Tharp's Thoughts Weekly Newsletter (View On-Line)

-

Article An Interview with Three Super Trader Students by R.J. Hixson

-

-

-

TradingTip Quantitative Easing—Panacea or Sleight of Hand? Pt. 3 by D.R. Barton, Jr.

Four Systems Workshops Coming in November!

Three-day Forex Systems

One-Day Each Super Trader Systems

Learn More....

Learning by Teaching;

A Conversation with Three Super Trader Students

Interviews by R.J. Hixson

Last year, Van offered his Super Trader students the opportunity to thoroughly learn one of their trading systems by teaching it to other traders. Several of them took him up on his offer and that’s the origin for the upcoming Great Super Trader Systems Workshop. Whether you have an interest in attending the workshop or not, we thought readers would find interesting how these three Super Traders answered the same ten questions. We hope some of their comments will help you generate some trading ideas of your own. Enjoy.

Mark McDowell

Q. What are your thoughts about the markets right now?

Today, I classify the market as “bull quiet.” I believe we’re in the midst of a long-term bear market, but I expect that both bull and bear cycles will occur in the context of the overall market. I believe cycles are shorter during long-term bears than during long-term bulls, so I’m trying to stay nimble and use trading systems that match up with the market type.

Q. What do you trade?

I trade stocks, ETFs and Forex.

Q. What kinds of trading systems do you use, and how many do you have in operation?

Currently, I use 1) the intraday system I’ll be teaching at the November workshop; 2) a swing-trading system that enters on pullbacks in a trend; 3) a weekly system based on relative strength in a large set of ETFs; 4) a monthly system based on momentum in a small set of ETFs; 5) and a trend-following system for Forex trading.

Q. Do you have a preferred style of trading, or do you focus on a particular kind of price movement?

I don’t have a preferred style. My overall objective is to have multiple systems that are uncorrelated, so I look for different techniques for entries, exits, position sizing, etc. in various markets.

Q. Why do you trade?

I trade to generate income and save for retirement. I left Accenture in 2002 and decided to make trading my profession soon after that. I also have a systems background, so I enjoy developing and trading new systems.

Q. At what area of trading do you believe you excel? Why?

My strengths are in design, coding and testing trading systems that are more mechanical and less discretionary in approach. During the last couple of years, I’ve done a lot of research and tried various ways of trading—both mechanical and discretionary—on a variety of time frames. Currently, I have several systems that are in various stages of design, coding and testing.

Q. If you could improve one area of your trading, what would it be? Why?

I’d like to improve my ability to read the market so I can adapt more quickly and dynamically to turning points. In other words, I’d like to become more effective at “trading in the now,” as Van says. I think it would improve my overall trading results.

Q. What difference did the Super Trader program make in your trading?

The Super Trader program made a huge difference in three areas: psychology, business planning and system development.

The Super Trader program provides a significant amount of information to support the development of a detailed business plan and trading systems that fit you as an individual. I believe it would have taken me far longer and cost me a lot in terms of trading losses and missed opportunities if I’d tried to develop a business plan and trading systems on my own.

But the biggest improvement was in my psychology, where I experienced several personal transformations and learned how to continue to transform myself. The psychological work we do in the Super Trader program has had a positive effect on both my trading and other areas of my life.

Q. What prompted you to want to teach one of your systems?

First, it’s great to have the opportunity to help other traders, and I wanted to teach a trading system that originated with concepts taught in other Van Tharp Institute workshops I’ve attended. Also, I know from past experience that the process of teaching my trading systems to other people provides me with a deeper understanding of those systems. I believe the questions and discussions will generate a lot of good ideas.

Q. What should people know about the system you‘ll be teaching at the ST Systems workshop?

I designed this intraday system so that it would be easy to execute. It uses a set of simple criteria for setups and then uses intraday price action for making entries and exits The system scans for stocks and ETFs that have pulled back in a trend. It uses tight stops once it enters a position. Exits occur when stops are hit or when the intraday target is hit. The win ratio is greater than 50%. It’s based on research originally published by Larry Connors and uses a statistics-based approach to managing entries, stops and exits. I began developing and testing the system almost three years ago. I’ll be presenting my third version of the system.

Bruno Serfaty

Q. What are your thoughts about the markets right now?

I guess you’re talking about the U.S. equity market, but you could expand the question to include the fixed income markets, the commodity markets, or international markets.

I’m always reluctant to answer such questions because they often lead to making predictions. I always prefer to identify what’s going on in the present and what the big picture looks like.

From a macro-economic point of view, we now have two major opposing forces at work. On the one hand, banks and governments, particularly in the U.S. and Europe, try to improve their respective balance sheets through a massive and somewhat unprecedented deleveraging process. This leads to restricted lending and government cutbacks, naturally constraining economic activity and job creation.

On the other hand, central banks are pursuing an aggressive quantitative easing policy, effectively supporting banks and governments in order to keep the world economic activity financed.

Over the last couple of years, the U.S. policy makers have been among the most aggressive with this quantitative easing approach and one of the least proactive when it comes to deficit reduction. The net result is that the U.S. equity market has been one of the best performing markets in the world, as measured by the S&P large cap index. The poor relative performance of the small and midcap sectors indicates that the current rally is not generally broad based and could be quite vulnerable to large corrections. At present, market volatility (as measured by the weekly Average True Range) is quite benign.

As a result, we’re using the U.S. equity markets to trade long swing-trading strategies, but with a restrictive capital/risk allocation, because the rally is based on capital injected by central banks rather than on solid strong economic and profit growth.

Other markets that we find interesting are precious metals (silver, gold), which, after a long correction, have started to trade well again. I’m also looking with interest at ETFs based on such countries as India, Brazil and China, which have been among the worst performers in recent months but have the potential to catch up with their U.S. counterpart.

Q. What do you trade?

Let me answer this question as the second part of the response to the next question.

Q. What kind of trading systems do you use, and how many do you have in operation?

Our firm’s objective is to generate steady and consistent returns over time.

We therefore seek genuine diversification in our trading systems. We accomplish this in two primary ways: diversification in terms of markets we trade and diversification in terms of time frames, from long term to short term.

For long-term trading, we use a long-term trend-following system with a tactical overlay across global markets through Exchange Traded Funds. This includes international markets, fixed income markets and some liquid commodities.

While the U.S. equity market is trending up, we use an equity swing trading system that successfully captures the volatility of individual stocks without being too exposed to overall market volatility. Because of our stock selection process, we tend to trade more small and midcap companies ($1 billion market cap minimum).

Finally, because we’re based in Europe, we trade the Eurostoxx and the Bund Futures with a short-term day trading system, particularly during volatile periods.

Q. Do you have a preferred style of trading, or do you focus on a particular kind of price movement?

Yes, I like to buy on weakness and sell on strength. I like to trade against the crowd, but only within a very strict framework.

Q. Why do you trade?

Every day is a different challenge.

Q. At what area of trading do you believe you excel? Why?

I excel at designing repeatable trading processes that make money over time. Then I teach others to run them on my behalf.

Q. If you could improve one area of your trading, what would it be? Why?

Short-term day trading. It requires such patience, discipline and courage. I admire those who successfully trade on a daily basis.

Q. What difference did the Super Trader program make in your trading?

That’s a long story. On a personal level, I’ve achieved a greater sense of self-awareness and belief.

On a technical level, I’ve learned to never blame myself or anyone else when we lose money, but I’m constantly asking myself and my colleagues: What’s missing? That’s an empowering question.

Q. What prompted you to want to teach one of your systems?

I want to share and give what I’ve learned from Van to others. I’m grateful for the opportunity. If I can help someone trade better, I’ll have achieved my objective.

Q. What should people know about the system you’re going to teach at the ST Systems workshop?

The system I’m going to teach is based on common sense, reasonable probability and trust that if you keep applying yourself, you’ll enjoy great success.

Frank Eaves

Q. What are your thoughts about the markets right now?

My primary focus right now is on the Super Trader program and research for Dr. Tharp, so I don’t pay much attention to the day-to-day movements of the markets.

Q. What do you trade?

Actually, I’m not trading at the moment. I chose to refrain from trading while I work through the psychological portion of the Super Trader program. Before I started the program, I didn’t really trade with formal systems, so I’m grateful to be out of the markets at the moment. When I do finally start trading again, it will be a completely different experience for me. I’m not even half finished with the program, and already my view of the markets and systems has changed quite drastically.

Q. What kind of trading systems do you use, and how many do you have in operation?

In the past, I day traded the S&P E-Mini futures contract and swing-traded technology stocks.

Q. Do you have a preferred style of trading, or do you focus on a particular kind of price movement?

My beliefs about the market have been changing a lot. I’m developing systems that will allow a computer to do the trading for me. This mechanical approach appeals to me because I’m a programmer; I like the consistency that computers can bring to trading. Also, an algorithm increases my span of control considerably. An individual might be able to consistently trade four symbols a day with a particular system, but a computer algorithm could execute the same system against more symbols. I expect that I can automate multiple trading systems to execute against many symbols. With the appropriate position sizing algorithm, an automated trader could earn a very good return on investment.

Q. Why do you trade?

My beliefs about my reasons for trading have evolved over time.

Initially, trading looked like a way to help me maintain my standard of living in retirement. That view began to shift as I progressed through my corporate career. I worked 60 to 80 hours a week, but when review time came around, I was getting less than 1%-2% in annual raises. I realized that if I learned how to trade well, I could put in less time and have a much better return on that time.

My next beliefs about trading were mostly based on fear in the wake of the financial crisis. In 2008 it became clear to me that a severe crisis could force a company to lay off even its good employees. This thought hadn’t occurred to me before then because I’d been operating under a strong belief system: if I worked really hard, my company would keep me, and my family could maintain the standard of living we’d grown accustomed to. As that belief system fell apart, my mental state became filled with a lot of fear and a preoccupation with scarcity. That’s when I began to see trading as a way for me to live anywhere and still be able to maintain my standard of living.

Now, as a result of Dr. Tharp’s Super Trader lessons, I’ve learned that there’s abundance everywhere, and that our natural state is one of thriving. I’ve gained a much deeper understanding of how Dr. Tharp views the markets: There is infinite wealth available. When I start trading again, I’ll tap into that abundance.

Q. At what area of trading do you believe you excel? Why?

I excel at automating and back testing systems. I’m a professional computer programmer and have been applying my skills to help me understand and trade different markets for over 10 years.

Q. If you could improve one area of your trading, what would it be? Why?

I would improve my ability to recognize when my beliefs stop me from seeing that a system can be traded successfully. Before testing various trading systems for Dr. Tharp, I had a set of beliefs that informed me about whether or not a certain system would work. They were just beliefs, but I interpreted them as true and therefore operated as if they were true. I’ve written reports in which I concluded that a particular system didn’t work, only to discover later, after being encouraged to understand more about Dr. Tharp’s beliefs, that these systems really did work. It has been fascinating to make this discovery: my belief that a system would not work influenced my back testing process in such a way that the resulting data actually confirmed the belief. By changing my beliefs, I could change the back testing process and end up with test results that showed that the system actually did work.

That’s a very important point to keep in mind when trying to see the abundance that’s available in the markets. A trading system idea might look like it won’t work, but the more knowledge you have about yourself, and the more you understand yourself, the better you’ll be at determining whether you’re looking at the truth or a belief. The systems that work in the markets are so much simpler than any I would have thought possible, and the potential returns are so much bigger.

Q. What difference did the Super Trader program make in your trading?

Let me talk about the difference it has made overall as I have not begun trading again. The biggest difference is that my fear has gone down tremendously. Prior to being in the Super Trader program, I had a preoccupation with scarcity. Now I’ve developed a mentality of abundance.

Also, as I’ve discovered more about my belief systems and how those beliefs originated, I’ve become a calmer and happier person.

It’s as though I’ve become a different person since starting the Super Trader program. I can only image the difference I’ll see once I finish the entire curriculum.

Q. What prompted you to want to teach one of your systems?

Dr. Tharp asked me if I wanted to teach a system for which he’s had me do a lot of research. I really like this system because it helped me see relationships in the market that I wasn’t familiar with before.

Q. What should people know about the system you’re going to teach at the ST Systems workshop?

This system finds some opportunities in bear markets and lots of setups at the bottom of bear markets—something I previously didn’t know how to do. Someone could actually use it for signaling the bottom of a bear market, even if they decided not to take the trades. Also, the system uses certain kinds of data for screening that few traders probably think about using. I’ll provide lots of data and spreadsheets for people who like to play with that kind of stuff after the workshop has finished. Because there are a number of possible variations, it can be traded in many different ways and can be modified to fit most peoples’ personal belief systems.

Thanks to all three traders for sharing your thoughts and ideas.—R.J.

Trading Education

Workshops

Australia Workshop Dates Set and Ready for Registration!

To see the schedule, including dates, prices, combo discounts and location, click here.

Mini Trading Session Mini Trading Session

Instructor Ken Long would like to share a short video about a 2.3R trade from earlier this week. Thank you Ken!

Click to View Video

Trading Tip

Quantitative Easing—Panacea or Sleight of Hand?

Part 3

by D.R. Barton, Jr.

When pundits explain how the first two rounds of Quantitative Easing (QE) increased stock prices in the past 3 ½ years and that QE3 will therefore push prices higher from here on, they unintentionally make an error in logic. This kind of error is often labeled in Latin, “Post hoc, ergo propter hoc” and translates as “after this, therefore because of this”.

We looked at this logical fallacy known as “questionable cause” in the first article in this series. The simple way to explain this idea is that correlation between events does not equal a causal relationship between the events.

To refresh our memories, here’s the chart (from Denis Ouellet’s excellent blog) that proponents trot out for QE’s role in the stock market’s bull run:

While it’s almost certain that some of the previous QE money has trickled into the equities markets, it is less clear that this “easy money policy” has been the primary driver for the move up. Across the pond, the European Central Bank (ECB) has injected almost as much money into the Euro-sphere since 2009 as the U.S. Federal Reserve has injected into our economy here (several sources have cited the QE injections as equal on both sides of the pond…). So if QE injections led to higher stock prices here, then ECB injections should have caused a similar run up in the European stock markets, right?

Well, let’s take a look at European stock prices in the form of the DJ Euro STOXX 50 to test this premise:

Oops - looks like central bank injections only help U.S. equity prices! Some people argue that the two economies (U.S. vs. European Union) are very different. “But what about _____________?” they will ask. Fill in the blank with your favorite European Union financial / debt problem. Any and all of that is nonsense. If QE is responsible for rising stock prices, then the action should work regardless of economic externalities and if not, then we can conclude that the externalities are driving stock prices. So apparently QE doesn’t translate directly into higher stock prices. If that is the case, where are all those dollars and euros flowing?

More Dollars Chasing the Same Amount of Assets = ???

It’s not very hard to design a game to show 8-year-olds that more money chasing the same amount of goods equals higher prices for those goods. In teaching my 3rd through 6th grade economic competition teams, I have to make sure they can master the basics of economic theory. They seem to be able to get this one pretty easily.

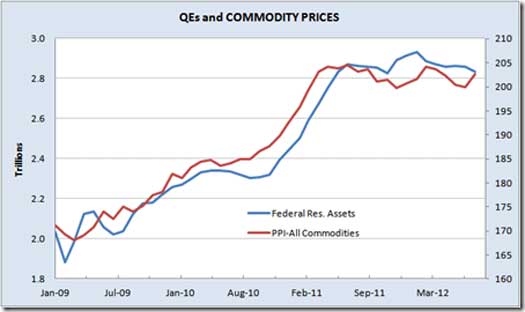

In what set of goods are we seeing rising prices? Once again, our buddy Denis Ouellet has a great chart showing the relationship between the increase in Federal Reserve Assets and commodity prices:

. .

The correlation between QE and commodity price levels is much higher than the QE vs. equities chart further above – and I might mention, more believable too. So maybe the gold bugs and agricultural bulls have it right: more QE leads to higher real asset prices. This trend should continue through the foreseeable future and that’s bad news for those at subsistence living levels who will have to pay more for rice, wheat, corn and soybeans.

Hope and Effort

The Fed has targeted this round of QE directly at real estate but I believe that the hoped-for effects will be muted. As I wrote just a couple of months ago, the shadow home inventory and demographic changes in the U.S. will conspire to keep real estate prices at post 2008 levels for some time to come. Given those factors and the current banking environment (banks are still loath to lend), Ben and the rest of the government intervention bureaucracy have a major task making additional structural changes in order to improve the real estate market.

I don’t doubt that they will try.

Great Trading,

D. R.

About the Author: A passion for the systematic approach to the markets and lifelong love of teaching and learning have propelled D.R. Barton, Jr. to the top of the investment and trading arena. He is a regularly featured guest on both Report on Business TV, and WTOP News Radio in Washington, D.C., and has been a guest on Bloomberg Radio. His articles have appeared on SmartMoney.com and Financial Advisor magazine. You may contact D.R. at "drbarton" at "vantharp.com".

Disclaimer

Ask Van...

Everything we do here at the Van Tharp Institute is focused on helping you improve as a trader and investor. Consequently, we love to get your feedback, both positive and negative!

Click here to take our quick, 6-question survey.

Also, send comments or ask Van a question by clicking here.

Back to Top

Contact Us

Email us at [email protected]

The Van Tharp Institute does not support spamming in any way, shape or form. This is a subscription based newsletter.

To change your e-mail Address, e-mail us at [email protected].

To stop your subscription, click on the "unsubscribe" link at the bottom left-hand corner of this email.

How are we doing? Give us your feedback! Click here to take our quick survey.

800-385-4486 * 919-466-0043 * Fax 919-466-0408

SQN® and the System Quality Number® are registered trademarks of the Van Tharp Institute

Back to Top |