Feeling Release

By

Van

K. Tharp

What if all of your problems were psychological problems? What if you could get whatever you want just by eliminating the psychological roadblocks to it? What if you didn�t understand any of this and as a result you are stuck right where you are now, making very little progress? Interested? Well read on.

The following is just one of many examples of people getting stuck psychologically and thinking it�s something else. Most people who enter trading are good at problem solving. Quite often they come from engineering backgrounds where they are trained at problem solving. But what if the very act of trying to solve a problem was what kept you stuck?

Jim was an electrical engineer by trade. He was great at solving problems until he got into trading. However, with trading he found that he got really stuck in trading positions. He�d figure out great systems and then get stuck trying to execute them. And he was always wondering why. This became a new problem for him to work on. But the more he worked on it, the more frustrated he became.

For such frustration, I always recommend the feeling release exercise that we use very effectively in Peak Performance 101 and it is also described in various forms in the Peak Performance Home Study Course.

When Jim came to me, his initial requirement was to release the feeling of frustration. He did that and felt a great relief. It now felt like he could move on with his life.

However, he still considered his trading to be a problem that he needed to solve. And this really bothered him, because he couldn�t seem to figure it out. As a result, I said, what if you just release the feelings that have to do with �trading being a problem that you need to solve.�

Jim was a bit puzzled, because this seemed different from the frustration. The frustration was a knot in his solar plexus and a tightness in his throat. He could relate to that as a feeling. But wanting to solve a problem didn�t seem like a feeling.

My response to this was to say, "but let�s pretend it is a feeling." �Where is the feeling?� I asked.

�Well my head seems to be spinning when I think about it,� Jim responded.

�Okay, that could be a feeling. Let�s act like it is. Now, are you willing to just let it go?�

Jim responded, �But I need to solve the problem.�

�What does it feel like to need to do something? Let�s pretend like that�s a feeling,� I responded.

�Okay,� said Jim.

�Now,� I repeated, �are you willing to let it go?�

�No, I don�t think so,� said Jim.

�Well, then, are you willing to allow it to be there� to embrace it.�

�I�m not sure,� said Jim.

�Would you rather have the feeling or would you rather be at peace,� I responded.

�Hmm,� said Jim, �it feels different now. In fact, I think it�s starting to disappear. Yes, I think it�s gone.�

�Okay, now go back to your trading,� I said.

Jim returned to his trading and over the next two hours he executed his trading system flawlessly. And when he realized what was happening, he was totally amazed.

�Wow,� said Jim, �suddenly when its no longer a problem for me, I just trade.�

�Yes,� I responded, �isn�t that interesting?�

Ask yourself, �Would you rather have your trading problems or be free of them?� This is a very important question, because if you are trying to figure out a problem you are going into the past. You can�t deal with the present -- what the market is doing -- because you are trying to deal with the past in figuring out the problem.

Also ask yourself, �If you are trying to figure out a problem, what are you doing? Are you not planning to have the problem again in the future? And isn�t it possible that your planning might just create it again in the future?�

Perhaps you haven�t thought about all of these issues before, but I�m recommending that you do now. Perhaps the trading process is much more psychological than you ever thought. Perhaps its not about solving problems after all.

Editors Note: Throughout the issues you will see certain words with odd spellings, such as Fre-edom and mort-gage. This is because spam filters are likely to block message that contain certain words and this is one solution.

Proven Tactics for Swing Trading Workshop

- Learn the Pro Traders' Secrets for Capturing Huge Profits in Bear or Bull Markets

- Become Skilled at Swing Trading - the Trading Style That Fits Into YOUR Schedule

- Don't Lose a Bundle by Holding Stocks During The Last Market Decline! Find Out the Master Traders' Alternative to "Buy & Hold"

- Discover the Detailed Trading Strategies that Win in Today's Markets

Small Stocks Continue to Outperform

by D. R. Barton, Jr

"The higher we soar, the smaller we appear to those who cannot fly."

--Friedrich Nietzsche

Here�s an interesting stock comparison for traders and investors to ponder:

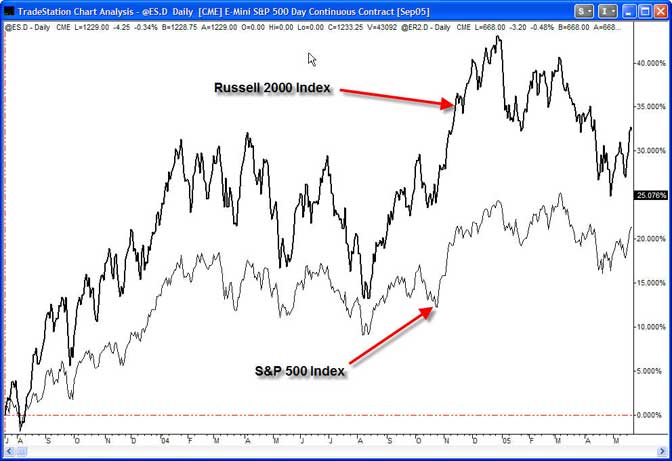

The out- performance of small cap stocks is alive and well. The Russell 2000 is the most widely used index for tracking small cap stocks (generally those with less than two billion dollars of market capitalization). In the chart above, the Russell 2000 performance is compared to the S&P 500 index performance on a �percentage change� basis for the past years.

While the gap has closed since the end of 2004 (when the small caps were outperforming by a 42% to 22% margin) the small caps still continue to push ahead, despite many analyst calling for the demise of the class.

However, a note of caution may be in order. With the market pushing higher, it may be tempting to chase the higher returns of the small cap world. This should be done prudently since the small caps have shown a bit of relative weakness in the in the last seven to eight months. A Wall Street Journal article this week pointed out that the Russell 2000 is heavily weighted toward REITS and these small cap real estate stocks are the ones that could be hit fast and hard if there is any hiccup in the real estate juggernaut.

It is rarely a bad idea to bet with strength in a rising market. Small caps may give that opportunity. But it may be prudent to take profits a little more quickly than usual since there are some warning signs showing up in this group.

D. R. Barton, Jr. will be teaching the upcoming Proven Tactics of Swing Trading Course, August 2005 and is a featured speaker in the Van Tharp Institute Course, Make Money Work for You.

He is the Chief Operating Officer and Risk Manager for the Directional Research and Trading hedge fund group. D. R. has been actively involved in trading, researching and teaching in the markets since 1986. D. R. has taught extensively in many investment areas including intra-day trading, swing trading, and cutting edge risk management techniques.

His writing credits include co-authoring Safe Strategies for Fin-ancial Fre-edom and co-creator and contributing author on Fin-ancial Fre-edom Through Electronic Day Trading.

WHEN IS A SYSTEM FAILING OR MERELY IN SEVERE DRAWDOWN ?

Author: Dieter

Date: 07-20-05 12:32

One may use a system that has been adequately tested and found to be acceptable, only to

lose money when trading it. Presuming that one's trading technique is correct, there will come a point after consistent

loses when one questions the continued validity of the system relative to the market conditions. Markets are in

constant change and over time previously successful systems will fail - but what tools could one use to objectively differentiate between a

losing streak / drawdown and a failure on the part of the trading system?

Regards

Dieter

Reply To This Message

Re: WHEN IS A SYSTEM FAILING OR MERELY IN SEVERE DRAWDOWN ?

Author: Chris B

Date: 07-20-05 13:01

Here's an example:

If your system is trend following, with a certain time frame (say 1 month), and you check the markets you are trading with this system, and see that there were no sustained trends that lasted 30 days, then you can reasonably assume that the system is not broken.

The markets are just not cooperating.

Chris B

Reply To This Message

Re: WHEN IS A SYSTEM FAILING OR MERELY IN SEVERE DRAWDOWN ?

Author: PMK

Date: 07-20-05 13:17

Dieter,

Assuming your system has a lifetime positive expectancy, and you are familiar with the types of market it should work in (so you know conditions are favorable), and the fundamental premise upon which the system is built is still valid, then whether a system is broken, or not, depends on its deviation for 'normal' performance.

I suggest you look at the win%, the average size of winners to losers, the slippage and commissions, and the number of opportunities over the lifetime of the system and see how they compare to recent (e.g. last 30) trades. If the recent numbers are within one of standard deviations of the average then the result may be considered 'normal' - i.e. it is just a temporary losing streak.

If the recent result are greater than 1 standard deviation from average then your system may be broken and you should suspend real-money trading and commence paper trading to ensure results improve before risking more cash.

Hope this helps

Paul

Editors Note: Van Tharp's Market Mastery Issue, "Does Your System still Work In Changing Markets." is very helpful with this topic. Click here to read page one or to order.

Do Not Reply to This Email using the reply button as the email is not monitored. Please click this link contact us: [email protected]

The Van Tharp

Institute does not support spamming in any way, shape or form. This is a subscription

based newsletter. If you no longer wish to subscribe, Unsubscribe

Here.