set your watch or alarm for a period of time that works for you (so that you�re not watching the time). And just do nothing.

It is especially important that you do not make this exercise another item on your �to do� list. Instead, notice when your brain needs quiet time and just go and do nothing. The world will not stop turning if we stop �doing� things and nurture our spirits for a short period of time.

Oddly enough, this simple exercise of nothing time has been attributed by many of the famous thinkers, inventors and most successful people in the world as being the time that some of their greatest achievements have come to them (Einstein, Henry Ford and Edison to name a few).

Contrary to the practice of brainstorming or thinking through a complex problem, taking time to do �nothing� allows the brain to slow down and get clear, so that the mind is open to new possibilities.

�When the solution is simple, God is answering� ~Einstein

In the final part of this series, we will look at more ways to nurture the Spirit and take a look at where your mind takes you.

Cheers ~ Mel

About Melita Hunt: Melita Hunt�s energy and enthusiasm is the cornerstone of her writing and speaking success. She has been associated with the Van Tharp Institute since 1999 and is currently the acting CEO of the company. Her diverse career has led her from an accounting background, to marketing and sales, real estate investing and coaching. She has traveled the world visiting over 30 countries and has worked throughout Australia, in London and now in the USA.

An avid reader and seminar attendee, Melita has a special interest in sharing her knowledge and inspiring people to be the best they can be. She has written a series of children�s bedtime stories and is author of a soon to be released adult parable titled The Wizard Within. You can contact Melita at [email protected]

|

Coming

to Phoenix, Arizona, January 2006. |

The 17 Steps to Becoming a Great Trader

� Create a Trading Business Plan

� Develop Trading Strategies

� Complete a Self-Assessment

� Discover a Structured Approach to DisciplineThese are just some of the 17 lessons that you'll learn in Van Tharp's latest and newest workshop...

Mixed Message in the Housing Market

by D. R. Barton, Jr.

On Monday (11/28), the news for the housing market was bad � existing home sales were down 2.7%. And the number was actually worse since Hurricane Katrina has spurred a sharp regional increase in home sales from folks who were displaced by that nasty storm.

Then today (11/30), the new home sales numbers were released � and they reached and all-time high of over 1.4 million, up 13% versus last month!

So the market for housing is split decision. No sound of a bubble bursting just yet�

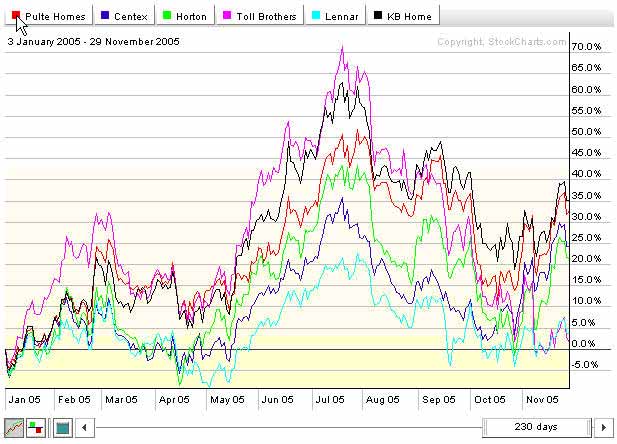

But the market seems to be building in a discount into housing market, anticipating some sort of cool down. As an illustration of that point, take a look a the percentage change in pricing since the beginning of the year for six of the top publicly traded home builders in Chart One.

Housing stocks rose sharply for the first half of the year and peaked in July. Since then, the stocks have given back 50 � 100% of the gains they had racked up in the first half of the year. (I hope those of you holding housing stops were using some sort of trailing stop!)

It�s clear that the traders and investors are �pricing in� a correction. It�s equally clear that there are two stocks in my list of six that are clearly underperforming: Pulte Homes and Lennar.

If we get the expected downturn in the housing market, these might be the best shorting candidates.

But, as the new home sales figures show � demand is still strong. And the sky isn�t falling just yet.

Great Trading!

D. R. Barton, Jr. is the Chief Operating Officer and Risk Manager for the Directional Research and Trading hedge fund group. D. R. has been actively involved in trading, researching, and teaching in the markets since 1986. D. R. has taught extensively in many investment areas including intra-day trading, swing trading, and cutting edge risk management techniques.

His writing credits include co-authoring Safe Strategies for Fin-ancial Fre-edom and co-creator and contributing author on Fin-ancial Fre-edom Through Electronic Day Trading.

Concerned

(About Trading System)

Author: Stu

Date: 11-26-05 10:59

Dr Van Tharp,

After arriving in America as an immigrant with nothing, and building up some cash I tried my hand at discretionary day trading for 18 months, losing everything, and having to return to Corporate America, (long hard sop story!).

Time constraints (being at work) and experience dictated that I needed a mechanical ( computer based) trading system. I subsequently went out and spent

$5,000 for a system that runs on Tradestation that supposedly has fantastic returns.

During this Thanksgiving week I read your book-Trade Your Way to

Financial Freedom (twice), and it exposed the world of position sizing to me. MY concern now is that the system I have just bought, with

excellent advertised results, may not be that fantastic for my account

size ($50,000) after all.

What products/suggestions do you have for me to test this system using my account size and position sizing (equal value

units) strategy before I spend another period of time being led down another garden path that leads to nowhere.

I do not have the actual trades that were taken to create the test data, but do have things like exposure%, CAR, Max system % drawdown, profit factor,#trades,Avg % profit/loss,% winners.

I trust the company I bought this product from, but after reading your book know that I have been naive in assuming that the published results would automatically apply to me. Please help!! I cannot afford to

lose everything again, but lack the knowledge to make an informed

assessment.

Thank you.

Reply To This Message

Re: Concerned

Author: Mark Tenn

Date: 11-26-05 12:03

Chances are you got a system the is over-optimized. At least you probably realizes by now that buying systems is not a good idea

Reply To This Message

Re: Concerned

Author: PMK

Date: 11-26-05 13:14

Stu,

The first step is to determine what your objectives are regarding expected return, maximum

comfortable drawdown, frequency of trades, type of instruments etc.

Once you have done that, I would recommend leasing a system if you do not have the desire or time to buy one. There are various ways to do this including Attain Capital, Collective2, or direct from various system vendors. DISCLAIMER: I am a trading system vendor on Collective2 (and directly on my site pmkingtrading.com for a TradeStation system).

Generally, any system you evaluate should not have 'fantastic returns' if you want it to have longevity. A high win percentage is indicative of an over-optimized system, and high yearly returns of taking too much risk.

In the end, you will have to do as much work to evaluate and choose a trading system as you would to develop your own. From my point-of-view, customers are 'leasing' my trading advice, help, guidance, and system development expertise just as much as the actual trading systems - believe it or not my ultimate goal is for

customers to become better traders and be able to develop their own systems. I know my own trading will improve

immeasurably by helping others go through the learning curve.

Paul

p.s. Unless you have the actual trades the system you purchased took historically it is very difficult to do any kind of simulation or statistical analysis - I would be wary of any system vendor that will not give you a full list of historical trades, and also their position-sizing algorithm and minimum required account size.

Editors Note: As Always...read the complete and unedited thread (titled "concerned") at the link below. This post has many more interesting comments.

Special Reports By Van Tharp

Click below to read page one of each report, or to order.

Do Not Reply to this email using the reply button as the email address is not monitored. Please click this link contact us: [email protected]

The Van Tharp

Institute does not support spamming in any way, shape or form. This is a subscription

based newsletter. If you no longer wish to subscribe, Unsubscribe

Here.